BlockSTO

Ment Tech Labs partnered with BlockSTO to create a secure and intelligent real estate investment platform where users can participate in premium property projects through blockchain-backed tokenization and AI-driven insights. Designed for global accessibility, BlockSTO combines transparency, automation, and data-driven decision-making to make real estate investing inclusive and efficient for every investor.

Region/Industry

Project Duration

Client Type

BlockSTO is a global real estate investment platform built to bridge the gap between high-value properties and everyday investors. The company’s vision was to make real estate participation as seamless as digital investing, combining blockchain transparency with AI-driven market intelligence.

To achieve this, BlockSTO partnered with Ment Tech Labs to develop an ecosystem that transforms how properties are funded, owned, and managed. The platform enables investors to buy tokenized shares of real estate assets, earn dividends in crypto, and take part in collective decision-making through BSTO tokens.

Ready to Build the Next Real Estate Investment Platform?

BlockSTO’s founders approached Ment Tech Labs with a clear vision to simplify real estate investment by merging blockchain transparency with AI-driven insights. However, before this vision could be realized, several challenges had to be addressed across technology, compliance, and user experience layers.

Complex Property Investment Structures

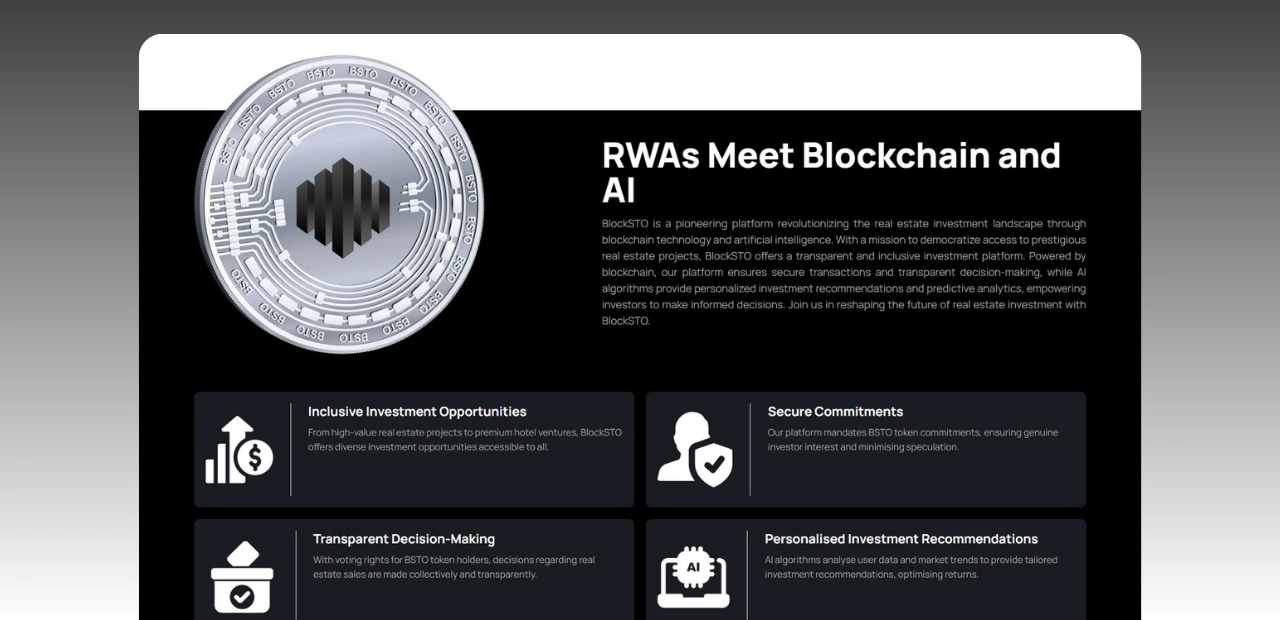

Traditional real estate investments involved multiple intermediaries, long settlement periods, and limited transparency. BlockSTO needed a way to tokenize properties, automate investor allocation, and provide full visibility of asset ownership through blockchain.

