Banking has already gone digital. Now, it’s becoming intelligent. After years of investing in apps, APIs, and automation, the industry is entering a new phase where technology doesn’t just follow commands, it makes decisions. This is being driven by Agentic AI, systems that can act independently, learn from data, and coordinate across complex financial environments.

Already, 70% of banking executives say their institutions are piloting or using agentic AI, unlocking gains once thought impossible from up to 2,000% productivity boosts in compliance tasks to 40% cost reductions in operations. And according to Deloitte, half of all enterprises using generative AI will deploy agentic AI by 2027, with banking leading this evolution.

In this blog, we will explore how agentic AI is transforming modern banking making fraud detection proactive, customer service predictive, and decision-making autonomous. It’s setting a new standard for speed, accuracy, and personalization across financial services while helping banks manage risk, improve efficiency, and deliver smarter customer experiences.

What is Agentic AI in Banking?

Agentic AI in banking represents a major evolution from traditional, reactive systems to proactive, decision-making intelligence. Unlike earlier AI models that rely on human input for every action, agentic AI operates autonomously toward defined goals analyzing data, making decisions, and executing multi-step processes with minimal human oversight. Think of it as having a highly skilled banking professional who works 24/7, never tires, and can handle thousands of complex operations at once with precision and consistency.

At its core, banking operates with three core capabilities:

- Autonomy: Acting independently without constant prompts or supervision

- Adaptability: Learning from new data and adjusting behavior accordingly

- Coordination: Collaborating with other AI systems across a bank’s ecosystem

These capabilities enable agentic AI systems to do far more than process information; they understand context, make judgments, and take action. For example, when detecting potential fraud, an agentic AI system doesn’t just flag a suspicious transaction. It can instantly freeze the account, notify the customer through their preferred channel, review related transactions, and even initiate an investigation all within seconds.

Business Benefits of Agentic AI in Banking

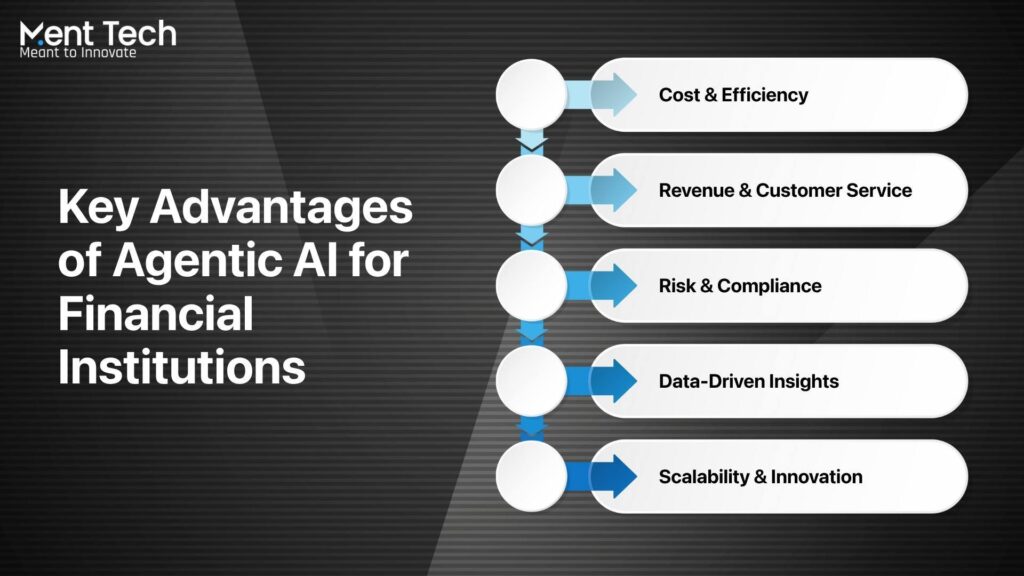

The practical benefits of agentic ai use cases in banking extend across every aspect of financial operations, delivering measurable improvements that directly impact the bottom line.

1. Cost & Efficiency

Banks implementing agentic AI are seeing dramatic reductions in manual work and processing times. Some institutions report cost reductions of up to 40% in specific departments. This happens because AI agents can handle routine tasks that previously required multiple staff members, working around the clock without breaks or errors caused by fatigue.

2. Revenue & Customer Service

How does agentic ai enhance customer engagement in banking? By providing personalized, immediate responses to customer needs. Instead of waiting for business hours to get financial advice or loan information, customers can interact with AI agents that understand their complete financial picture and can make real recommendations or even pre-approve services instantly.

