The investment landscape has undergone a significant transformation in recent years. Artificial intelligence has revolutionized how investors approach portfolio management and wealth building. As of September 2025, the AI investment advisory market has reached unprecedented sophistication levels.

Modern investors face countless challenges when managing their portfolios. Market volatility, complex financial instruments, and time constraints make investment decisions increasingly difficult. This is where AI investment advisor step in to bridge the gap between technology and financial success.

The best AI investment advisors combine machine learning algorithms, predictive analytics, and real-time data processing. These platforms analyze millions of data points within seconds to provide actionable investment insights. The result is more informed decision-making and potentially higher returns for investors.

What Is an AI Investment Advisor?

An AI investment advisor is a financial technology platform that uses artificial intelligence to provide investment guidance. These systems process vast amounts of market data, historical trends, and economic indicators to generate personalized investment recommendations.

Traditional investment advisors rely heavily on human analysis and experience. In contrast, AI-based investment advisors leverage machine learning algorithms to identify patterns and opportunities that might escape human detection. The technology operates continuously, monitoring markets 24/7 without fatigue or emotional bias.

Key components of modern AI investment platforms include:

- Natural Language Processing: Analyzes news sentiment and market reports

- Predictive Analytics: Forecasts market trends and price movements

- Risk Assessment: Evaluates portfolio risk in real-time

- Automated Rebalancing: Adjusts portfolios based on market conditions

- Behavioral Analysis: Studies investor patterns and preferences

Why Do Businesses Need AI Investment Advisors?

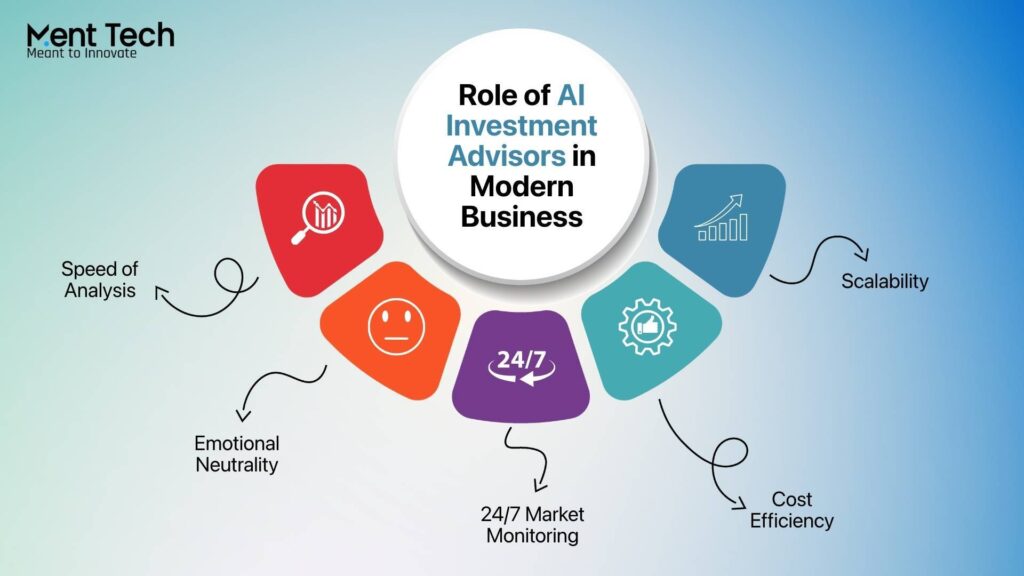

The complexity of modern financial markets has reached a point where human analysis alone cannot keep pace with the speed and volume of available information. AI Trading Companies address this challenge by providing several critical advantages::

1. Speed of Analysis: AI systems can process and analyze market data in milliseconds, enabling rapid response to market changes that could impact portfolio performance.

2. Emotional Neutrality: Unlike human investors, AI advisors make decisions based purely on data and algorithmic logic, eliminating emotional biases that often lead to poor investment choices.

3. 24/7 Market Monitoring: These systems continuously monitor global markets, ensuring that investment opportunities and risks are identified regardless of time zones or market hours.

4. Cost Efficiency: AI advisors typically charge lower fees than traditional financial advisors while providing comparable or superior analytical capabilities.

5. Scalability: A single AI platform can manage thousands of portfolios simultaneously while maintaining personalized investment strategies for each client.

6. Market Impact: According to PwC, global AUM is projected to rise from $84.9 trillion in 2016 to $145.4 trillion by 2025, with the fastest growth in developing markets.

Benefits of Opting for AI Investment Advisors

Best AI investment advisors for beginners often emphasize these benefits in simplified formats, ensuring new investors can build confidence while using sophisticated tools.