Limited Access for Retail Investors

High entry barriers made real estate investment accessible only to institutional players. The goal was to design a tokenized model where users could invest fractionally, opening participation to a broader audience without compromising compliance or security.

Lack of Unified Governance and Decision-Making

The client wanted investors to have an active voice in property sale or reinvestment decisions. Creating a decentralized governance framework with verifiable voting rights for BSTO token holders was a key technical and legal challenge.

Predictive Investment Intelligence

The founders envisioned a platform where AI could forecast property performance, predict demand trends, and offer personalized investment recommendations. Building this layer required designing an adaptive AI engine that learns from user behavior and market data.

Regulatory and Compliance Alignment

Operating across regions meant BlockSTO had to comply with global KYC/AML standards and real estate regulations. This required an end-to-end compliance framework integrated into the investment process, without slowing user onboarding or transactions.

Ment Tech’s Approach

To turn BlockSTO’s vision into a fully operational and regulation-ready investment platform, Ment Tech Labs followed a structured, agile process. The goal was to build a system that merged blockchain reliability with artificial intelligence, giving investors a transparent, data-backed, and user-friendly experience from day one.

Discovery and Planning Phase

Our team began by working closely with BlockSTO’s leadership to define the business model, compliance roadmap, and product architecture. We analyzed how blockchain could simplify asset ownership while ensuring alignment with real estate regulations and investor protection laws. This phase set the foundation for designing a platform that could support both institutional-grade investors and retail users.

Key Deliverables:

Design and Experience Phase

The UX design team focused on making a complex investment system feel effortless. We created intuitive dashboards for browsing projects, investing with BSTO tokens, and participating in governance votes. Visual simplicity and data clarity were key to ensuring investors could make confident, informed decisions.

Key Deliverables:

Development and Integration Phase

Once the design was finalized, our blockchain and AI teams collaborated to bring the platform to life. Smart contracts were written to manage property tokenization, dividend distribution, and on-chain governance. Simultaneously, the AI team integrated predictive analytics models to personalize investment recommendations and market forecasts.

Key Deliverables:

Testing, Audit, and Deployment Phase

Before launch, the entire platform underwent multiple layers of testing, from functional validation to external smart contract audits. Security, data integrity, and performance were prioritized to ensure the platform could handle real-world investment traffic without downtime or data loss.

Key Deliverables:

