SAFTP Finance

Ment Tech Labs partnered with SAFTP Finance to develop an advanced trading automation platform that combines algorithmic trading, yield farming, and cross-chain liquidity management. The system empowers traders and institutions to deploy automated strategies with full transparency and on-chain execution.

Region/Industry

Project Duration

Client Type

SAFTP Finance was founded with a mission to simplify on-chain trading and yield generation through automation. The team wanted to create a hybrid platform that blends algorithmic trading bots with DeFi yield strategies, giving both retail and institutional users the ability to automate complex liquidity operations without coding expertise.

The idea was to build a system capable of executing arbitrage, staking, and liquidity management across multiple blockchains from a single unified dashboard. The platform would also feature real-time analytics, performance tracking, and AI-driven trade execution to help users optimize returns securely.

To turn this concept into a fully functional trading automation suite, SAFTP Finance partnered with Ment Tech Labs to design and develop a smart, cross-chain, and modular platform that merges algorithmic precision with decentralized finance efficiency.

Let’s build intelligent DeFi platforms that automate growth and empower traders.

Before collaborating with Ment Tech Labs, the SAFTP Finance team faced several technical and operational challenges that limited automation efficiency, liquidity performance, and user trust. These issues needed to be solved to deliver a secure and scalable trading automation experience.

Limited Cross-Chain Liquidity Management

The initial system couldn’t move liquidity across networks efficiently, causing fragmented pools and reduced strategy performance.

Lack of Real-Time Trading Execution

Trade executions often lagged or failed during high market volatility, leading to missed arbitrage and yield opportunities.

No Unified Dashboard for DeFi and Trading Bots

Users had to manage separate interfaces for DeFi staking and trading strategies, creating friction and complexity.

High Gas Fees and Inefficient Automation Loops

The early automation scripts consumed excessive gas, making frequent rebalancing and yield harvesting unprofitable.

Security and Transparency Gaps

Users lacked visibility into strategy logic and transaction histories, raising concerns over fund safety and operational trust.

Absence of Performance Analytics and Risk Controls

The platform lacked AI-driven insights, risk tracking, and backtesting tools to measure and optimize trading outcomes.

Ment Tech’s Approach

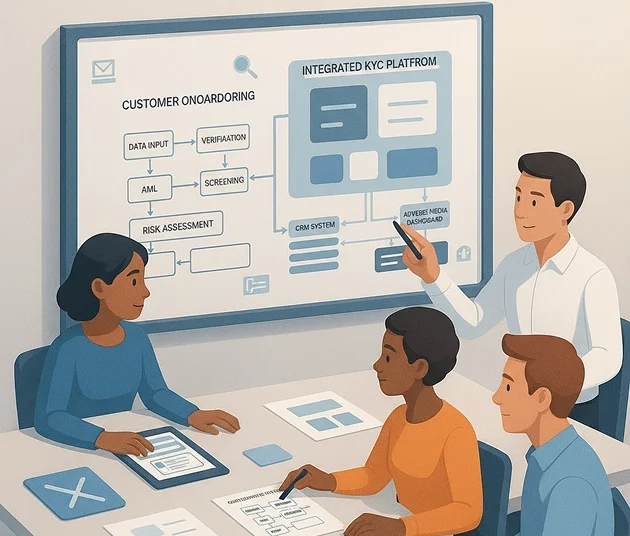

Ment Tech Labs approached SAFTP Finance with a clear goal to build a hybrid trading automation platform that merges algorithmic trading precision with DeFi efficiency. The process followed a structured roadmap focused on speed, scalability, and transparency.

Product Discovery and Architecture Design

Researched existing trading and DeFi frameworks to define the core architecture. Designed a unified system capable of connecting centralized APIs and on-chain protocols.

Algorithmic Trading Engine Developme

Developed a Python-based trading engine for high-frequency execution. Integrated multiple exchange APIs for real-time arbitrage and yield strategies.

