Have you ever thought about the real worth of a single customer to your business? This is exactly what customer lifetime value CLV helps you understand. It measures the total revenue you can expect from a customer from the very first purchase to the last interaction. Knowing this number changes how you see marketing, sales, and retention efforts because it shows the bigger picture of profitability.

Understanding what is customer lifetime value CLV is not only about knowing a definition. It is about seeing the story behind customer relationships, learning how buying patterns evolve, and using that knowledge to make smarter decisions.

In this guide, we will explore the customer lifetime value CLV definition, the most effective ways to calculate it, the different models you can use, and how to apply these insights to grow your revenue. From understanding the basics to applying it in ecommerce and beyond, you will learn how to turn this metric into a powerful tool for sustainable business growth.

What Is Customer Lifetime Value?

Customer lifetime value, often written as CLV, is the total amount of revenue a business can expect to earn from a single customer over the entire length of their relationship.

CLV is the total amount a customer spends with you over time, not just the first purchase. For example, if someone shops from your e-commerce store five times a year, spending an average of $50 each time, and they keep buying from you for four years, their customer lifetime value would be $1,000.

Businesses track CLV because it helps answer important questions like:

- How much can we afford to spend to get a new customer?

- Which customers are the most profitable over time?

- How can we keep our best customers coming back?

When you know your CLV, you can focus on keeping loyal customers, improving repeat sales, and making smarter marketing and pricing decisions.

Why Customer Lifetime Value CLV Matters for Your Business?

Understanding customer lifetime value CLV helps you see the bigger picture of your revenue. It shows how much each customer is worth over time, guiding smarter decisions on marketing, sales, and retention.

A higher customer lifetime value CLV means customers are buying more often, spending more, and staying loyal for longer. When you know this number, you can focus on the customers who bring the most profit, set the right budgets for acquiring new ones, and create strategies that keep your best customers coming back.

Here are some of the key reasons why tracking customer lifetime value CLV can make a real difference for your business:

1. Total Revenue

Shows how much a customer contributes in revenue over their entire relationship, helping you understand overall customer lifetime value CLV.

2. Profit Check

The Profit Check feature compares the customer lifetime value (CLV) with the acquisition costs to determine the true profitability of customers.

3. Top Segments

Identifies the most valuable customer groups so you can focus marketing on those with the highest CLV.

4. Better Retention

Guides strategies to keep high-value customers longer, increasing their overall contribution.

5. Accurate Forecasts

Helps plan sales, inventory, and resources based on long-term customer spending patterns.

6. Smart Investment

Supports better allocation of budget toward loyalty programs and experiences that improve customer lifetime value CLV.

