Dubai is redefining global property investment through real estate tokenization. What was once limited to pilot projects is now a regulated marketplace where properties are fractionalized into blockchain-based tokens. With just a crypto wallet and a few hundred dollars, investors worldwide can access Dubai’s luxury apartments, commercial spaces, and rental properties that once required millions in capital.

Dubai’s Prypco sold a Dh 1.75 million tokenized villa in under five minutes, proving strong global demand for fractional real estate.

Unlike short-term crypto projects, tokenized real estate is anchored in tangible, compliant assets that deliver long-term value, liquidity, and transparency. Backed by forward-looking regulations and secure blockchain infrastructure, Dubai is setting the global benchmark for accessible, borderless property investment.

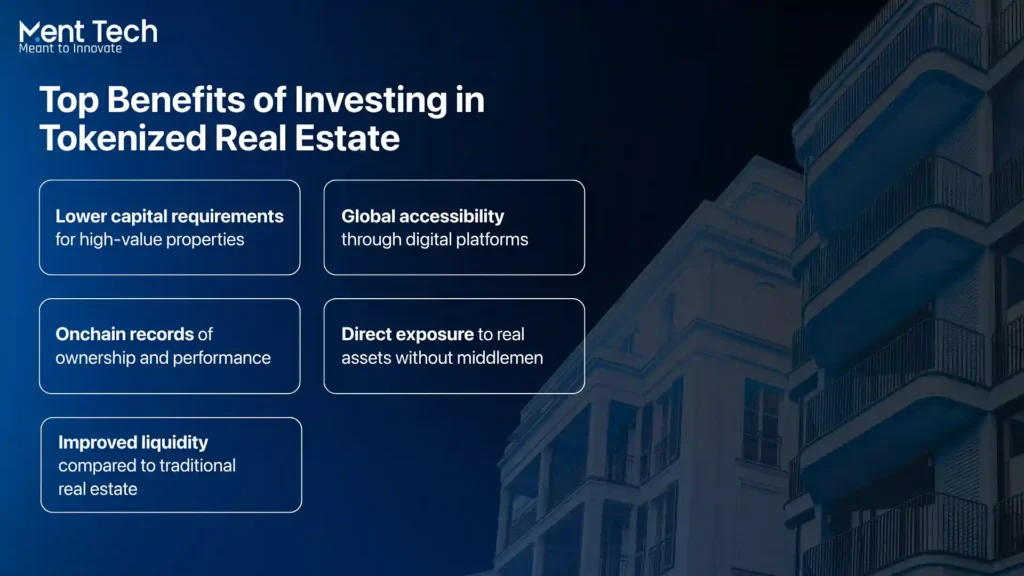

Benefits of Investing in Tokenized Real Estate

Tokenized real estate makes Dubai’s property market more accessible, transparent, and liquid. It lowers entry barriers while giving investors direct, secure access to high-value assets.

1. Lower Capital Requirement

Instead of millions upfront, tokenization lets investors buy fractional shares of premium properties with just a few hundred dollars. This opens Dubai’s high-value real estate market to a wider pool of global buyers.

2. Global Market Access

Through blockchain-powered platforms, investors from anywhere in the world can participate in Dubai’s real estate market. RWA Tokenization removes geographical restrictions and makes property ownership truly borderless.

3. On-Chain Records

All ownership and performance data is securely stored on blockchain, creating tamper-proof records. This ensures higher transparency, reduces fraud, and builds investor confidence compared to traditional paperwork.

4. Direct Asset Ownership

By cutting out intermediaries, tokenization provides direct exposure to real properties. Investors enjoy reduced costs, clearer rights, and more control over their assets.

5. Improve Liquidity

Unlike traditional real estate, which can take months to sell, tokenized assets can be traded swiftly on digital exchanges. This makes property investment far more flexible and liquid.

How Real Estate Tokenization Works?

Real estate tokenization turns property ownership into digital tokens on a blockchain. These tokens represent small fractions of the asset, making real estate investment more accessible, liquid, and transparent.

Here’s a step-by-step look at the process:

1. Asset Digitization: A physical property is converted into a digital form by linking its value and ownership rights to tokens.

2. Token Creation: Tokens are generated and recorded on a blockchain, ensuring security and decentralization.

3. Smart Contracts: Rules and conditions are embedded into smart contracts, which automatically execute transactions when requirements are met.

4. Fractional Ownership: The property is divided into multiple tradable units, with each token representing a share of the asset.

5. Investment and Trading: Investors can buy these tokens, allowing participation in real estate without purchasing the whole property.

6. Liquidity and Transparency: Tokens can be traded on digital cryptocurrency exchanges, improving liquidity while ensuring secure and transparent transactions.

7. Income Distribution: Tokens may also provide rights to income streams, such as rental earnings or profits from resale.

Steps to Launch a Tokenized Real Estate Platform in Dubai

Real estate tokenization in Dubai requires both regulatory approval and strong technical infrastructure. Here is the steps to build and launch a compliant and secure platform for investors.

1. Regulatory Foundation & Legal Structure

To operate in Dubai, securing a VARA license and creating a Special Purpose Vehicle (SPV) is essential. Partnering with the Dubai Land Department (DLD) ensures compliance and gives digital tokens the same legal value as property deeds.

2. Property Selection & Valuation

Choose the right property, get a professional valuation, and tokenize it into fractional units for wider access. This model also extends to Tokenizing financial products, making investment more inclusive.

3. Technical Infrastructure Development

Select a secure blockchain, deploy smart contracts, and build a user-friendly platform. Many businesses use Token Launch Services to speed up deployment and ensure smooth investor participation.

4. Security & Compliance

Implement KYC/AML checks and conduct regular audits to safeguard investors. Similar frameworks now support RWA entertainment tokenization, ensuring trust across new asset classes.