Studies show potential increases of 30% in lending volumes and 50% reduction in loan approval times when banks implement comprehensive agentic AI systems. This speed advantage often translates directly into winning more customers who value quick, efficient service.

3. Risk & Compliance

Perhaps nowhere is agentic AI more valuable than in risk management. These systems can monitor thousands of transactions simultaneously, learning from new fraud patterns and adapting their detection methods in real-time. This proactive approach helps banks stay ahead of threats rather than simply reacting to them after damage occurs.

4. Data-Driven Insights

Agentic AI provides banks with deeper, data-driven insights that support smarter decision-making. By analyzing vast amounts of financial, market, and customer data, AI agents can identify trends, opportunities, and potential risks that may not be visible through traditional methods. This enables banks to make faster, more informed strategic decisions across lending, investments, and product development.

5. Scalability & Innovation

Agentic AI allows banks to scale operations efficiently without proportionally increasing costs or workforce. By automating complex, multi-step processes, banks can expand services, launch new products, and enter new markets more quickly. This flexibility also fosters innovation, as employees are freed from repetitive tasks to focus on strategic initiatives and creative problem-solving.

Key Challenges and Considerations in Deploying Agentic AI in Banking

While the benefits are significant, implementing agentic ai in banking use cases comes with real challenges that institutions must address thoughtfully.

| Challenge | Description | Risk Level | Mitigation Strategy |

| Governance & Compliance | Regulatory scrutiny, audit trails, accountability | High | Human-in-the-loop controls, comprehensive logging |

| Algorithmic Bias | Unfair decisions in lending, fraud detection | High | Diverse datasets, regular fairness testing |

| Data Privacy & Security | Sensitive financial data exposure, cyberattacks | Critical | End-to-end encryption, zero-trust architecture |

| Skills Gap | Lack of AI expertise, training requirements | High | Staff upskilling, external partnerships |

| Legacy System Integration | Complex system compatibility issues | Medium | API-first approach, gradual migration |

| Explainable AI | Need for transparent decision-making | High | Interpretable models, decision documentation |

| Operational Risk | Agent errors, infinite loops, system failures | High | Circuit breakers, continuous monitoring |

| Customer Trust | Acceptance of autonomous financial decisions | Medium | Clear communication, override controls |

| Liability & Legal | Unclear responsibility for AI actions | High | Clear governance frameworks, insurance |

| Model Risk | Flawed algorithms, incorrect predictions | High | Robust testing, validation processes |

| Scalability | Infrastructure limitations, performance issues | Medium | Cloud-native architecture, load balancing |

| Vendor Dependency | Reliance on third-party AI providers | Medium | Multi-vendor strategy, in-house capabilities |

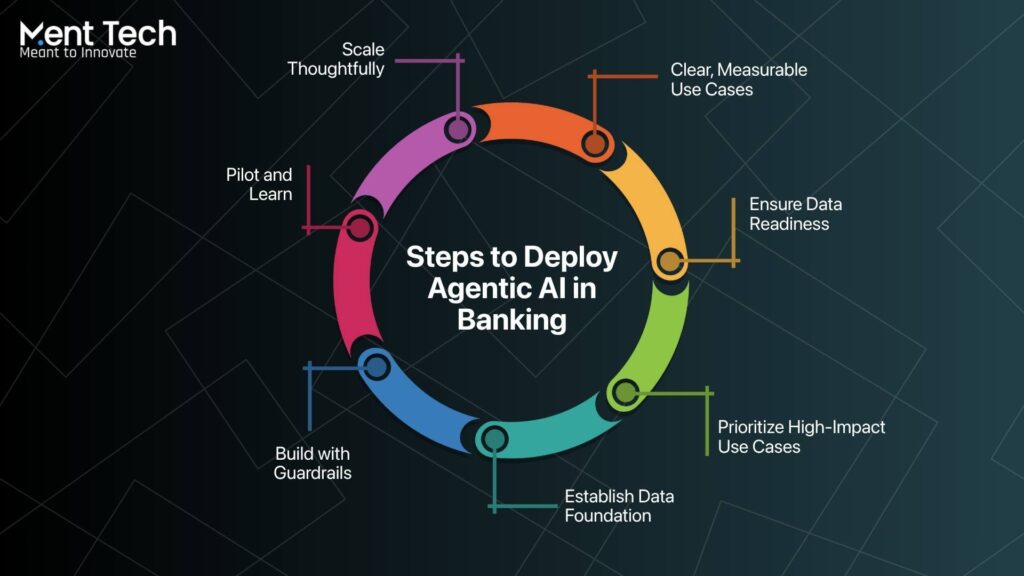

Steps to Deploying Agentic AI in Banks

Successfully implementing agentic ai in banking operations requires a structured approach that balances ambition with practical realities.