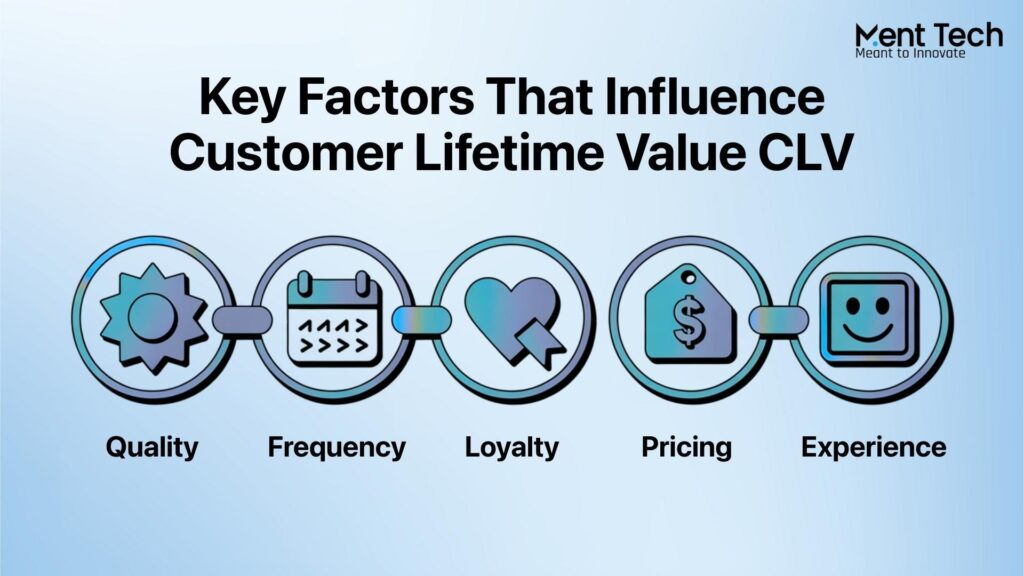

Factors That Shape Customer Lifetime Value CLV

The amount a customer spends with your business over time is not random. It is shaped by several key factors that you can influence.

- Quality: When customers feel your product or service delivers real value, they are far more likely to return, recommend you to others, and remain loyal for years. Strong quality creates trust, and trust keeps people coming back.

- Frequency: How often customers buy from you has a direct impact on customer lifetime value CLV. A coffee shop that serves the same person several times a week will naturally see a higher CLV than a store that makes a sale once every few years.

- Loyalty: A deep connection to your brand can keep customers from drifting toward competitors. Loyalty is often built through consistent quality, exceptional service, and shared values that resonate with your audience.

- Pricing: The right pricing approach can increase the size of each purchase without pushing customers away. Well-balanced prices encourage repeat business and make customers feel they are getting fair value.

- Experience: Every interaction matters, from the first website visit to customer support after a sale. A smooth, positive experience at each touchpoint often turns one-time buyers into long-term supporters.

Customer Lifetime Value CLV Models

There is more than one way to measure customer lifetime value CLV, and the method you choose depends on your goals and the type of data you have. The two most common approaches are historical CLV and predictive CLV.

Historical CLV

It looks at what has already happened. It uses past purchase data to work out the total value a customer has brought to your business so far. This method is straightforward and works well for companies with stable customer patterns and reliable sales history. It helps you understand the actual value customers have delivered, which is useful for spotting trends and identifying your best buyers.

Predictive CLV

It focuses on what is likely to happen in the future. It combines past customer behavior with forecasting techniques to estimate future purchases, retention rates, and spending. Businesses often use this approach when planning marketing campaigns or deciding how much to invest in retaining certain customers. Predictive models can be especially powerful when paired with AI-driven customer lifetime value CLV analysis, which can process large amounts of data and give you more accurate forecasts.

Both models have their place. Historical CLV gives you a solid picture of what has worked, while predictive CLV helps you plan ahead with confidence. Many successful businesses use both to balance insight from the past with expectations for the future.

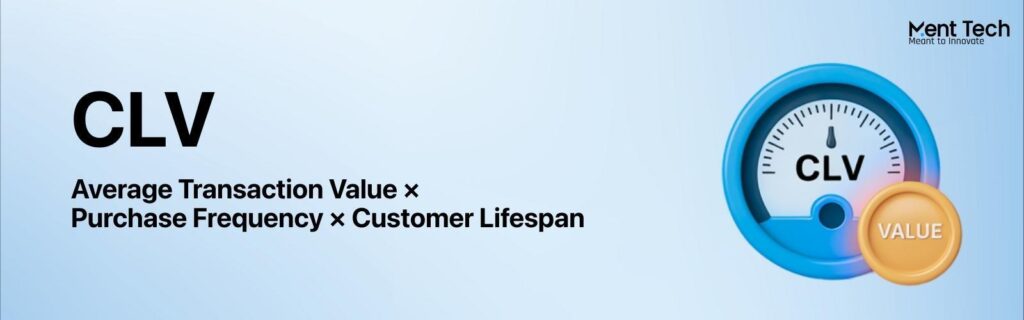

The Customer Lifetime Value CLV Formula

Calculating customer lifetime value CLV does not have to be complicated. The most common formula is straightforward and works for many types of businesses.

