The global financial landscape is constantly evolving, and with it, the complexity of financial crimes. Money laundering alone is estimated to account for about 3-5% of global GDP, which equates to trillions of dollars each year. The sheer scale of these illicit activities puts immense pressure on financial institutions to safeguard their operations. As criminals continue to develop more sophisticated methods, traditional compliance systems are struggling to keep pace.

Enter intelligent solutions for KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance, powered by the latest technological advancements. Recently, banks and financial institutions have increasingly turned to these solutions to tackle the growing challenge of financial crime. AI-driven systems are making this shift possible by improving accuracy, efficiency, and responsiveness in compliance efforts.

These smart technologies go beyond basic rule-based systems, offering more comprehensive AML solutions and KYC compliance strategies that adapt to evolving threats. Banks can stay ahead in the fight against money laundering and fraud by utilizing advanced tools to analyze transactions, verify customer identities, and predict risks.

How Intelligent Technology is Advancing Anti-Money Laundering Efforts?

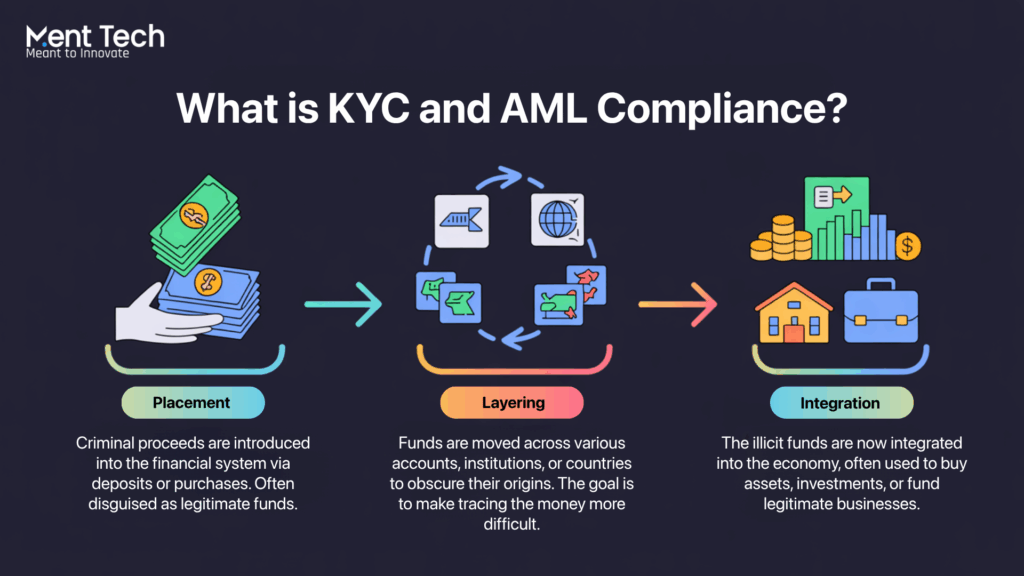

When it comes to keeping our financial systems safe, KYC (Know Your Customer) and AML (Anti-Money Laundering) are two of the most critical pillars. These frameworks ensure that financial institutions can identify and prevent illegal activities, from money laundering to fraud and terrorism financing.

KYC is all about verifying the identities of customers. It’s not just about knowing who’s using your services but understanding the risks they might pose. Banks collect and verify information like names, addresses, and financial activities to build a risk profile for each customer. It’s a process that helps banks know exactly who they’re dealing with and ensure they’re not unknowingly enabling criminal activities.

On the other hand, AML goes further by detecting and preventing the illegal process of disguising the origins of illegally obtained funds. The entire financial system’s integrity is at risk if criminals manage to channel illicit money through it without detection.

This is where intelligent technology powered by AI steps in. AI-driven KYC solutions are enhancing how banks and institutions verify customer identities and assess risks. Meanwhile, AI is also improving AML compliance, making it easier for financial institutions to detect suspicious transactions and flag potential threats with greater accuracy.

What Role Does AI Play in KYC and AML Compliance?

In today’s fast-paced financial world, keeping up with the evolving tactics of criminals requires more than just traditional compliance methods. AI for KYC and AML compliance is stepping in as a game-changer, offering a smarter and more efficient way to detect fraud, verify identities, and prevent illegal financial activities.

AI-powered KYC solutions are transforming how financial institutions verify customer identities and assess risks. Instead of relying solely on manual checks, AI analyzes large volumes of data quickly and accurately, identifying red flags that might go unnoticed with traditional methods. This is especially crucial in the modern digital banking environment, where customers may be interacting with institutions across different platforms and jurisdictions.