Smart Contract Development for DeFi Automation

Created secure, gas-optimized smart contracts for staking and rebalancing. Enabled automated yield strategies across multi-chain ecosystems.

Unified Cross-Chain Dashboard

Built a React-based interface for managing assets and liquidity pools. Users can monitor live trades, yields, and cross-chain transfers seamlessly.

AI-Powered Risk and Performance Analytics

Integrated an AI analytics engine to predict volatility and optimize strategies. Offered users real-time insights for better trading outcomes.

Security Audits and Transparency Tools

Performed detailed audits and transaction simulations pre-launch. Added on-chain transparency dashboards for user trust and accountability.

Deployment and Continuous Optimization

Deployed on Polygon with full CEX and DEX integrations. Continuous updates now extend functionality to Solana and EVM-compatible chains.

Ment Tech Labs delivered a hybrid trading and DeFi automation platform that unified centralized and decentralized operations into a single dashboard. Each solution enhanced automation, security, and performance across all trading environments.

Hybrid Trading Engine Integration

Built a trading engine connecting centralized APIs and on-chain DEXs. Enabled users to execute arbitrage and market-making strategies in real time.

Smart Contract Automation Suite

Developed contracts for staking, yield optimization, and fund rebalancing. Each contract is gas-efficient and supports cross-chain compatibility.

AI-Driven Strategy Optimization

Integrated machine learning models to predict volatility and adjust risk parameters. Improved performance consistency across changing market conditions.

Unified Cross-Chain Dashboard

Designed a seamless dashboard to manage assets across multiple chains. Users can view portfolios, active bots, and liquidity pools in one place.

Real-Time Analytics and Reporting Tools

Added detailed analytics for trade execution, yield rates, and arbitrage gains. Enhanced user decision-making through transparent performance data.

Security and Audit Implementation

Conducted multiple rounds of penetration testing and contract audits. Established full transaction transparency and fund safety assurance.

Automated Yield Farming Module

Created an engine for auto-compounding and liquidity reallocation. Helped users maximize passive income with zero manual management.

Scalable Cloud Infrastructure

Deployed AWS-based backend to handle heavy data and trading loads. Ensured stability, uptime, and global accessibility for all operations.

Multi-Network Liquidity Bridge

Integrated cross-chain liquidity transfers with low latency. Enabled seamless asset mobility between Polygon, Ethereum, and BNB Chain.

Our clients

SAFTP Finance was designed to merge algorithmic trading and DeFi automation into one platform. Each feature enhances trading precision, cross-chain liquidity, and passive yield generation for users worldwide.

Hybrid Trading Architecture

Combines centralized exchange APIs with decentralized liquidity pools. Enables seamless execution of both on-chain and off-chain strategies.

Automated Arbitrage Engine

Executes real-time price monitoring and cross-exchange arbitrage. Ensures users capture profit opportunities instantly and securely.

Cross-Chain Liquidity Management

Allows assets to move between multiple blockchains efficiently. Optimizes capital allocation across trading and yield pools.

AI-Powered Strategy Optimization

Uses predictive analytics to evaluate market trends and volatility. Helps users adapt trading behavior for consistent returns.

DeFi Yield Automation Suite

Automates staking, yield farming, and reward compounding. Reduces manual intervention while maximizing on-chain earnings.

Unified Portfolio Dashboard

Displays real-time balances, trade history, and liquidity positions. Users can control strategies and monitor results from one interface.

Smart Contract Governance Layer

A built-in governance system ensures transparency and fund security. Users can track all on-chain activities through verified contracts.

Multi-Exchange API Integration

Supports Binance, Uniswap, and other major exchanges. Expands strategy coverage across both CEX and DEX environments.

Comprehensive Risk and Performance Analytics

Offers backtesting tools and ROI visualizations for every strategy. Enables data-driven decision-making and portfolio optimization.

Driving Performance and Efficiency Across DeFi Markets