CLV = Average Transaction Value × Purchase Frequency × Customer Lifespan

The average transaction value is the typical amount a customer spends each time they buy from you. Purchase frequency refers to how many times they buy in a set period, such as a year. Customer lifespan is the average length of time someone continues to buy from you.

For example, if the average order is $40, the typical customer buys five times a year, and they stay with you for four years, your customer lifetime value CLV would be:

$40 × 5 × 4 = $800

This number tells you how much revenue, on average, each customer generates during their relationship with your business. Once you know it, you can make smarter choices about marketing spend, retention programs, and product development.

How to Use Customer Lifetime Value CLV Insights?

- Identify and prioritize your top customers by offering rewards, early product access, or personalized deals to increase loyalty.

- Improve your return on investment by using CLV to determine how much you can spend on acquiring new customers profitably.

- Segment your customer base using CLV to design targeted campaigns for different value groups.

- Create retention strategies that are based on long-term customer behavior and engagement.

- Promote products that are tied to high-CLV customers and consider developing related offerings to match their preferences.

- Use CLV data to guide inventory planning, staffing, and support decisions that align with long-term value.

Ways to Improve Customer Lifetime Value CLV

Improving customer lifetime value CLV is about keeping customers happy, encouraging them to spend more, and making them want to return again and again. Small changes in how you engage with your customers can lead to big increases in the revenue they generate over time. Here are some proven ways to make it happen.

1. Loyalty Programs

Create rewards systems that give customers a reason to come back. A well-designed loyalty program can increase purchase frequency and raise overall customer lifetime value CLV.

2. Better Onboarding

Help new customers understand how to get the most out of your product or service from the start. A smooth onboarding experience builds trust and sets the stage for a longer relationship.

3. Personalized Marketing

Use purchase history and preferences to send offers that feel relevant. Targeted messages often lead to higher engagement and a stronger customer lifetime value CLV.

4. Upselling and Cross-Selling

Encourage customers to explore higher-value or complementary products. Done well, this increases average transaction size and boosts long-term revenue.

5. Improved Customer Service

Positive interactions at every touchpoint keep customers satisfied and loyal. Excellent service can be one of the fastest ways to lift customer lifetime value CLV.

6. Simpler Purchase Experience

Make buying easy, whether online or in-store. A smooth checkout process reduces drop-offs and increases repeat sales.

7. Easy Returns

A hassle-free return policy builds confidence. Customers who know they can return items without problems are more likely to buy again.

Common Customer Lifetime Value CLV Mistakes to Avoid

While tracking customer lifetime value CLV can transform how you grow your business, there are common mistakes that can make the numbers misleading or limit the impact of your strategy.

- Focusing Only on Revenue: Looking only at total revenue without factoring in costs can give an inflated view of CLV. Profitability matters just as much as sales.

- Treating All Customers the Same: Not all customers have the same value. Ignoring segmentation means you might spend equally on low-value and high-value customers, which reduces returns.

- Relying on Outdated Data: Using old or incomplete customer data can lead to inaccurate calculations and poor decisions. CLV should be updated regularly to reflect current buying behavior.

- Ignoring Retention Opportunities: If CLV is low, it may be because customers are leaving too soon. Skipping retention strategies means missing out on the easiest way to increase value.

- Overlooking the Customer Experience: Numbers alone will not improve CLV. Without investing in customer service, product quality, and the overall experience, the value will remain flat.

Real-World Use Cases of Customer Lifetime Value CLV

Seeing how customer lifetime value CLV works in real situations can make the concept far more practical. Here are examples from different industries showing how businesses apply CLV insights.

1. Ecommerce Store

An online clothing brand calculated that loyal customers spend about $600 a year and remain active for three years, giving a CLV of $1,800. With this data, they increased marketing spend on audiences similar to their best buyers, confident the returns would cover acquisition costs.