For AML, AI is also proving to be a powerful tool. It enables real-time transaction monitoring and helps identify suspicious activities by analyzing transaction patterns that could indicate money laundering or other financial crimes. AI algorithms continuously learn from past data, adapting to emerging fraud tactics, which makes these systems more effective over time.

Key areas where AI is making a difference include:

- Transaction Monitoring: AI systems can monitor transactions in real-time, analyzing volume, value, and patterns to flag unusual activities.

- Customer Due Diligence: With AI-based KYC services, financial institutions can verify identities faster and more accurately, ensuring that only legitimate customers are onboarded.

- Predictive Analytics: AI can predict potential risks by analyzing historical data, giving banks a proactive approach to AML compliance.

- Suspicious Activity Reporting (SAR): Automating the generation of SARs streamlines the process, helping banks comply with regulations more efficiently.

By leveraging AI, financial institutions can reduce human error, improve compliance accuracy, and stay ahead of the constantly changing landscape of financial crime. This technology enhances KYC and AML efforts and offers a more seamless, faster experience for both the institution and its customers.

What Are the Benefits of Using AI for KYC and AML Compliance?

As financial institutions continue to combat the growing risks of money laundering and fraud, integrating AI in KYC and AML compliance offers several compelling advantages. AI-driven systems are revolutionizing the way banks and financial organizations approach these critical areas, providing them with the tools needed to improve efficiency, accuracy, and overall effectiveness. Here’s how:

1. Improved Accuracy and Reduced Errors

One of the biggest challenges with traditional compliance methods is the high potential for human error, whether it’s in identity verification or flagging suspicious activities. AI eliminates much of this risk by automating key processes and continuously learning from large data sets to ensure more accurate assessments of customer risks and transactions.

2. Streamlined Processes and Cost Reduction

Compliance departments in banks and financial institutions often spend countless hours on manual processes like verifying identities, conducting background checks, and monitoring transactions. AI-driven solutions can automate many of these routine tasks, freeing up valuable resources. The result is a more cost-effective compliance operation that can scale with the growing demands of the financial sector.

For example, AI-driven KYC processes significantly reduce the time needed to onboard customers by quickly verifying their details and assessing their risk profiles. Similarly, with AI for AML, institutions can automate transaction monitoring and generate Suspicious Activity Reports (SARs) more efficiently, reducing the manual effort required.

3. Real-Time Monitoring and Detection

AI is capable of processing massive amounts of data in real time, something traditional compliance methods often struggle with. For AML compliance, this real-time capability allows financial institutions to detect suspicious transactions as they happen, enabling immediate action. Whether it’s a sudden spike in transaction volume or a pattern that indicates potential money laundering, AI helps banks respond to threats instantly.

4. Scalability and Flexibility

As financial institutions grow and expand into new markets, the volume of transactions and customer data increases dramatically. AI systems can scale to handle vast amounts of data without compromising performance. Whether it’s a global bank dealing with millions of customers or a growing fintech company, AI can support the expansion of operations while maintaining high standards of KYC and AML compliance.

5. Enhanced Reporting and Analytics

AI not only helps detect suspicious activity but also provides powerful analytics and reporting capabilities. With AI for KYC and AML, institutions gain deeper insights into their compliance programs and risk profiles. AI-driven platforms offer real-time dashboards, visualizations, and trend analyses that help compliance teams make better-informed decisions.

In summary, the integration of AI in KYC and AML compliance isn’t just about keeping up with the pace of financial crime. It’s about giving financial institutions the tools to stay ahead of the curve, improve operational efficiency, reduce costs, and ensure a safer, more secure banking environment for all. With its ability to streamline processes, improve accuracy, and offer real-time insights, AI is proving to be a game-changer in the fight against financial crime.

What Are the Challenges of Using AI for KYC and AML Compliance?

1. Data Quality

- Challenge: Inconsistent or inaccurate data can undermine the effectiveness of AI in KYC and AML compliance.

- Solution: Invest in AI Development Services to implement systems that cleanse and validate data, ensuring accurate, high-quality input for AI models.

2. Regulatory Compliance

- Challenge: AI solutions must be continually updated to adhere to local and global regulatory standards, which can be complex.

- Solution: Use Adaptive AI Solutions that evolve with changing regulations, ensuring your AI-driven KYC and AML systems are always compliant.

3. Transparency and Explainability

- Challenge: The “black box” nature of some AI algorithms makes it difficult to understand how decisions are made.

