JetSwap Finance

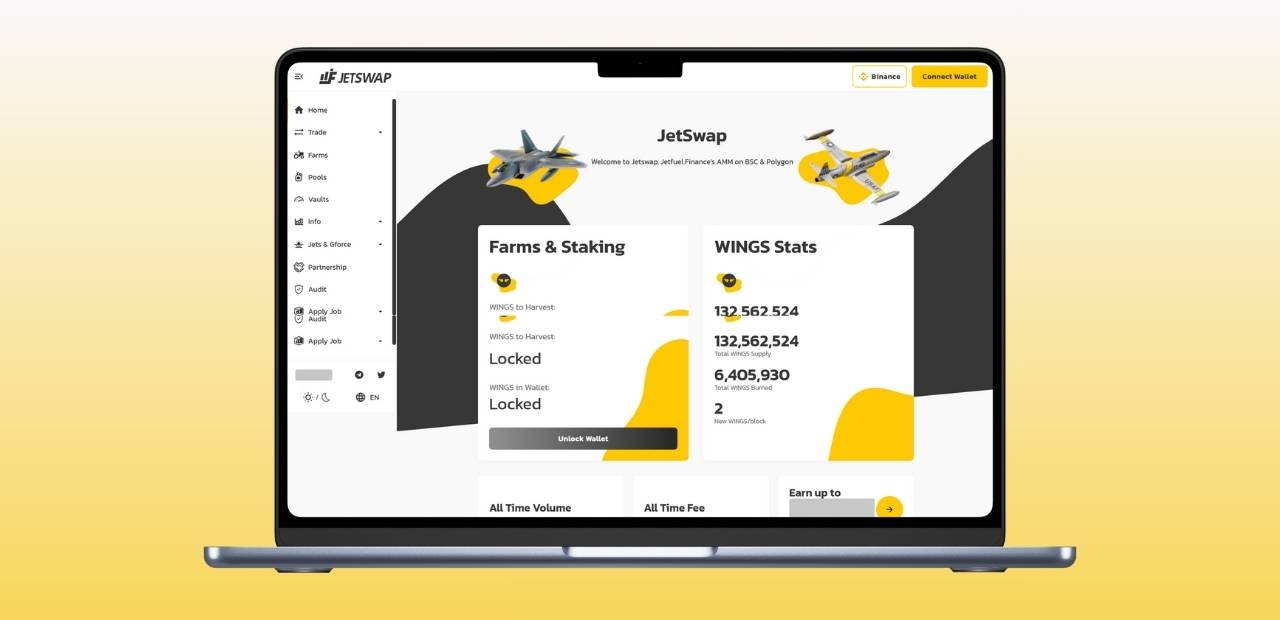

Ment Tech Labs partnered with JetSwap Finance to build an automated market maker designed for speed, scalability, and capital efficiency. The platform enables real-time swaps, yield farming, and liquidity mining across Binance Smart Chain and Polygon, offering users optimized APY rates with minimal transaction costs.

Region/Industry

Project Duration

Client Type

JetSwap Finance is a decentralized exchange protocol focused on high-speed swaps and yield farming automation. The project operates as part of the JetFuel ecosystem, providing users access to cross-chain liquidity pools and innovative farming mechanics.

The client approached Ment Tech Labs to develop a next-generation AMM that could handle rapid transaction throughput, optimize liquidity rewards, and reduce gas costs across multiple networks. The goal was to combine user-friendly DeFi access with an infrastructure capable of delivering institutional-grade performance.

Build DeFi Protocols That Perform at Scale

Before partnering with Ment Tech Labs, SocialSwap had a strong vision i.e. to combine trading with social interaction. But executing that vision within a decentralized framework presented unique challenges that required both blockchain expertise and product clarity.

Optimizing Transaction Speed Across Networks

JetSwap needed to achieve fast swap confirmation times on Binance Smart Chain and Polygon without compromising accuracy or increasing gas costs.

Capital Efficiency in Farming Pools

Existing AMMs struggled with idle liquidity and uneven pool rewards. The team wanted a smart allocation mechanism that continuously optimized yields for active participants.

Cross-Chain Liquidity Synchronization

Bringing liquidity from multiple blockchains into a single interface required seamless interoperability, especially during high-volume farming and migration events.

Reward Distribution and Token Emissions

Balancing WINGS and GFORCE token rewards across different pools and networks was critical to maintaining token stability and user engagement.