2. Subscription Service

A meal delivery company noticed subscribers with a CLV above $1,000 regularly interacted with recipe content and seasonal offers. They launched tailored meal plans and exclusive promotions to extend subscription lengths.

3. Retail Chain

A home goods store found that customers who attended in-store workshops had a 40 percent higher CLV than those who did not. They invested in more workshop events, knowing they directly improved loyalty and purchase frequency.

4. SaaS Platform

A project management software provider segmented customers by CLV and identified that enterprise clients had a value five times higher than small teams. They shifted resources toward dedicated enterprise onboarding and premium support.

5. Hospitality

A hotel chain calculated CLV across different traveler profiles and discovered business travelers had the highest repeat booking rates. They created targeted loyalty perks like faster check-in and complimentary meeting space access to keep them coming back.

6. Fitness Studio

A boutique gym tracked CLV and saw that members who attended referral events stayed twice as long as others. They increased referral incentives, which boosted both member retention and new sign-ups.

These cases show that once you understand customer lifetime value CLV, you can focus efforts on the customers and strategies that produce the most lasting revenue.

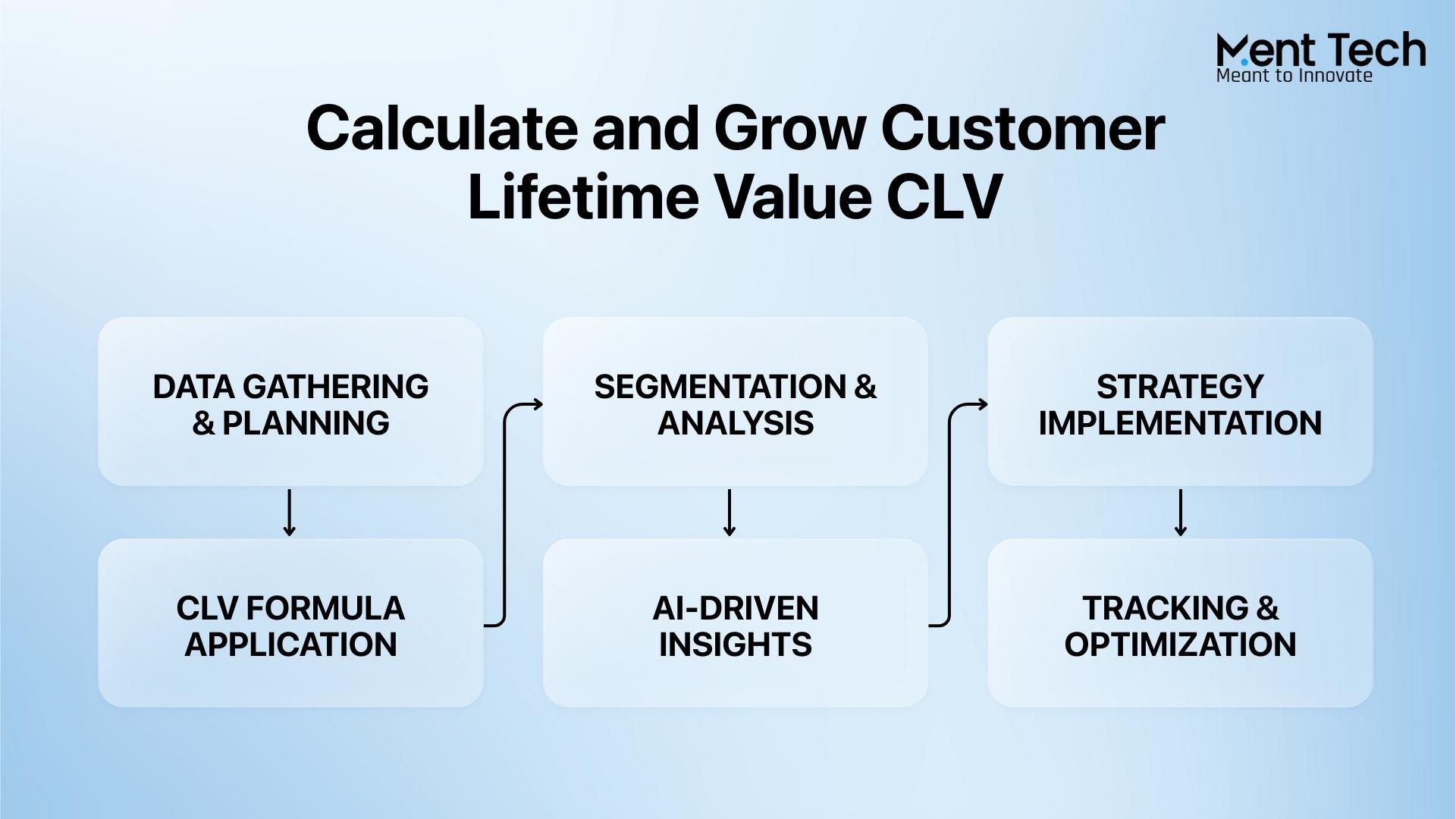

Tools and Methods for Tracking Customer Lifetime Value CLV

Tracking customer lifetime value CLV becomes much easier when you have the right tools in place. Manual spreadsheets can work for small datasets, but as your customer base grows, you need more advanced methods to keep data accurate and actionable.

A good starting point is a CRM system. Platforms like HubSpot, Salesforce, or Zoho store customer details, purchase history, and engagement patterns, making it simple to calculate and update CLV over time. For ecommerce businesses, built-in analytics on platforms like Shopify, WooCommerce, or Magento can automatically calculate average order values and purchase frequency.

For companies ready to take CLV tracking further, AI-powered analytics offer a huge advantage. AI-driven customer lifetime value CLV analysis can forecast future spending patterns, identify high-value customer segments, and suggest targeted retention strategies.

This is where Ment Tech Labs comes in. As an AI development company, we design custom solutions that integrate with your existing systems to automate CLV tracking and analysis. Our tools process large volumes of data, deliver real-time insights, and help you act quickly to retain and grow your most valuable customers.