5. Platform Launch & Investor Onboarding

Launch with strong marketing, simplify onboarding, and enable secondary trading to provide investors with liquidity and flexibility.

Key Investment Hurdles Faced by Global Asset Managers in Dubai

Dubai’s real estate market continues to grow at an impressive pace, but international asset managers still face several obstacles when trying to participate directly.

- Legal Barriers

Purchasing property in Dubai usually requires setting up a local entity or using nominee structures. These processes are costly, time-intensive, and raise concerns about transparency and control challenges that a crypto marketing agency often highlights when promoting tokenized real estate solutions.

- Operational Complexities

Managing investor relations, tracking ownership records, handling subscriptions and redemptions, distributing returns, and staying compliant are still largely manual tasks. This lack of automation makes the process inefficient, particularly for cross-border investors who expect smoother onboarding and fund administration.

- Liquidity Constraints

Even where fractional ownership models exist, exit opportunities remain limited. Without established secondary markets, investors often find themselves locked in, with few options to redeem or transfer their holdings. This lack of liquidity reduces the overall appeal of the asset class for both managers and investors.

Why Developers in Dubai Are Turning to Tokenized Real Estate

Investors are not the only ones who benefit from tokenized real estate. For developers, this model opens new capital flows, speeds up funding cycles, and strengthens project control. Here’s how it works in practice.

1. Global Capital Access

Tokenization opens doors to international investors, helping developers raise funds beyond traditional banks and institutions while expanding their reach worldwide.

2. Faster Funding Cycles

With smart contracts automating compliance and transactions, funding rounds close in days, not months, removing delays from paperwork and intermediaries.

3. Equity Retention

Instead of giving up large equity stakes or taking on heavy debt, developers can raise capital while maintaining ownership and long-term project control.

4. Transparent Operations

Blockchain technology backed data gives investors real-time visibility into ownership, cash flows, and project progress, building trust and lasting partnerships.

Real World Examples of Real Estate Tokenization in Dubai

Dubai has become a global leader in blockchain-driven property investment. With support from government initiatives, private platforms, and guidance from blockchain consultants, real estate tokenization is making property ownership faster, safer, and more accessible. Here are some of the most impactful real-world examples:

1. Prypco Mint Platform

Backed by the Dubai Land Department (DLD) and regulated by VARA, Prypco Mint has become a leading real estate tokenization platform. Properties are selling out in minutes, with investments starting from just AED 2,000, making premium real estate more accessible.

2. DAMAC and MANTRA Partnership

DAMAC Group joined forces with blockchain platform MANTRA to tokenize $1 billion worth of luxury properties. This deal marks a significant step toward institutional adoption of tokenized real estate.

3. MAG Group, MultiBank Group, and Mavryk

These companies announced a $3 billion initiative in 2025 to tokenize luxury properties, including The Ritz-Carlton Residences in Dubai, opening opportunities for global investors.

4. SmartCrowd

As a fractional investment platform regulated by the UAE’s SCA, SmartCrowd allows individuals to invest in real estate with as little as AED 500, ensuring compliance and lowering entry barriers.

5. Dubai Land Department’s Pilot Project

The DLD launched a Real Estate Tokenization Project in 2025 under its Real Estate Evolution Space initiative. As the first registration authority in the Middle East to adopt blockchain tokenization, the project has attracted strong international investor interest.

Conclusion

Dubai has already turned real estate tokenization from an experiment into reality, setting a global benchmark. Instead of waiting months for legal clearances and financial processes, property transactions can now be executed in minutes through blockchain-powered platforms, supported by clear regulations and robust digital infrastructure.

At MentTech, we see this transformation as more than just a technological shift. It’s the beginning of a new era in property ownership. Tokenized real estate doesn’t replace traditional investment models; it enhances them by making the market more inclusive, liquid, and transparent.

As a leading real estate tokenization development company, MentTech specializes in building compliant, scalable platforms that empower investors, developers, and institutions to participate in this new economy with confidence. By combining blockchain innovation with regulatory alignment, we help redefine real estate’s potential, making ownership smarter, faster, and accessible to a global audience.

Frequently Asked Questions

1. What is real estate tokenization, and how does it work?

Real estate tokenization is the process of converting a physical property into digital tokens on a blockchain. Each token represents fractional ownership in the asset. Investors can buy, sell, or trade these tokens globally without needing to own the entire property or go through traditional intermediaries.

2. Can anyone invest in tokenized real estate in Dubai?

Yes, Dubai’s legal framework now allows retail and international investors to participate in tokenized real estate. Through regulated platforms, users from around the world can invest in fractional shares of properties using a digital wallet and a small capital amount.

3. Is tokenized real estate in Dubai regulated?

Yes, the Virtual Assets Regulatory Authority (VARA) in Dubai introduced a dedicated legal category called Asset-Referenced Virtual Assets (ARVAs). Platforms must be licensed under Category 1 and follow strict compliance rules, including audits, disclosures, and investor protections.

4. What are the benefits of investing in tokenized real estate?

Investors benefit from lower entry costs, improved liquidity, access to global properties, on-chain ownership records, and potential rental income. It’s a simplified and transparent way to invest in real estate, especially in high-demand markets like Dubai.

5. How do real estate developers benefit from tokenization?

Tokenization allows developers to raise capital faster without relying on banks or giving away equity. With a dedicated developer team, they can tap into global investor pools, cut fundraising friction, and manage compliance through automated blockchain infrastructure.

6. What kind of returns can tokenized real estate offer in Dubai?

Dubai offers some of the highest rental yields globally, often between 6 to 9 percent depending on the location. Tokenized real estate platforms enable investors to tap into this yield while maintaining fractional ownership of the asset.