Smart Contract Security and Audit Readiness

The protocol had to withstand volume spikes, flash-loan attacks, and bot exploits. Every function required layered security and external audit readiness.

Maintaining Low Fees Without Sacrificing Reliability

JetSwap aimed to offer low transaction fees while preserving consistent liquidity depth and swap success rates under volatile conditions.

Ment Tech’s Approach

To transform Aurix Technologies’ vision into a fully functional, user-focused exchange ecosystem, Ment Tech Labs followed a structured and agile approach. The goal was to create a secure, high-performance, and reward-driven platform that could serve both professional traders and everyday users.

Discovery Phase

We began by analyzing JetSwap’s liquidity flow, user behavior, and transaction data from the JetFuel ecosystem. This helped define key metrics for swap speed, gas optimization, and yield distribution across networks.

Design Phase

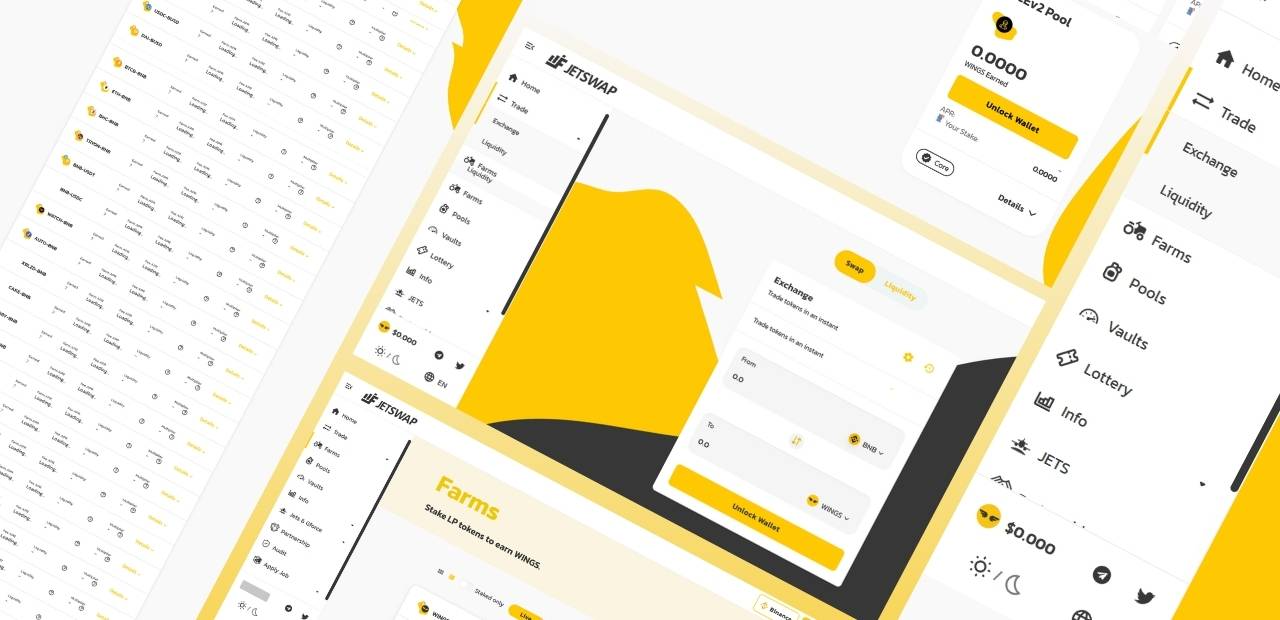

Our DeFi architects designed the system architecture around multi-chain liquidity access. The interface and contract flow were mapped to minimize transaction steps, ensuring faster execution and clear user visibility into pool rewards.

Development Phase

Ment Tech Labs developed the automated market maker using Solidity and custom routing logic optimized for Binance Smart Chain and Polygon. The farming and staking contracts were designed with adjustable emission controls, allowing token rewards to scale based on pool activity.

Testing Phase

The platform underwent multiple audit rounds and transaction simulations. Load testing was performed under real-world traffic conditions to ensure price accuracy and prevent slippage across active liquidity pairs.

Deployment and Optimization Phase

JetSwap was deployed with integrated farming vaults and real-time APY recalculation. Post-launch monitoring tools were implemented to track liquidity depth, transaction speed, and yield performance across all supported networks.

