Most businesses today feel the same frustration when dealing with real-world assets: too much paperwork, too many middle layers, and too many delays just to verify something as simple as ownership or value. And while teams spend time chasing documents, the world around them is quietly moving toward a smarter model, one where assets are easier to manage, easier to access, and easier to trust.

That shift is already visible in the numbers. The global tokenized real-world assets (RWAs) market was valued at USD 297.71 billion in 2024 and is expected to reach USD 612.71 billion by the end of 2025. Looking further ahead, the industry is projected to grow to USD 9.43 trillion by 2030, driven by a powerful CAGR of 72.8% between 2025 and 2030. This growth isn’t fueled by hype alone; it reflects a clear demand from businesses seeking faster, more efficient, and more transparent asset management systems.

That’s where AI tokenization finds its place. It doesn’t try to replace your existing processes overnight. Instead, it makes ownership simpler: assets can be verified instantly, values update automatically, and records stay transparent without manual effort. In this blog, we’ll walk through what AI tokenization really means, the components behind it, where it’s already being used, how businesses can build their own platform, and the trends shaping its future.

Why Are Businesses Switching to AI-Driven Digital Assets?

Many businesses are turning toward AI-driven tokenized assets because the old way of handling ownership, records, and asset management creates delays and confusion. AI helps remove these slow points by making valuations clearer, checks smoother, and decisions more reliable. It gives companies a way to work with assets without the usual friction that comes from paperwork, manual reviews, and outdated systems.

Key reasons driving this move:

- AI keeps asset values updated using real data, so results stay accurate instead of outdated.

- Compliance work becomes lighter because AI can review documents, rules, and requirements automatically.

- Risks are spotted early through pattern analysis, helping businesses stay prepared instead of reacting late.

- Security improves because AI notices unusual activity that may signal fraud or manipulation.

- Tokenization becomes easier to access, allowing more people to hold small portions of large assets with confidence.

AI-driven tokenized assets provide clarity and reliability in a space where businesses often struggle with delays and uncertainty. This makes the entire process smoother, safer, and more open for anyone who wants to participate.

Core Components of Effective AI Tokenization

AI-powered tokenization works smoothly only when a few important parts come together. Each part plays its own role and helps the system stay accurate, safe, and easy to use for businesses and investors.

1. Blockchain Infrastructure

This is the foundation where all asset details, ownership records, and token rules live. Platforms like Ethereum, Solana, or private chains simply act as the “ground” that keeps everything secure and verifiable.

2. AI and Data Processing Layer

This part helps the platform understand the asset. AI reads past records, market patterns, and live data to keep valuations updated, detect risks, and support clean decision-making.

3. Token Setup & Smart Contracts

This is where the logic sits. It defines how tokens are created, divided, transferred, or removed. Smart contracts also handle things like payouts, royalties, and ownership updates without manual work.

4. Compliance & Control System

Every asset needs checks before it can be traded. This section manages identity verification, audit trails, permissions, and regulatory requirements so businesses stay safe and compliant.

5. User Dashboards & Trading Platform

People need a simple place to explore assets, manage tokens, and view analytics. Clean dashboards, wallet connections, and trading views make the experience smooth for beginners and professionals.

6. Security, Audit & Growth Support

This protects everything behind the scenes. It includes data encryption, key management, regular audits, fraud detection, and systems designed to handle growth without slowing down.

Each component adds a layer of trust and reliability, helping businesses handle assets in a cleaner, more organized way while reducing effort and keeping users confident in every transaction.

Key Benefits of Using AI Tokenization for Businesses

AI tokenization helps businesses work smarter with assets, money flows, and data. It removes a lot of slow manual tasks, protects sensitive information, and opens new ways for companies to earn and grow without adding complexity.

