Finance teams are under pressure from rising compliance demands, repetitive processes, and the need for faster, more accurate decisions. Despite significant investment in AI, many institutions still struggle with efficiency gaps and limited impact on day-to-day operations.

Agentic AI in finance is shifting this landscape. AI agents in banking, accounting, and corporate finance operate autonomously, analyzing data, assessing risk, and supporting compliance without constant supervision. A recent survey revealed that 70% of financial institutions reported revenue gains of 5% or more after adopting AI, while over 60% achieved annual cost reductions of at least 5%, proving the tangible value of AI in financial operations.

From risk assessment to Agentic FinOps, the applications of AI agents in the finance industry are becoming central to modern operations. By reducing manual workload and strengthening accuracy, agentic AI in finance and accounting is setting the foundation for more resilient and future-ready financial systems.

Market Reality Check:

- 79% of organizations report at least some level of AI agent adoption.

- The current AI agents market size stands at $7.84 billion and is projected to reach $52.62 billion by 2030.

- 62% of organizations expect ROI above 100% from agentic AI deployment.

How AI Agents Work the Smart Way in Finance?

AI agents are transforming the finance industry by combining automation, intelligence, and advanced analytics. They optimize complex operations, process large datasets, and provide actionable insights for smarter decision-making. From customer support to risk monitoring, these systems keep financial operations efficient, accurate, and adaptive.

- Data Ingestion: AI agents gather data from ERP systems, invoices, journal entries, and internal finance reports, providing a complete and real-time view of financial activity.

- Machine Learning Models: These agents analyze large datasets using advanced algorithms to detect patterns, forecast trends, and generate actionable financial insights.

- Natural Language Processing (NLP): NLP allows AI agents to understand and respond to client queries in natural language, enhancing interactions and automating customer support.

- Automation Frameworks: AI agents execute predefined workflows automatically, from processing invoices to reconciling accounts, reducing errors and saving time.

- Strategic Insights & Risk Monitoring: AI agents provide proactive recommendations, identify potential risks, and deliver insights to support smarter financial decision-making.

What Makes AI Agents Different from Traditional Automation?

AI agents differ from traditional finance automation by learning from data and adapting to new scenarios. They handle complex tasks like transaction analysis, personalized advice, and risk assessment. With technologies like the Taproot Inscription Engine , these agents process data variations dynamically for faster, more accurate financial operations.

| Capability | Traditional Automation | Agentic AI in Finance |

| Decision Making | Follows predefined rules only | Evaluates context and makes informed choices |

| Learning | Requires manual rule updates | Continuously improves from experience |

| Exception Handling | Escalates to humans immediately | Attempts resolution using learned patterns |

| Compliance | Checks against static rules | Adapts to regulatory changes dynamically |

| Integration | Point-to-point connections | Orchestrates across multiple systems intelligently |