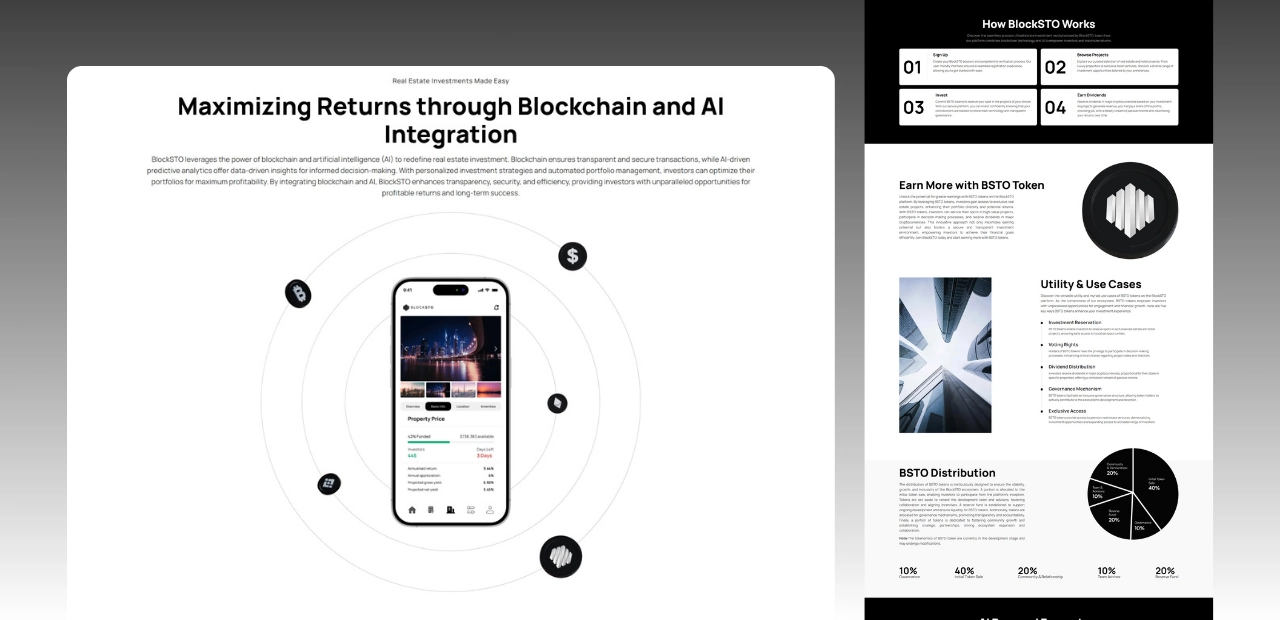

Ment Tech Labs delivered a complete tokenized real estate investment ecosystem built to make property ownership transparent, data-informed, and globally accessible. Every component of BlockSTO was designed to combine the security of blockchain with the intelligence of AI, creating a frictionless experience for both first-time investors and seasoned real estate participants.

Tokenization Engine for Real Estate Assets

Built a robust framework that converts properties into digital tokens, enabling fractional ownership and transparent transactions powered by blockchain smart contracts.

Predictive AI Investment Advisor

Designed an adaptive AI model that studies property data and investor behavior to recommend opportunities with the highest growth and stability potential.

On-Chain Governance and Voting System

Developed a decentralized governance layer where BSTO token holders can vote on sales, reinvestments, and key project decisions in a transparent manner.

Automated Dividend and Yield Distribution

Implemented smart contracts that distribute earnings directly to investor wallets in real time, ensuring fairness and traceability in every payout.

Secure KYC and Compliance Framework

Integrated automated KYC and AML verification modules that maintain full compliance with global standards without disrupting user experience.

Real-Time Portfolio Dashboard

Created an intuitive dashboard displaying asset performance, ROI tracking, and governance rights for a complete view of investor portfolios.

Our clients

Core Capabilities That Power BlockSTO

Property Tokenization Framework

Built a blockchain-based engine that converts real estate assets into fractional digital tokens, enabling transparent ownership and seamless global participation.