1. Stronger Protection for Business & Customer Data

- Sensitive details are turned into harmless digital tokens, so even if hackers break in, the real data stays safe

- AI watches for unusual activity and stops fraud before it spreads

- Every transaction is locked in a tamper-proof format, keeping records clean and dependable

2. Lower Costs & Faster Operations

- Compliance checks, reporting, payouts, and transfer approvals run automatically

- Companies avoid extra middlemen, which removes fees and delays

- Deals that once took days can move in minutes

3. Better Access to Global Investors

- Businesses can break assets into smaller digital pieces, allowing more people to participate

Cross-border transactions become smoother because assets follow one common digital format - Assets that were hard to sell like real estate, invoices, or inventory, gain more liquidity

4. New Earning Models for AI & Data

- Companies can turn data, AI models, or digital services into tokenized products

- Investors can support and trade these AI-driven assets, creating fresh revenue lines

- Businesses can safely share tokenized data for research or analytics without revealing anything sensitive

5. Smarter Decisions With Real-Time Insights

- AI studies patterns across markets, user activity, and asset performance

- It gives businesses clear signals on risks, value changes, and demand

- Teams can make decisions faster because they have live, accurate information

AI tokenization helps companies protect what matters, grow faster, and reach a wider audience, all while keeping daily work simple and predictable.

Real-World Examples of AI Tokenization

Many projects are already using AI tokenization in live markets, not just pilot tests. These examples show how different industries are moving real assets into digital form and using AI to keep the process accurate, transparent, and easier for everyday users.

Real Estate Fractional Ownership

RealT lets users buy small digital shares of real properties. The platform uses AI to verify property documents, update rental income data, and keep prices accurate so people can invest in real estate without high entry costs.

Tokenized Government Bonds

Franklin Templeton’s BENJI offers tokenized U.S. treasury funds where AI monitors yield changes, interest movements, and daily liquidity. It keeps bond data continuously updated so users get a simpler way to access government-grade assets.

Private Credit Tokens

Centrifuge turns private credit assets, like invoices or business loans, into digital tokens. AI evaluates borrower data, repayment patterns, and risk indicators so lenders can access safer, real-world income opportunities.

Supply Chain Asset Tokens

VeChain tokenizes supply chain items by linking real-world logistics data directly to the chain. AI verifies product movement, checks authenticity, and updates condition reports to ensure accurate asset tracking.

Revenue-Based Tokens for Businesses

Opulous converts future music earnings into digital tokens. AI reviews artist revenue history, streaming data, and payout cycles to provide predictable, transparent income for token holders.

How to Build an AI Tokenization Platform for Your Business?

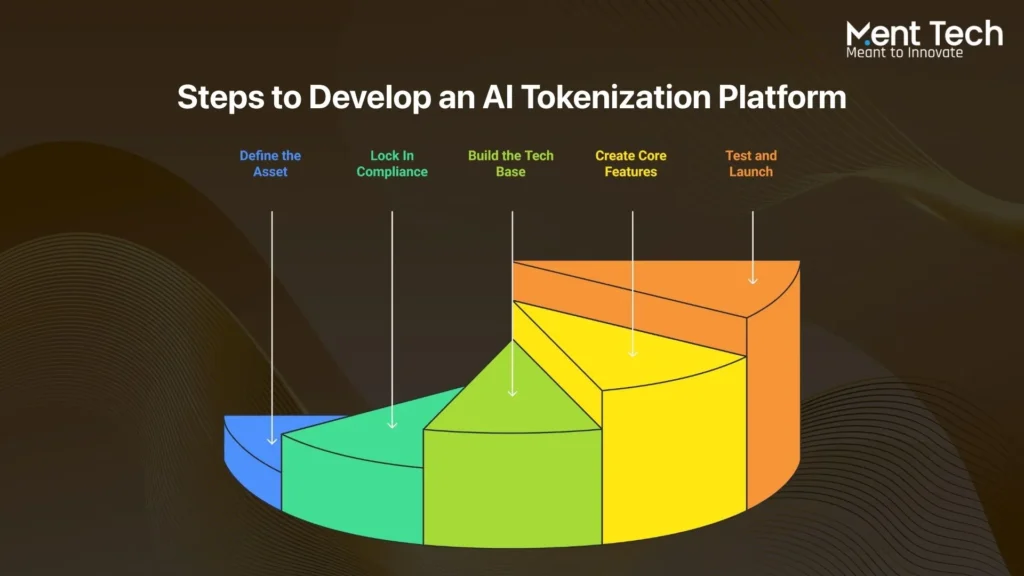

Building an AI-powered tokenization platform happens in clear stages. Each step adds the pieces your business needs to turn real assets into digital tokens people can safely buy and use.