Step 1: Start with Clear, Measurable Use Cases

Begin with processes that are well-defined, high-volume, and have clear success metrics. Document processing, basic customer inquiries, and routine compliance checks often make good starting points because the rules are clear and the benefits are easy to measure.

Step 2: Ensure Data Readiness

Before deploying AI agents, banks need clean, accessible data. This often means consolidating information from multiple systems, establishing data quality standards, and creating secure access paths that AI agents can use without compromising security.

Step 3: Identify and Prioritize High-Impact Use Cases

Select well-defined, high-volume banking processes where agentic AI can deliver clear, measurable value with manageable risk. Examples include document processing for loans, KYC compliance, customer inquiries, and transaction monitoring for fraud. Assign a business owner for each use case and set quantifiable success metrics aligned to business priorities.

Step 4: Establish Data Foundation and System Architecture

Develop a unified, high-quality data environment that supports autonomous decision-making. This involves consolidating information from disparate systems, implementing data quality standards, and establishing secure API access with granular permissions.

Step 5: Build Comprehensive Guardrails and Risk Controls

To ensure safe and compliant AI operations, establish clear boundaries for autonomous actions versus those requiring human oversight. Implement approval workflows for high-risk decisions, enforce least-privilege access, encrypt sensitive data, and maintain detailed audit trails for all agent activity.

Step 6: Pilot and Learn

Start with limited pilot projects that allow teams to learn how agentic AI works in practice. Use these pilots to refine processes, identify unexpected challenges, and build confidence before broader deployment.

Step 7: Scale Thoughtfully

Once pilot projects prove successful, expand gradually while maintaining oversight and learning from each phase. Consider using AI Agent Builder for Business Use Cases platforms that can accelerate development while maintaining consistency.

Use Cases for Agentic AI Across Banking Operations

Agentic AI use cases in banking span the entire financial services ecosystem. Let’s examine specific applications with real-world examples:

Front-Office Applications

1. Personalized Financial Advisory Services

Banks are deploying ai agents in banking that act as personal financial advisors. These systems analyze customer transaction history, financial goals, and market conditions to provide tailored recommendations. For example, if a customer’s spending pattern indicates they’re saving for a major purchase, the AI agent automatically suggests optimal savings strategies and investment options.

2. Enhanced Customer Experience

Agentic AI enhances customer engagement in banking by anticipating needs before customers realize them. Case study: A major regional bank implemented agentic AI that proactively notifies customers about unusual account activity, suggests ways to avoid fees, and automatically schedules financial consultations when major life events are detected through spending patterns.

3. Advanced Conversational Banking

Moving beyond traditional chatbots, agentic AI enables sophisticated conversational interfaces that can handle complex, multi-step financial transactions. These systems can open new accounts, process loan applications, and resolve disputes without human intervention.

Middle-Office Applications

1. Intelligent Credit Scoring and Loan Processing

According to industry reports, some institutions using agentic AI have achieved 50% reduction in loan approval times while maintaining or improving approval accuracy. The AI evaluates creditworthiness using alternative data sources including financial behavior patterns, social indicators, and market signals.

2. Dynamic Risk Assessment

Agentic AI examples in banking include systems that continuously monitor loan portfolios, adjusting risk assessments based on real-time economic indicators, borrower behavior changes, and market conditions.

3. Autonomous Fraud Detection

With 56% of banking executives expressing high confidence in agentic AI for fraud detection, these systems represent a critical use case. They can identify suspicious patterns, freeze accounts, notify customers, and begin investigations simultaneously—all within milliseconds of detecting anomalies.

Back-Office Applications

1. Regulatory Compliance Automation

Compliance represents one of the most impactful applications, with some banks reporting 200-2,000% productivity gains in KYC/AML processes. AI agents can monitor regulatory changes, update procedures automatically, and ensure continuous compliance across all operations.

2. Treasury and Liquidity Management

Advanced agentic AI in banks can optimize treasury operations by analyzing cash flows, predicting liquidity needs, and executing funding strategies automatically based on market conditions and regulatory requirements.

3. Intelligent Document Processing

AI agents can generate audit-ready reports, process complex financial documents, and maintain regulatory documentation with minimal human oversight, significantly reducing administrative burden.