A Cross-Chain AMM Optimized for Speed, Yield, and Stability

Automated Market Maker Core

Developed a swap engine capable of handling high transaction throughput with accurate pricing and minimal slippage on Binance Smart Chain and Polygon.

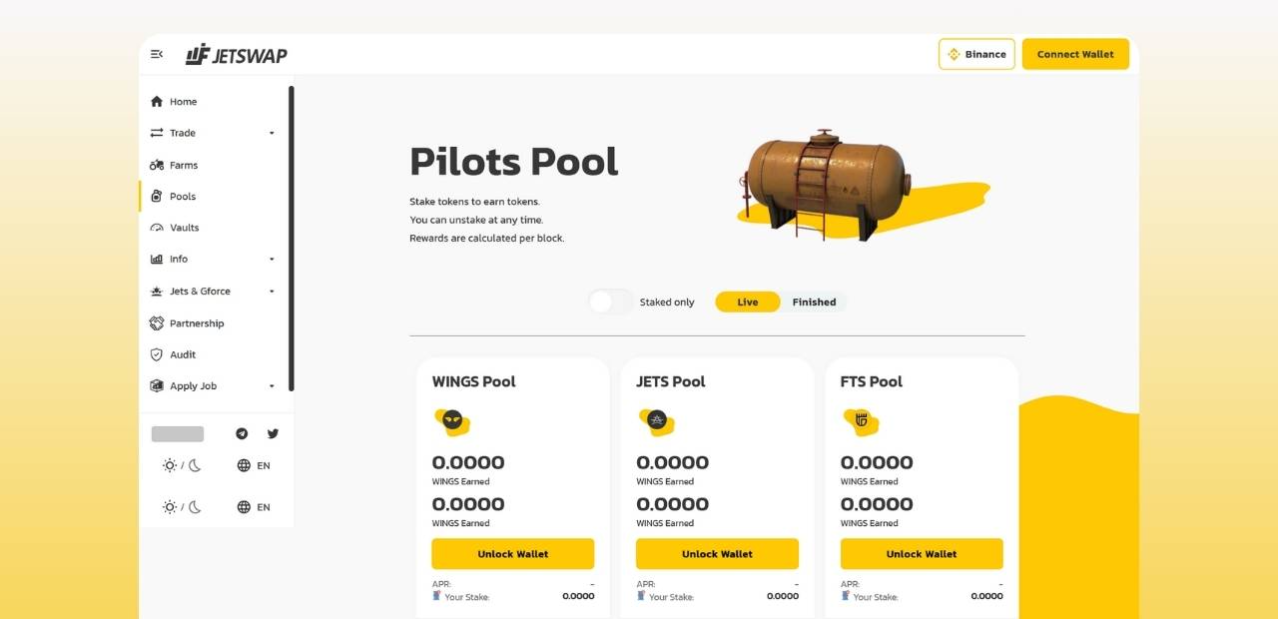

Dynamic Yield Farming Contracts

Delivered adaptive farming contracts with real-time emission adjustments based on pool activity, ensuring fair and continuous reward distribution.