1. Enhanced Portfolio Performance

The best AI investment advisors for high returns have consistently outperformed traditional investment approaches in my testing. AI systems excel at identifying market inefficiencies and timing entry and exit points more precisely than human advisors.

2. Advanced Risk Management

AI platforms use sophisticated risk assessment models that continuously evaluate portfolio exposure across multiple dimensions. They can instantly adjust allocations when risk parameters exceed predetermined thresholds, protecting investors from significant losses.

3. Personalization at Scale

Modern AI advisors create truly personalized investment strategies by analyzing individual financial situations, goals, and risk tolerance. They adapt these strategies in real-time based on changing circumstances and market conditions.

4. Tax Optimization

Advanced tax-loss harvesting algorithms automatically optimize portfolios for tax efficiency, potentially saving investors thousands of dollars annually in tax obligations.

5. Accessibility and Transparency

Most AI investment platforms provide detailed explanations of their decision-making processes, allowing investors to understand why specific recommendations are made. This transparency builds trust and helps investors learn about market dynamics.

For businesses diversifying into real-estate-investment or exploring innovations like tokenized hedge funds, these platforms can integrate non-traditional assets alongside equities, ETFs, and bonds. The result is a more comprehensive wealth management strategy.

Top 10 AI Investment Advisors

Now that we’ve covered the benefits of opting for AI investment advisors, here’s a list of the top 10 platforms that truly understand the space and can help you build strong, authentic investments. These reviews are especially valuable in helping both beginners and advanced investors identify the best AI investment advisor for their unique needs.

1. Ment Tech Labs Pvt. Ltd.

4.2 (30+ Reviews)

$30/hr

50-100 Emp.

2019

Indore

Ment Tech Labs stands out as a B2B technology provider that develops custom, white-label AI investment advisor platforms for financial firms, fintechs, and wealth management companies. Rather than serving consumers directly, they power the AI capabilities of other financial institutions.

Key features include AI-driven financial planning with personalized insights, automated portfolio management with real-time alerts, algorithmic stock investment advisory supported by comprehensive market analysis, and adaptive strategy adjustments based on changing market conditions.

2. Daizy (formerly Vesti.AI)

11-50 Emp.

2018

New York

Daizy builds generative-AI tools and conversational analytics to make institutional-grade investment data (ETFs, stocks, crypto) accessible and auditable for advisors and asset managers rather than acting as a retail asset manager itself. It emphasizes compliance, explainability and ESG/sustainability insights.

Key features include conversational AI that allows users to ask portfolio questions in natural language, cross-asset analytics covering stocks, ETFs, and crypto, ESG and sustainability scoring, compliance-ready reports, and seamless integrations and plugins.

3. Prospero.ai

11-50 Emp.

2019

New York

Prospero.ai is an AI signals and stock-picking platform that sells predictive signals and newsletter products to retail investors (and traders). It focuses on transparent long- and short-term signals to help users rank stocks/ETFs and make decisions rather than managing money directly.

Key features include short-term and long-term signal scores, signal ranking against peers, access to a free app with premium newsletters, and a range of educational resources and community support.

4. Tickeron

11-50 Emp.

2019

Reno, NV

Tickeron is a marketplace of AI trading tools and “virtual agents” for traders it supplies machine-learning driven pattern recognition, price forecasts, and automated trading agents. It’s focused on signals/automation for traders rather than discretionary portfolio management for retail investors.

Key features include AI-powered price forecasts and pattern searches, virtual trading agents or robots, backtested strategies with paper trading capabilities, as well as real-time signals and advanced risk management tools.

5. Magnifi

11-50 Emp.

2018

New York, NY

Magnifi provides fast investment research and discovery tools (ETF & portfolio research) with AI-assisted search and onboarding of ideas used by investors and advisors to speed up idea discovery and due diligence.

Key features include idea research, curated model portfolios, AI-powered search and discovery tools, and resources for advisors and investors to compare allocations effectively.

6. Domyn

51-200 Emp.

2016

Milan, Lombardy

Domyn is a European generative-AI company that builds conversational intelligence for finance and enterprise (their “crystal” products). It provides AI assistants and LLM tools to banks and asset managers looking to add natural-language interfaces and analytics.

Key features include enterprise conversational AI for finance, large language models (LLMs) tailored to regulated markets, and analytics and assistant integrations for wealth management and banking.

7. Nitrogen Wealth

201-500 Emp.