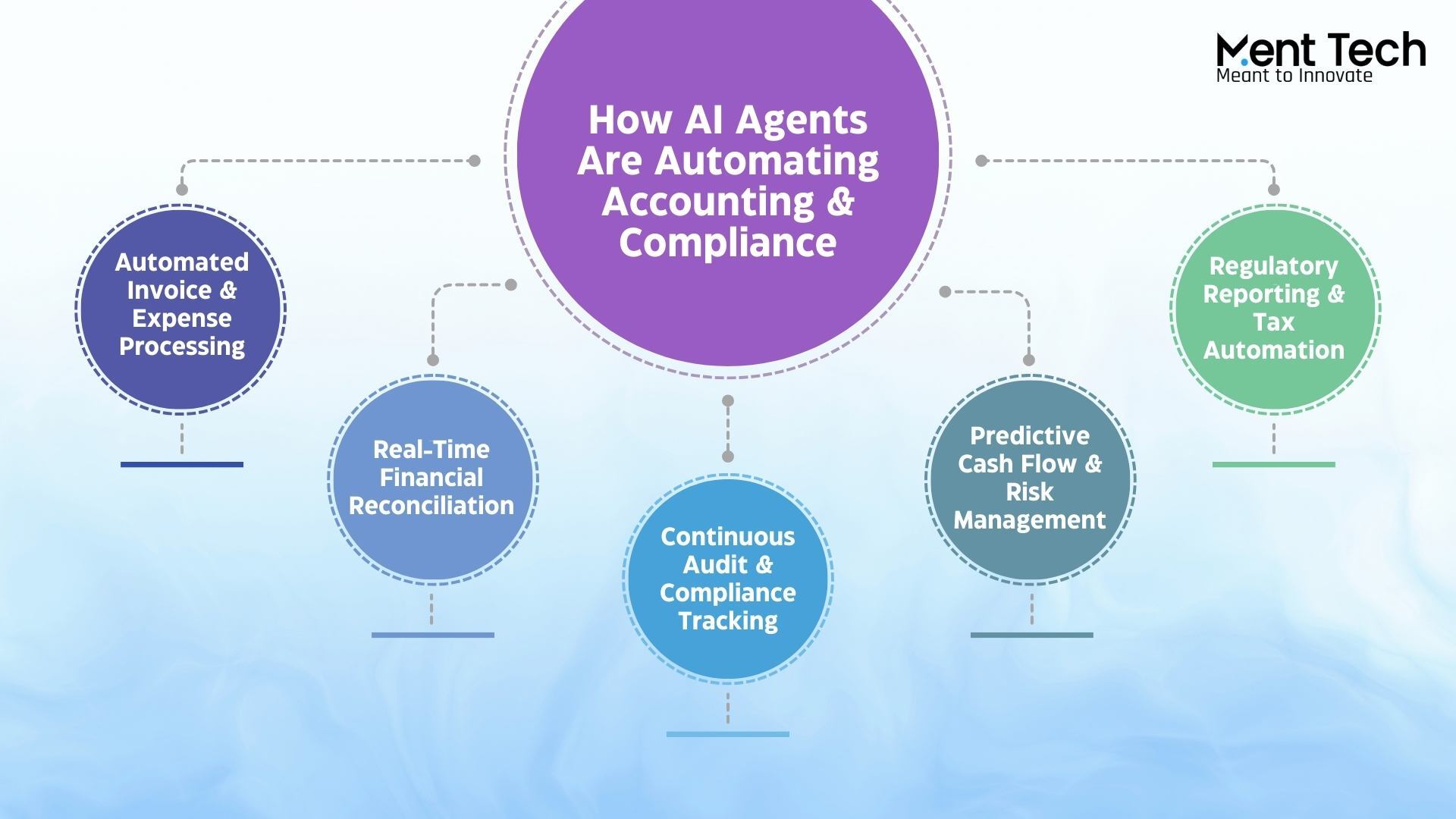

Applications of AI Agents in Modern Finance

AI agents in modern finance automate routine tasks, enhance decision-making, and provide actionable insights across accounting, trading, and risk management. Their applications improve efficiency, accuracy, and customer experience, enabling organizations to focus on strategic growth.

1. Investment Advisory

AI agents in finance create personalized investment strategies by analyzing client goals, risk tolerance, and market insights. They monitor portfolio performance in real time and suggest adjustments. This helps financial advisors deliver smarter, data-driven guidance.

2. Liquidity Planning

Agentic AI in finance optimizes cash flow and payment schedules to maintain liquidity. It assesses obligations, reserves, and forecasts cash requirements automatically. Organizations can reduce errors and improve financial stability.

3. Portfolio Optimization

Agentic AI applications in finance identify ideal asset allocations to maximize returns while minimizing risk. They continuously evaluate historical and real-time market data for better decisions. This ensures portfolios stay aligned with client objectives.

4. Market Analysis

AI agent applications in finance provide real-time insights on stocks, sectors, and overall market trends. They analyze financial reports, news, and social data for actionable intelligence. This empowers businesses to make faster, informed investment decisions.

5. Risk Assessment

AI agents for risk assessment in finance detect potential threats by analyzing historical and current market data. They guide risk mitigation strategies in trading, lending, and compliance. Continuous monitoring ensures operational resilience and safeguards assets.

6. Customer Support Automation

AI agents in finance and accounting improve client interactions through chatbots and virtual assistants. They respond instantly to queries, provide tailored guidance, and handle routine tasks efficiently. This enhances customer satisfaction while reducing manual workload.

Essential AI Agent Platform Features to Explore Before Choosing

Selecting the right AI agent platform can transform the way finance and accounting teams operate. The ideal solution combines intelligent automation, smooth integration, and actionable insights to improve efficiency and accuracy. Focusing on these key features ensures faster deployment, smarter decisions, and smoother financial operations.