How Human-AI Collaboration Drives Smarter Banking Decisions?

| Banking Function | AI Agent Role | Human Role | Collaboration Outcome |

| Loan Processing | Pre-screens applications, verifies documents, calculates risk scores, gathers financial data | Reviews complex cases, negotiates terms, makes final decisions, builds customer relationships | 50% faster processing with personalized service |

| Fraud Detection | Monitors transactions 24/7, flags suspicious patterns, blocks obvious fraud attempts | Investigates complex cases, contacts customers, handles appeals, manages false positives | 85% reduction in fraud losses with maintained customer trust |

| Investment Advisory | Analyzes market data, generates portfolio recommendations, tracks performance metrics | Provides personalized guidance, explains strategies, offers emotional support during volatility | Data-driven recommendations with human empathy |

| Customer Onboarding | Collects documentation, performs KYC checks, validates information, sets up accounts | Welcomes customers, explains products, handles special requests, resolves complications | Streamlined process with personal touch |

| Credit Risk Assessment | Processes financial statements, calculates ratios, compares industry benchmarks | Reviews edge cases, considers qualitative factors, makes exception decisions | More accurate risk evaluation with contextual understanding |

| Compliance Monitoring | Scans transactions for violations, generates reports, tracks regulatory changes | Interprets complex regulations, handles investigations, manages regulatory relationships | 99% compliance accuracy with regulatory rapport |

| Customer Service | Handles routine inquiries, processes transactions, provides account information | Manages complaints, builds relationships, handles sensitive issues, provides financial counseling | 24/7 availability with human connection when needed |

| Wealth Management | Monitors portfolios, rebalances assets, identifies opportunities, tracks goals | Develops long-term strategies, manages client relationships, provides life planning advice | Optimized performance with personalized wealth strategies |

Future of Agentic AI in Banking

The trajectory of agentic ai examples in banking suggests we’re still in the early stages of transformation. Industry predictions indicate that by 2027, 50% of enterprises using generative AI will deploy agentic AI systems, with banking leading this adoption.

Looking ahead, we can expect to see AI agents handling increasingly complex tasks. Gartner predicts that agentic AI will autonomously resolve 80% of common customer service issues by 2029. This doesn’t mean replacing human customer service entirely, but rather ensuring that humans can focus on the complex, relationship-building interactions where they add the most value.

The evolution toward “invisible intelligence” is already beginning, where agentic AI operates seamlessly within existing banking systems, making operations smoother without customers or employees needing to learn new interfaces or processes.

We’re also seeing the development of specialized AI agents that can Monetize AI Assistants by creating new revenue streams through enhanced service offerings and operational efficiencies.

Conclusion

Agentic AI is changing the way banks operate by enabling systems that act independently, learn from data, and make decisions across complex processes. These intelligent systems improve fraud detection, streamline loan approvals, enhance compliance, and deliver more personalized customer experiences. As adoption grows, agentic AI is becoming an essential tool for increasing operational efficiency, managing risk, and supporting smarter, faster decision-making throughout financial institutions.

At Ment Tech Labs, we help banks unlock the full potential of agentic AI through deep expertise in AI agent development, compliance integration, and enterprise deployment. Our team of AI developers builds autonomous systems that operate reliably, scale efficiently, and drive measurable performance gains. If you’re looking to modernize your banking operations, it’s time to hire AI developers who can turn intelligence into impact.

FAQs

Regular AI in banking typically responds to specific requests or follows predetermined rules, like answering customer questions or flagging suspicious transactions. Agentic AI can work independently toward goals, making decisions and taking multiple steps without constant human guidance. It’s the difference between a tool that helps you work and a digital employee that can complete entire processes autonomously.

Security is built into properly designed agentic AI systems through multiple layers of protection, including encrypted data access, role-based permissions, and continuous monitoring. Banks implement strict boundaries defining what AI agents can access and what actions they can take. All activities are logged and auditable, often providing better security oversight than manual processes.

Rather than replacing employees, agentic AI typically augments human capabilities by handling routine tasks and data processing, allowing people to focus on relationship building, complex problem-solving, and strategic work. Most successful implementations create human-AI partnerships where both contribute their unique strengths.

The primary challenges include regulatory compliance (cited by 63% of executives), skills and capability gaps (58%), data quality and integration issues (54%), and ensuring AI decisions are explainable and unbiased. Banks also need to manage the cultural change required for employees to work effectively with autonomous AI systems.

Implementation timelines vary greatly depending on the scope and complexity of the use case. Simple applications like document processing might be deployed in a few months, while comprehensive systems handling complex workflows could take 12-18 months or more. Most banks start with pilot projects to learn and refine their approach before broader deployment.