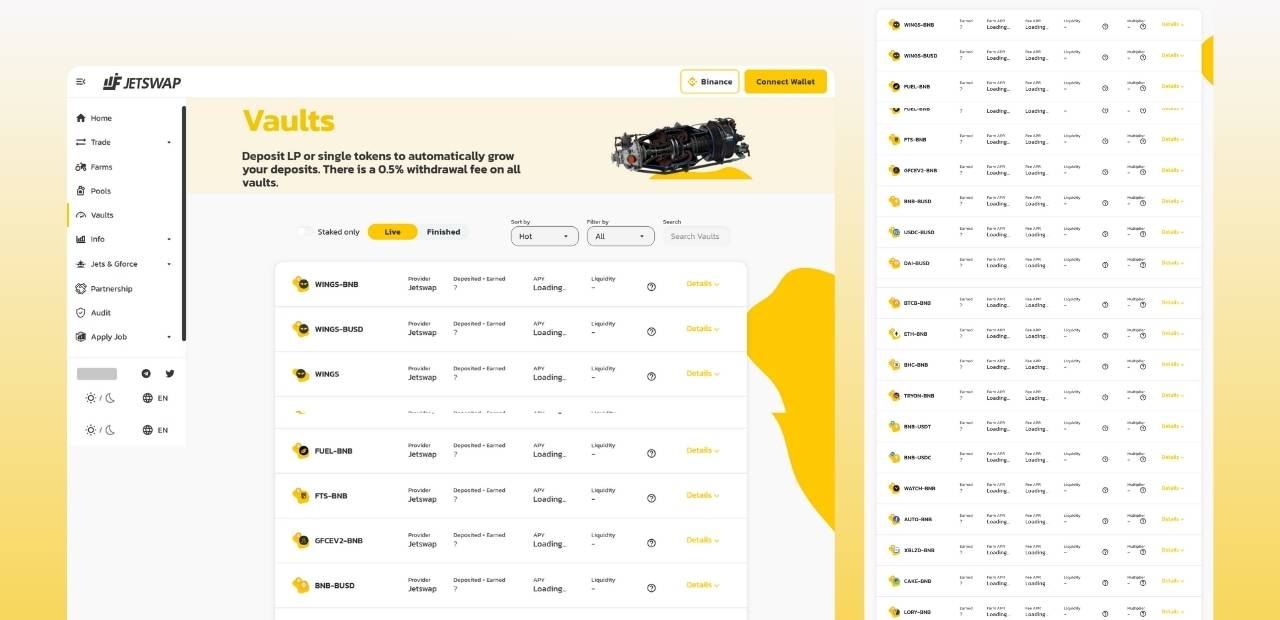

Vault-Based Liquidity Architecture

Created liquidity vaults to auto-compound rewards and reduce gas consumption while improving capital utilization across multiple pools.

Multi-Network Integration Layer

Built seamless cross-chain connectivity for liquidity migration, reward claiming, and staking between BSC and Polygon networks.

Governance and Token Utility Framework

Integrated governance controls for WINGS and GFORCE tokens, enabling proposals, vote weighting, and reward policy management through on-chain mechanisms.

Analytics and Monitoring System

Implemented live analytics for liquidity depth, pool performance, and transaction metrics, accessible through an internal dashboard and public interface.

Our clients

The Aurix Exchange platform is a robust digital asset ecosystem that seamlessly integrates trading, payments, and

rewards. Each component is crafted for optimal reliability, scalability, and real-time efficiency.

Instant Swap Execution

Users can swap tokens with near-instant confirmation and consistent pricing accuracy across all supported pairs.

Cross-Chain Farming Access

Participants can stake and earn yields across Binance Smart Chain and Polygon through a unified farming interface.

Real-Time APY Tracking

Dynamic yield tracking shows live APR and pool performance, allowing users to choose the most profitable farms.

Compounding Vaults

Auto-compounding vaults enable users to reinvest earnings automatically for higher annualized returns.

Liquidity Pool Insights

Each pool displays total value locked, token ratios, and historical returns, offering full visibility to liquidity providers.

Integrated Governance Portal

Holders of WINGS and GFORCE tokens can vote on proposals, reward parameters, and new farm launches directly within the platform.

Driving Performance and Efficiency Across DeFi Markets

UAE

Building A1, Dubai Digital Park, Dubai Silicon Oasis, Dubai, United Arab Emirates.

USA

5857 Owens Ave Suite 300

Carlsbad, CA 92008

UK

One Avenue, 23 Finsbury Circus, London, England, EC2M 7EA

Ireland

101, Monkstown Rd, Monkstown, Blackrock Co. Dublin, Ireland

India

Annapurna Rd, Saraswati

Nagar, Indore, Madhya Pradesh, 452001

Ment Tech Labs Private Limited operates as a technology provider, not engaged in cryptocurrency holding or trading. Our website showcases a range of software technology products, solutions, and services that comply with local laws and regulations, holding the necessary licences and approvals. For detailed information about a specific product, solution, or service, kindly contact our sales team.

Ment Tech Labs Private Limited is a registered trademark in multiple Asian countries, following appropriate company registration procedures.

The trademark 'Ment Tech Labs Private Limited' holds international registration number BPLM16595F and belongs to Ment Tech Labs Pvt. Ltd., an Indian company registered with company number U62099MP2023PTC064895. However, the company does not offer any financial or similar services advertised on this website.

By accessing this website, you agree to the terms and conditions provided in the Legal Information and Disclaimers, Privacy Policy, and Cookie Policy documents. These documents contain essential information about the company, its products and services, as well as your responsibilities as a user of this website. If you do not agree with the outlined terms and conditions, we recommend leaving the website.