1. Low-Code AI Agent Creation

Platforms with low-code or no-code tools let finance teams build and customize AI agents without heavy IT involvement. This accelerates automation across accounts payable, tax, and reporting while empowering teams to act independently.

2. Cognitive Automation for Documents

AI agents should handle unstructured financial data efficiently. By extracting, classifying, and processing invoices, contracts, and audit reports, they reduce manual effort and ensure reliable, accurate data.

3. Smooth AI and ML Integration

Top platforms connect with pre-trained or custom machine learning models for tasks like fraud detection, predictive forecasting, and credit risk analysis. Integration with external AI services expands the platform’s capabilities.

4. Real-Time Insights and Monitoring

Finance teams need complete visibility. Platforms should offer dashboards that track performance, detect anomalies, and monitor compliance in real time, supporting faster, data-driven decisions.

5. Enterprise-Grade Security and Compliance

Protecting financial data is essential. Platforms should provide encryption, audit trails, role-based access, and compliance with SOX, GDPR, and PCI-DSS to safeguard operations.

6. Pre-Built Financial Agents

Ready-made agents for reconciliations, invoice processing, and compliance reporting accelerate implementation. Teams can customize these agents to achieve results quickly and reduce setup time.

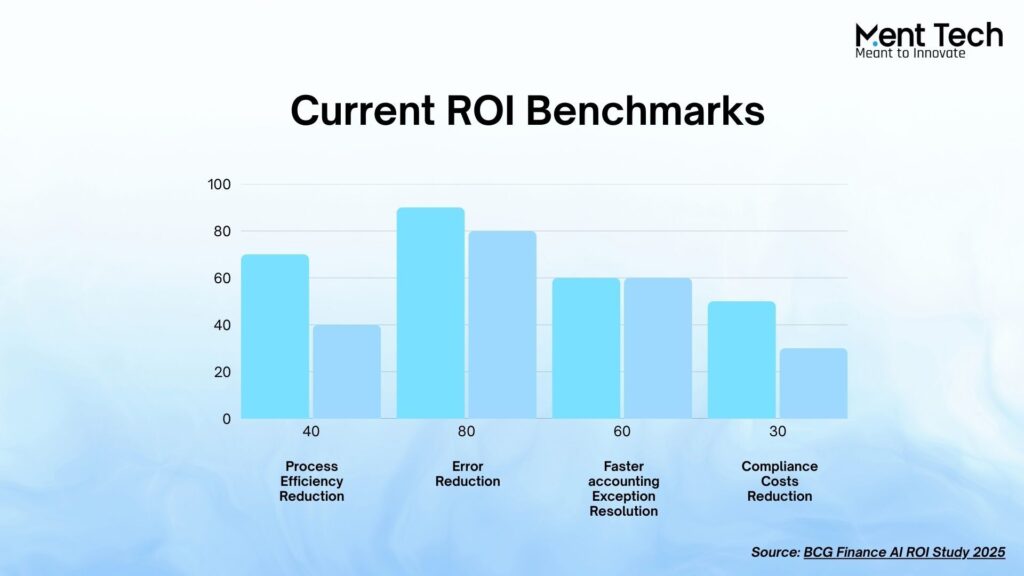

How Do You Measure ROI from AI Agents in Finance?

Measuring the return on investment from agentic AI in finance requires a comprehensive approach that captures both quantitative benefits and qualitative improvements. BCG’s research shows that while the median ROI from AI initiatives is 10%, leading finance teams achieve returns above 20%, with successful teams running 10-11 AI use cases simultaneously.

Quantitative Metrics

- Process Efficiency: 40-70% reduction in processing time for routine transactions

- Exception Resolution: 60% faster resolution of accounting exceptions and discrepancies

- Error Reduction: 80-95% fewer manual errors in financial data processing

- Compliance Costs: 30-50% reduction in compliance-related manual effort

Strategic Value Metrics

- Decision Speed: Real-time financial insights enabling faster strategic decisions

- Risk Prevention: Early identification and prevention of compliance violations

- Talent Optimization: Finance professionals focused on high-value activities

- Scalability: Ability to handle growth without proportional staff increases

How to Build LLM-Based AI Agents for Financial Services?