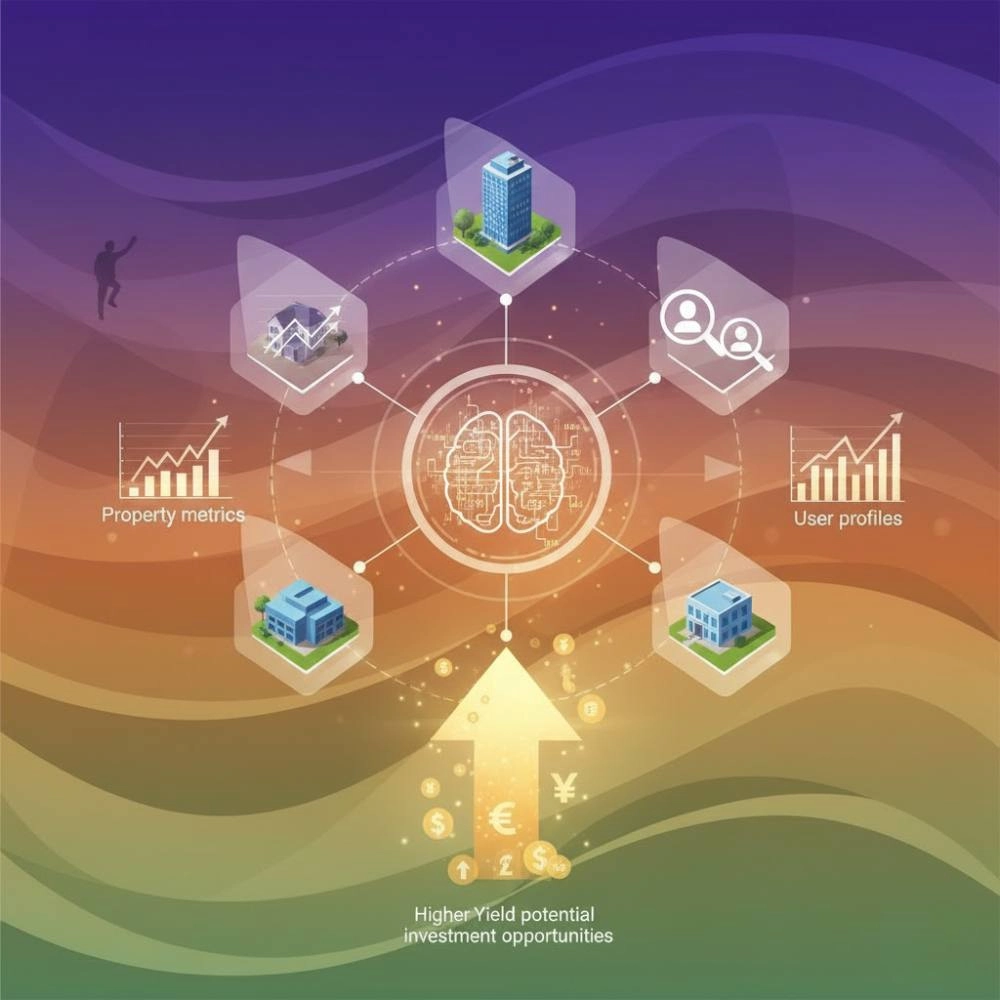

AI Investment Recommendation Engine

Integrated predictive analytics that assess property metrics and user profiles to suggest personalized investment opportunities with higher yield potential.

Decentralized Governance Module

Developed a secure voting system where BSTO token holders can collectively decide on sales, reinvestments, and project updates with full transparency.

Automated Dividend and Payout System

Implemented smart contracts that distribute dividends in major cryptocurrencies instantly, ensuring accuracy and trust in every transaction.

Unified Investor Dashboard

Created an all-in-one dashboard displaying portfolio value, returns, and voting history, giving investors real-time insights and complete portfolio control.

Compliance and Security Infrastructure

Integrated KYC, AML, and encryption frameworks that safeguard user data, support multi-jurisdictional compliance, and ensure regulatory readiness.

Driving Performance and Efficiency Across DeFi Markets

UAE

Building A1, Dubai Digital Park, Dubai Silicon Oasis, Dubai, United Arab Emirates.

USA

5857 Owens Ave Suite 300

Carlsbad, CA 92008

UK

One Avenue, 23 Finsbury Circus, London, England, EC2M 7EA

Ireland

101, Monkstown Rd, Monkstown, Blackrock Co. Dublin, Ireland

India

Annapurna Rd, Saraswati

Nagar, Indore, Madhya Pradesh, 452001

Ment Tech Labs Private Limited operates as a technology provider, not engaged in cryptocurrency holding or trading. Our website showcases a range of software technology products, solutions, and services that comply with local laws and regulations, holding the necessary licences and approvals. For detailed information about a specific product, solution, or service, kindly contact our sales team.

Ment Tech Labs Private Limited is a registered trademark in multiple Asian countries, following appropriate company registration procedures.

The trademark 'Ment Tech Labs Private Limited' holds international registration number BPLM16595F and belongs to Ment Tech Labs Pvt. Ltd., an Indian company registered with company number U62099MP2023PTC064895. However, the company does not offer any financial or similar services advertised on this website.

By accessing this website, you agree to the terms and conditions provided in the Legal Information and Disclaimers, Privacy Policy, and Cookie Policy documents. These documents contain essential information about the company, its products and services, as well as your responsibilities as a user of this website. If you do not agree with the outlined terms and conditions, we recommend leaving the website.

© 2025 Ment Tech Labs. All Rights Reserved.