By choosing the right tools, you ensure that customer lifetime value CLV is not just a static number but a living metric that guides smarter business decisions every day.

Final Thoughts

Customer lifetime value CLV is not just a financial calculation. It is a roadmap for building stronger relationships, making better business decisions, and increasing revenue over the long term. When you understand how much value each customer brings, you can focus on keeping them longer, encouraging them to buy more, and serving them in ways that strengthen loyalty.

Ment Tech Labs is an AI development company that helps businesses use advanced technology to understand and improve customer lifetime value CLV. Our AI solutions can analyze customer data, predict future buying patterns, and identify high-value segments so you can act with precision. By combining powerful algorithms with a human-first approach, we make it easier to personalize marketing, refine retention strategies, and invest in customers who will deliver the greatest long-term growth.

If you are ready to take your customer lifetime value CLV strategy to the next level, our team can design and build AI-driven tools tailored to your business.

FAQ

The customer lifetime value CLV is the predicted total revenue a customer will generate for your business from the first purchase to the last. It combines purchase frequency, average order value, and customer lifespan into one clear metric.

AI-driven customer lifetime value CLV analysis uses machine learning and predictive modeling to forecast future buying behavior, identify high-value customer segments, and reveal opportunities for upselling and retention. This approach provides more accurate and actionable insights than manual calculations alone.

The CLV customer lifetime value uses three key inputs: average transaction size, number of transactions per year, and the average retention period. By multiplying these numbers, you can estimate the revenue generated by an average customer over time.

The customer lifetime value CLV model you choose depends on your business. Historical CLV models use past data to find the actual revenue a customer has brought in, while predictive CLV models forecast future spending patterns. Many businesses use both for a complete picture.

To calculate customer lifetime value CLV in ecommerce, find your average order value, multiply it by the average number of orders per year, and then multiply that by the average customer lifespan. This shows the total expected revenue from an online shopper.