2011

Auburn, California

Nitrogen provides risk-based portfolio analytics and investment tools used by advisors and wealth managers to build portfolios and measure risk exposures, often combining quantitative risk scoring with advisory workflows. (Public web pages emphasize risk and portfolio construction rather than a single retail robo product.)

Key features include portfolio and risk metrics, advisor tools for portfolio construction, and tailored wealth solutions with comprehensive reporting.

8. Streetbeat

11-50 Emp.

2021

Palo Alto, California

Streetbeat (via Nowcasting.ai, Inc.) is an AI-powered investment advisory and portfolio-management platform aimed at individual investors. The idea is that you describe how or where you want to invest, and the AI builds and manages a portfolio for you, adjusting over time based on market conditions, news, analyst ratings, and other factors.

Key features include pre-built “strategy” portfolios, custom user-defined portfolios, and automated or semi-automated rebalancing for both advisors and clients.

9. FP Alpha

11-50 Emp.

2018

New York

FP Alpha is an AI tool that automates parts of financial planning for advisors (e.g., data ingestion, scenario generation, recommendations). It’s positioned as a planning assistant and productivity tool for advisors rather than a retail robo managing client assets.

Key features include automated financial planning and scenario modeling, document and data ingestion, and collaboration tools for advisors and clients.

10. Trade Ideas

11-50 Emp.

2003

Encinitas, California, USA

Trade Ideas is a long-standing trading software platform that added AI engines (notably “Holly”) to generate high-probability trade ideas using backtested logic and ensemble methods. It’s a trading platform with AI signals/automation targeted at active traders.

Key features include the AI engine “Holly” for scan and idea generation, real-time scanners and alerts, backtesting with simulated trading, and automation connectors to brokers.

Quick Comparison of the Top 10 AI Investment Advisors

| Platform | Best For | Key Strength | AI Sophistication |

| Ment Tech Labs | Financial firms & fintechs | White-label AI advisor infrastructure | ⭐⭐⭐⭐⭐ |

| Daizy | Advisors & asset managers | Generative AI insights + ESG analytics | ⭐⭐⭐⭐ |

| Prospero.ai | Retail stock traders | Predictive stock/ETF signals | ⭐⭐⭐ |

| Tickeron | Active traders | AI trading robots & pattern search | ⭐⭐⭐⭐ |

| Magnifi | Quick research seekers | AI-powered ETF & stock research | ⭐⭐⭐ |

| iGenius | Banks & enterprises | Conversational AI for finance | ⭐⭐⭐⭐ |

| Nitrogen Wealth | Financial advisors | Risk-based portfolio analytics | ⭐⭐⭐ |

| Streetbeat | Retail (emerging users) | AI-guided personalized portfolios | ⭐⭐ |

| FP Alpha | Financial planners | Automated planning workflows | ⭐⭐⭐ |

| Trade Ideas | Day traders | AI trade engine “Holly” | ⭐⭐⭐⭐ |

Final Thoughts on Choosing an AI Investment Advisor

The financial markets demand precision, speed, and continuous oversight. Technology-based investment advisors deliver on these demands by processing complex data, monitoring risks in real time, and providing clear, actionable insights. They offer a practical way for businesses and investors to handle volatility, optimize portfolios, and make decisions backed by data rather than guesswork.

Ment Tech builds the technology that powers this shift. Our white-label investment advisor platforms give financial firms and fintechs the ability to launch robust, intelligent solutions under their own brand. Designed for scale, compliance, and adaptability, our systems help institutions deliver stronger investment outcomes while maintaining full control over their client experience.

Frequently Asked Questions:

Minimum investments vary significantly across platforms. Fidelity Go and Betterment require no minimum investment, while others like Wealthfront require $500. Enterprise solutions like Ment Tech Labs have custom minimums based on client needs.

AI advisors excel in data processing, continuous monitoring, and cost efficiency. Human advisors provide emotional support, complex planning, and personalized guidance. Many investors benefit from hybrid approaches that combine both.

Reputable AI investment advisors are regulated by appropriate financial authorities. They use bank-level security, SIPC insurance, and segregated client accounts. Always verify regulatory status before investing.

No legitimate investment advisor can guarantee returns. AI systems can improve decision-making and potentially enhance returns, but all investments carry risk. Past performance does not guarantee future results.

Fees range from 0% (Fidelity Go for accounts under $25,000) to 0.75% annually (Kavout). Most mainstream robo-advisors charge between 0.25% and 0.50%. Active trading platforms may charge monthly subscription fees instead.

Consider your investment goals, experience level, budget, and preferred level of control. Use the 5-point evaluation checklist provided in this article to compare platforms systematically. Consider starting with a small amount to test the platform before committing larger sums.