- Solution: Implement AI as a Service solutions that prioritize explainability and transparency, helping compliance teams interpret and trust AI decisions more easily.

4. Integration with Legacy Systems

- Challenge: Integrating advanced AI tools with outdated banking systems can be costly and technically challenging.

- Solution: Leverage AI Development Services to create flexible, scalable AI solutions that can seamlessly integrate with existing infrastructure, reducing friction in the transition.

5. High Initial Costs

- Challenge: The upfront cost of implementing AI solutions can be prohibitive for some financial institutions.

- Solution: Consider AI as a Service, which allows for lower initial investment and easier scalability, giving institutions the flexibility to pay for what they use without a huge upfront cost.

Read Also: Top 10 AI as a Service Companies in 2025

AI Architecture for KYC and AML Compliance

Incorporating AI into KYC and AML compliance requires a robust technical architecture that ensures scalability, security, and real-time responsiveness. Here’s an overview of the technical components involved in AI-driven compliance systems:

1. Data Ingestion Layer

- Function: This layer collects and consolidates data from various sources like financial transactions, customer profiles, external databases, and regulatory bodies. The data is then prepared for analysis.

- Technology: AI Development Services ensure the creation of custom data pipelines that support seamless integration with internal systems and third-party platforms, enabling smooth data collection and validation.

2. AI and Machine Learning Models

- Function: The heart of the system, where machine learning algorithms analyze and detect suspicious patterns in transaction data, verify customer identities, and flag potential risks in real-time.

- Technology: Through Adaptive AI Solutions, these models evolve over time, adapting to new threats and improving accuracy. This flexibility allows the AI to handle complex, changing patterns in both AML compliance and KYC verification.

3. Real-Time Monitoring and Analytics

- Function: The AI system continuously monitors incoming transactions and customer behaviors, flagging high-risk activities as they occur. Predictive analytics help foresee potential compliance risks.

- Technology: Real-Time Analytics Platforms like Apache Kafka or Apache Flink, and Big Data Frameworks such as Hadoop for large-scale data processing.

4. Decision Layer (Explainability & Transparency)

- Function: Ensures the decisions made by AI models are understandable and traceable by compliance officers. This is crucial for regulatory reporting and audits.

- Technology: Explainable AI (XAI) frameworks like LIME (Local Interpretable Model-agnostic Explanations) or SHAP (Shapley Additive Explanations) are used to provide transparency in model decisions.

5. Compliance and Reporting Layer

- Function: Automated generation of Suspicious Activity Reports (SARs) and other compliance reports for submission to regulatory bodies. Ensures that reporting is accurate and timely.

- Technology: Integration with RegTech solutions for automated reporting, compliance checks, and integration with Blockchain for secure transaction histories.

6. Security and Privacy

- Function: Ensures that AI systems adhere to data privacy laws like GDPR and CCPA while maintaining the security of sensitive financial information.

- Technology: Utilizing advanced encryption methods and AI Trading technology for secure transactions, the system ensures data privacy, offering end-to-end security and complying with GDPR and other data privacy standards.

What Can We Expect from AI in the Future of KYC and AML Compliance?