Learn how to create AI agents using large language models to automate financial tasks, optimize investments, and deliver personalized client insights. This step-by-step guide covers the key stages from goal definition to deployment and continuous improvement.

1. Define Business Goals

Clearly outline the financial tasks your AI agent will handle, such as automating transactions, optimizing portfolios, or personalizing client advice. Identify the target segment, banking, investment management, or insurance, and the challenges the agent should address.

2. Choose the Right LLM Model

Pick an LLM that matches your financial needs, like GPT-5 for natural language understanding, Google PaLM 2 for multilingual operations, or open-source options like BLOOM. Evaluate model performance, size, and licensing to ensure it fits your operational requirements.

3. Collect and Prepare Data

Gather high-quality datasets, including market trends, client profiles, transaction history, and regulatory records. Clean, format, and organize the data for accurate training, enabling precise predictions and actionable insights.

4. Design Agent Architecture

Build modular components: input processing to handle queries, LLM interaction for insights, output generation to present results clearly, and memory to maintain context across multi-turn conversations and personalized recommendations.

5. Integrate Knowledge and Analytics

Link the AI agent to external financial databases, market feeds, and regulatory sources. Incorporate reasoning, risk analysis, sentiment detection, and portfolio optimization to provide informed and actionable advice for clients.

6. Testing, Deployment, and Continuous Learning

Test the agent in various scenarios and validate outputs against human expertise. Deploy securely, and implement feedback loops to update the agent with market changes, regulatory adjustments, and client behavior for consistent accuracy and relevance.

The Real-World Business Impact of AI Agents

AI agents are transforming finance by automating complex processes, reducing errors, and accelerating decision-making. Their real-world impact improves operational efficiency, enhances customer experiences, and drives measurable business growth.

1. Fraud Detection

AI agents in finance can analyze large transaction datasets to identify anomalies and suspicious behavior. This proactive approach reduces financial losses and protects customers.

2. Personalized Advisory

Agentic AI in banking offers customized financial recommendations. By analyzing client preferences and risk profiles, it automates investment strategies and rebalances portfolios as needed.

3. Chatbots and Virtual Assistants

AI-powered chatbots handle account queries, provide advice, and guide users through transactions. They enhance user experience and free human staff for complex tasks.

4. Automated Trading Algorithms

AI agents can process large volumes of market data to identify trading opportunities. High-frequency trading and predictive modeling improve the speed and accuracy of transactions.

5. Regulatory Compliance Monitoring

AI agents track transactions and operations for regulatory compliance. They flag anomalies, automate reporting, and reduce the risk of fines and penalties.

6. Claims and Payment Processing

AI systems automate insurance claims and client payment schedules. They validate documents, detect errors, and accelerate approvals, improving operational efficiency.

Partner With Ment Tech to Build Your Agentic FinOps Solution

AI agents are changing the way finance works. They handle repetitive tasks, provide smarter insights, and help teams make better decisions. Businesses using AI agents early get an edge in efficiency and client experience, while others risk falling behind.

Ment Tech, a trusted AI agent development company, recommends starting with targeted experiments on critical financial tasks and gradually integrating AI agents into workflows that truly benefit from automation. Aligning AI strategy with business objectives and preparing teams for adoption is key to realizing maximum impact.

Integrate AI agents into your financial operations to optimize processes, improve decision-making, and drive measurable growth. Connect with us today to explore how AI can transform your business.

Frequently Asked Questions

Traditional automation follows predefined rules and escalates exceptions to humans. Agentic AI in finance uses contextual understanding to make intelligent decisions, learn from experience, and handle complex scenarios autonomously while continuously improving performance.

Initial pilot implementations typically take 8-12 weeks, with full-scale deployment occurring over 4-6 months.

According to 2025 research, 62% of organizations expect ROI above 100%, with U.S. companies projecting average returns of 192%.

Yes, agentic AI in finance is increasingly accessible to organizations of all sizes. Recent research shows adoption is especially strong among mid-market firms ($50M-$100M revenue), where nearly a third report organization-wide AI deployment. Smaller organizations often see faster implementation and clearer ROI due to simpler system landscapes.

Advanced AI agents for risk assessment monitor regulatory developments, analyze new requirements, and automatically adapt compliance processes. They can interpret regulatory text and implement necessary changes without manual rule updates.