Euler Finance

Ment Tech Labs partnered with Euler Finance to design and scale a next-generation DeFi lending platform governed by a decentralized autonomous organization (DAO). The project focused on modular lending architecture, risk-managed vaults, and on-chain governance for community-driven financial ecosystems.

Region/Industry

Project Duration

Client Type

Euler Finance emerged as a permission-less lending protocol redefining how DeFi ecosystems handle collateralization, liquidation, and risk exposure. The client wanted a lending super app that would enable users to lend, borrow, and swap without dependency on centralized intermediaries while maintaining capital efficiency and on-chain transparency.

The platform also aimed to serve as a developer-first ecosystem with modular components that let builders create custom lending markets and vaults using the Euler Vault Kit (EVK) and Ethereum Vault Connector (EVC). Governance was to be entirely decentralized, with community-led decision-making driving protocol evolution.

Explore DeFi Without Limits

Join the movement to make decentralized finance safer, faster, and governed by its users.

Before engaging with Ment Tech Labs, Euler Finance faced significant architectural, governance, and security complexities that limited scalability and community adoption.

Complex Risk Modelling for Isolated Markets

Each vault required independent risk parameters, including collateral ratios, oracle dependencies, and liquidation thresholds, complicating deployment.

Fragmented Governance Layer

The DAO governance process lacked seamless proposal creation, voting, and execution pipelines within the lending interface.

Capital Inefficiency in Borrowing

Borrowers couldn’t utilize cross-collateralization or dynamically manage leverage across multiple vaults, restricting liquidity flow.

Lack of Developer Enablement Tools

No accessible SDK or modular framework existed for third-party developers to build or extend custom lending products.

On-Chain Security Vulnerabilities

Isolated vaults introduced MEV and liquidation arbitrage risks that required advanced mitigation layers and continuous auditing.

Governance Transparency and User Education

New users struggled to understand DAO mechanics, proposal lifecycle, and tokenholder rights, impacting participation rates.

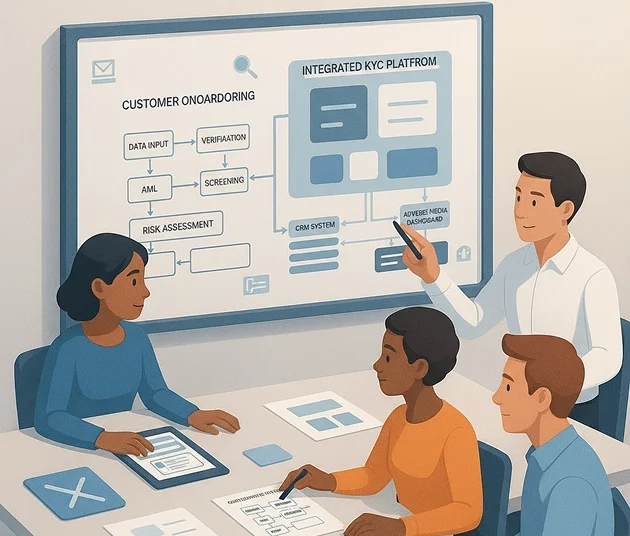

Ment Tech Labs’ Development Approach

Ment Tech Labs implemented a multi-phase approach focused on modular architecture, DAO governance automation, and protocol security. The goal was to establish Euler as a composable DeFi super app for users and developers alike.

Modular Architecture Planning

Designed a multi-layered vault architecture separating user assets, liquidity pools, and governance vaults to ensure isolated risk and seamless scalability.

Custom Vault Creation Kit (EVK)

Developed the Euler Vault Kit, enabling developers to launch permissionless lending vaults with predefined collateral logic, oracle integrations, and yield configurations.

Ethereum Vault Connector (EVC)

Built a connector module allowing cross-vault interactions users could borrow against one vault while staking collateral in another, enhancing capital efficiency.

DAO Governance Integration

Integrated proposal creation, voting, and execution within the DApp, linking directly to the Euler governance forum and ensuring transparency in every decision.

MEV Protection and Smart Auditing

Implemented on-chain transaction bundling and MEV-resistant mechanisms to protect borrowers and liquidators, alongside multi-round smart contract audits.

User Experience and Onboarding Framework

Designed an intuitive interface simplifying lending, borrowing, and staking actions while embedding education modules explaining DAO operations and DeFi risks.

DAO-Governed Lending Interface

Developed a governance-first DApp where users can lend, borrow, and vote on protocol changes in one interface.

Permissionless Vault Deployment Framework

Enabled community and institutional users to create isolated lending vaults with unique parameters and collateral rules.

Algorithmic Risk Assessment Engine

Built a dynamic risk engine that calculates real-time health factors, loan-to-value ratios, and liquidation margins per vault.

MEV-Protected Transaction Layer

Integrated advanced on-chain protection against sandwich attacks and arbitrage by batching transactions via secure relayers.

Developer SDK for Custom Integrations

Released a full SDK to help external developers integrate custom markets, lending logic, and oracle feeds.

Transparent DAO Proposal Lifecycle

Built a governance dashboard that visualizes proposals from submission to voting, ensuring full transparency for tokenholders.

On-Chain Insurance and Liquidation Pools

Deployed smart contracts that auto-liquidate undercollateralized positions and reimburse vault losses via insurance reserves.

Data Indexing and Analytics Framework

Implemented Graph-based indexing for transaction data, TVL tracking, and protocol metrics.

Multi-Network Expansion Capability

Designed a flexible backend for future integration across L2 chains such as Arbitrum, Optimism, and Base.

Our clients

Modular Vault Architecture

Built a scalable vault framework allowing users and developers to deploy isolated lending markets with independent risk profiles, collateral rules, and token parameters.

Dynamic Risk Engine

Developed an AI-assisted engine that continuously evaluates lending pool health, collateral volatility, and liquidity risk, adjusting parameters in real time to maintain protocol stability.

DAO Governance Module

Integrated a full on-chain governance layer where tokenholders can create proposals, vote, and execute protocol changes directly from the application interface.

MEV-Resistant Execution Layer

Implemented transaction bundling and private relays to prevent front-running, sandwich attacks, and liquidation exploits across vault transactions.

Custom Vault Builder SDK

Engineered the Euler Vault Kit (EVK), a toolkit enabling developers to design and deploy custom lending vaults with minimal coding effort.

Cross-Vault Collateralization

Created the Ethereum Vault Connector (EVC) to let users borrow against one vault while using assets in another as collateral, maximizing capital efficiency.

Automated Liquidation and Insurance System

Deployed a self-balancing liquidation pool that auto-settles undercollateralized positions and compensates users through on-chain insurance reserves.

Real-Time Governance Analytics Dashboard

Designed a live analytics module to track DAO voting activity, TVL growth, vault performance, and community participation across the ecosystem.

Developer API and Integration Layer

Built an open API system allowing third-party DeFi projects to integrate vault functionalities, oracle data, and lending markets into their own platforms.

Driving Performance and Efficiency Across DeFi Markets