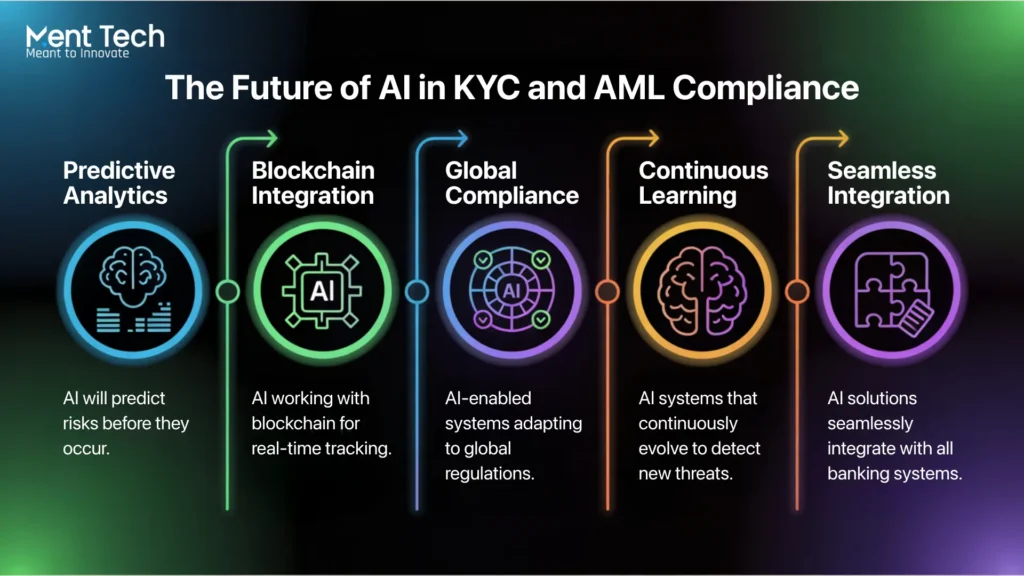

As we look to the future, AI for KYC and AML compliance will continue to evolve and have a major impact on the financial landscape. With financial crimes becoming increasingly sophisticated, AI will need to adapt to meet the growing demands of regulatory bodies and financial institutions. Here’s a glimpse into what the future holds for AI-driven KYC services and AML AI solutions:

1. Enhanced Predictive Capabilities

AI’s role in AML compliance is expanding to include more advanced predictive analytics. Instead of simply identifying suspicious activities, AI will be able to predict potential risks based on historical trends and real-time data. This shift toward predictive modeling will help financial institutions take a proactive approach to AML compliance, preventing illicit activity before it even occurs.

By leveraging vast datasets, AI in KYC will be able to foresee customer behaviors that may indicate potential risks, allowing compliance teams to address these risks before they escalate.

2. Integration with Blockchain Technology

One of the most exciting developments on the horizon is the integration of AI with blockchain technology for AML and KYC compliance. Blockchain offers a decentralized, transparent ledger system that can significantly enhance the way financial transactions are tracked and recorded. When combined with AI, this integration could lead to even more secure and efficient compliance systems.

For example, AI-based KYC services could utilize blockchain to verify identities and track transactions across multiple parties in real time, reducing the risk of fraud and improving the transparency of the process.

3. Real-Time Global Compliance

In an increasingly interconnected world, cross-border transactions are growing at an unprecedented rate. The need for AML AI solutions that can operate across jurisdictions and comply with varying regulations is more important than ever. The future of KYC and AML compliance will likely see the development of real-time, global compliance systems powered by AI.

4. Better Collaboration and Data Sharing

In the future, we can expect AI to foster better collaboration between financial institutions, regulators, and law enforcement. Secure, AI-driven platforms facilitate data sharing, enabling institutions to exchange valuable insights into potential risks and suspicious activities.

This increased collaboration will not only improve KYC verification processes but also enable more efficient investigations into financial crimes..

5. Continuous Learning and Adaptation

The ability to learn and adapt over time is one of the most important features of AI-driven KYC and AML compliance systems. As financial crime tactics continue to evolve, AI systems must stay up-to-date and adjust to new trends. Future AML AI solutions will be equipped with even more advanced machine learning models that can continuously improve their ability to detect and prevent illicit activities.

Conclusion

The future of KYC and AML compliance is evolving rapidly, and AI is at the heart of this transformation. Gone are the days of manual processes that slow down operations and leave room for errors. With AI, financial institutions can now detect fraud faster, verify identities more accurately, and stay ahead of emerging threats. From predictive analytics to real-time monitoring, AI is making compliance smarter and more efficient than ever before.

At Ment Tech, we’re excited to be part of this revolution. Our AI-powered KYC services and AML solutions are designed to streamline compliance and make your job easier. Imagine automating tedious tasks, reducing false positives, and catching suspicious activities as they happen, leaving your team with more time to focus on the big picture.

As financial crimes get more sophisticated, our AI systems continuously learn and adapt to new threats, keeping you one step ahead. With Ment Tech, you’re not just adopting technology; you’re future-proofing your compliance strategy, ensuring your institution remains secure and compliant in a rapidly changing world.

FAQs

KYC (Know Your Customer) is the process by which financial institutions verify the identity of their customers to prevent fraud, money laundering, and other illegal activities.

AI enhances KYC verification by automating the process of identity validation, speeding up customer onboarding, and improving accuracy. This leads to faster, more reliable verification and minimizes errors that could impact compliance.

AI plays a crucial role in AML compliance by automating the detection of suspicious activities. This helps identify and prevent money laundering at an early stage, ensuring that financial institutions remain compliant with regulations.

At Ment Tech, we specialize in providing AI-driven KYC services and AML AI solutions that help financial institutions meet regulatory requirements and combat financial crime.

While AI in AML and KYC compliance significantly reduces manual work, human oversight is still crucial.The future of compliance will be a collaboration between intelligent systems and experienced professionals.