Step 1: Define What You Want to Tokenize

Start by deciding the exact asset you want to tokenize and why it matters for your business. It could be digital files, IP, data, or any asset you want people to access or own in smaller parts. Be clear about who will use the platform and what value they will get from the token.

Step 2: Set Up Legal and Compliance Rules

Work with legal experts who understand blockchain and digital assets. Your platform must follow KYC, AML, data privacy rules, and any securities laws in your region. Build these checks into the system from the start so the platform stays compliant as it grows.

Step 3: Create a Solid Tech Base

Choose a blockchain that fits your needs for speed, cost, and security. Create smart contracts that handle ownership, transfers, and rules without manual effort. Add an AI layer that helps with valuation, risk checks, and real-time monitoring. Connect everything through simple APIs so the platform can work with your existing tools and payment systems.

Step 4: Build the Key Features

Create the engine that turns assets into tokens. Add onboarding tools that handle identity checks automatically. Use secure storage and strong encryption to protect wallets and sensitive data. Build a clean dashboard where users can view tokens, trade them, and manage their activity. Make sure you support smooth trading and easy liquidity so tokens stay active.

Step 5: Test, Audit, and Launch

Run deep testing with internal teams and outside experts to find and fix issues. Get third-party audits for your smart contracts and security setup. Once everything is verified, move into End-to-End AI Deployment and launch the platform. Keep monitoring performance, security, and compliance with live analytics to maintain trust and stability.

Emerging Future Trends Shaping the Rise of AI Tokenization

AI tokenization is moving toward a stage where assets won’t just sit on a ledger; they’ll report their own activity, update their own value, and interact with the world through live data. Early models from platforms like Fetch.ai, Autonolas, Peaq, and Dimo show that AI agents and connected machines can already negotiate tasks, settle micro-payments, and react to real events without human involvement. This is pushing tokenized assets into a more responsive environment where price, performance, and ownership can be updated continuously instead of relying on delayed manual checks.

In 2026, the biggest growth areas will come from AI agents that manage tokenized portfolios, IoT-connected assets that feed verified data directly on-chain, and machines that pay for compute, energy, or mobility in real time. Smart fleets will validate usage for mobility tokens, buildings will send maintenance and occupancy data to back property tokens, and personalized AI models will create micro-investment bundles based on a user’s spending rhythm, income flow, and long-term goals. These developments aren’t theoretical anymore they’re already being tested in live ecosystems, and they’re setting the foundation for a more responsive and data-rich tokenized economy.

Conclusion

AI tokenization gives people a clearer and more direct way to access real assets by reducing delays, removing repeated manual work, and keeping information updated without constant human involvement. As assets move into digital form and AI handles verification, pricing, and monitoring, everyday users can interact with real value more easily. By 2026, this approach is expected to become a normal part of how people buy and hold asset-backed tokens.

Ment Tech helps businesses build advanced AI tokenization systems with strong AI development tools and dependable infrastructure. From AI-powered document checks to automated token creation and secure dashboards, We provide everything needed to launch and scale a tokenization platform with confidence. Companies get a future-ready setup that’s built for growth, and if you want to bring expert support into your team, you can Hire AI Developers from Ment Tech to speed up development, improve accuracy, and deliver a smooth, secure digital experience for your users.

Frequently Asked Questions (FAQs)

Yes. Most businesses can plug AI tokenization into their existing systems without rebuilding everything from scratch. The process usually involves connecting your data sources, adding smart-contract logic, and setting up AI modules for valuation, compliance, and monitoring.

Ment Tech manages every core part of an AI tokenization system, including data checks, AI models, token creation, compliance flows, dashboards, and technical setup. Ment Tech also offers AI Consulting to guide companies in planning, optimizing, and scaling their tokenization projects with the right strategy.

By 2026, AI is expected to play a major role in finance, real estate, logistics, manufacturing, healthcare, and compliance-heavy sectors. These industries rely heavily on fast decisions, accurate data, and continuous monitoring areas where AI brings clear improvements.

No. Most platforms are built like simple apps where users can log in, view assets, buy or sell tokens, and track performance with clear dashboards.

AI tokenization can work with real estate, invoices, credit, carbon credits, gold, art, music royalties, intellectual property, data, or even AI models. If something has value, it can usually be tokenized.