In 2025, smart founders and high-net-worth individuals are shifting focus from just high-growth markets to infrastructure that delivers security, speed, and scale. One clear trend is the rise of Tokenization as a Service (TaaS), adopted by enterprises and investment-backed startups alike.

With 94% of customers avoiding companies that mishandle data, over 60% of businesses are investing in tokenization services and advanced data protection. Data protection today isn’t just compliance; it’s about control, automation, and unlocking new business models.

TaaS provides a flexible, cloud-native way to secure sensitive data, digitize real-world assets, and expand liquidity. For HNIs, it enables fractional ownership, access to regulated financial instruments, and real-time oversight. This blog explores why TaaS is gaining ground, how it works, and how it can help you protect data, monetize assets, and stay ahead of compliance.

What Is Tokenization as a Service and How It Works?

Tokenization as a Service (TaaS) is a fully managed solution that enables businesses and investors to protect sensitive data or digitize real-world assets without building infrastructure from scratch. Instead of setting up tokenization systems manually, companies use a secure, cloud-based platform to handle everything from encryption and token creation to compliance and wallet integration.

At its core, TaaS replaces real data with secure digital tokens. These tokens can be safely used across platforms and apps, but are meaningless if exposed. The original data is stored in a secure token vault, accessible only to verified users or smart contracts. This approach allows real-time operations like payments, asset transfers, or data sharing while keeping data safe.

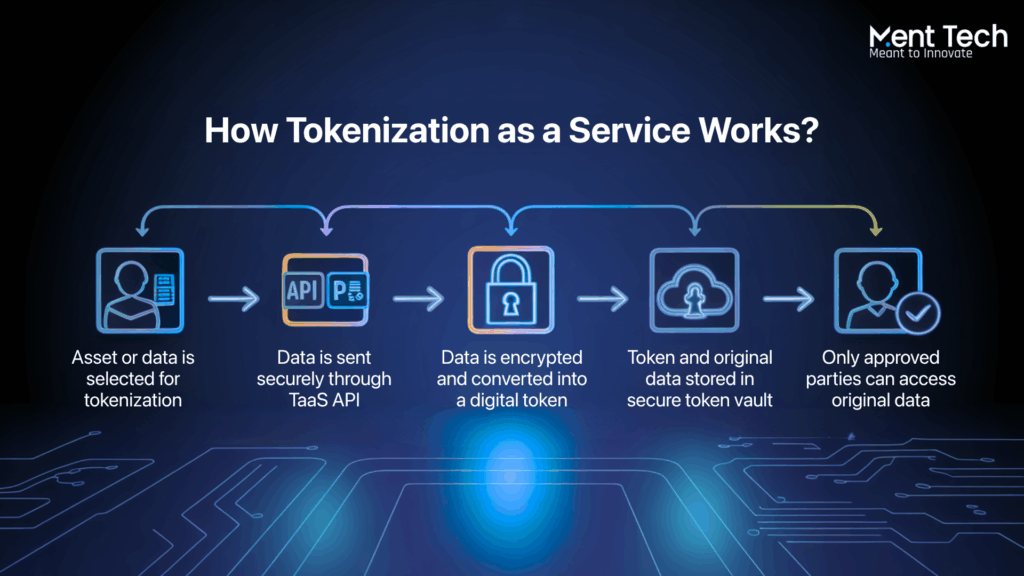

How Tokenization as a Service Works?

1. Asset or data is selected for tokenization

The business or investor identifies the sensitive asset or data to tokenize, such as financial info, identity records, or physical documents. This ensures that only relevant data is targeted for protection and digitization.

2. Data is sent securely through TaaS API

The selected data is transmitted safely to the TaaS platform via secure APIs. Encryption during transit prevents unauthorized access and sets the stage for token launch services.

3. Data is encrypted and converted into a digital token

The original data is encrypted and replaced with a secure digital token. This token acts as a safe substitute that can be used across systems without exposing the real data.

4. Token and original data stored in secure token vault

Both the encrypted token and the original data are stored in a highly secure vault. The vault protects data from breaches while supporting real-time operations like payments and transfers.

5. Only approved parties can access original data

Access to the original data is restricted to verified users or smart contracts. This ensures privacy, regulatory compliance, and controlled visibility while enabling trusted digital operations.

Why TaaS Is So Valuable in 2025?

In 2025, businesses face growing pressure to protect data, comply with regulations, and scale operations quickly. Tokenization as a Service (TaaS) has emerged as a critical tool for founders, enterprises, and high-net-worth individuals navigating these challenges.

As industries adopt digital assets and financial tokenization, traditional security methods are falling behind. TaaS platforms are becoming the go-to solution for companies that need speed, security, and scalability without rebuilding infrastructure or managing a dedicated blockchain consultant expert team.

For HNIs, TaaS provides privacy and controlled access, making it easier to tokenize private equity, real estate, or royalty rights. Digital tokens can be securely managed, traded, or held in token vaults, reducing the risk of fraud or data breaches while enabling fast adoption of innovative financial models.

Key Drivers Behind the Adoption of TaaS

- Rising Regulatory Pressure: With PCI DSS, GDPR, and local data privacy laws evolving swiftly, businesses are using compliance-ready tokenization to stay ahead.

- Need for Speed: TaaS reduces the time it takes to go live with digital products or token offerings.

- Global Expansion: Enterprises expanding to multiple regions use TaaS to stay compliant and secure across borders.

- Investor Expectations: More investors are now asking about token strategies, especially in sectors like real estate, fintech, and energy.

As a result, tokenization services are no longer limited to fintech firms or Web3 startups. They are being used by luxury brands, SaaS companies, family offices, and even governments.

By working with an experienced asset tokenization development company, startups and investors can launch in weeks rather than months with full security and compliance built in.

How Founders and HNIs Use Tokenization Services?

1. Founders Tokenize Equity and Revenue Streams

Startups are using Tokenization as a Service to convert company shares, revenue contracts, or IP rights into secure digital tokens. This helps raise capital faster, enable community ownership, and streamline investor onboarding through a tokenization platform.

2. Digital Assets Without Building In House

By working with a token development company, founders can launch asset backed tokens without setting up a blockchain team. The platform provides APIs and smart contracts, making it easy to integrate tokenization services into existing workflows.

3. Gamified Products and Loyalty Programs

Many early-stage companies use TaaS platforms to create internal tokens for rewards, loyalty points, or gaming ecosystems. These tokens can be tracked, managed, and exchanged securely using real-time APIs and secure token vaults.

4. HNIs Unlock Liquidity Through RWA Tokenization

High-net-worth individuals use RWA entertainment tokenization to digitize high-value assets such as real estate, collectibles, or private equity. These tokenized holdings offer more liquidity, easier transfers, and greater portfolio flexibility.

5. Cross Border Asset Management

HNIs with multi-region investments are using tokenization as a service to maintain control and compliance. Tokenized assets can be stored in a secure token vault, accessible only by approved parties or heirs, enabling better estate planning and cross-border transfers.

6. Built In Compliance for Regulated Sectors

Both founders and HNIs benefit from compliance-ready tokenization. Whether it is PCI DSS, GDPR, or HIPAA, TaaS platforms simplify data protection by embedding legal safeguards and audit logs directly into the tokenization process.

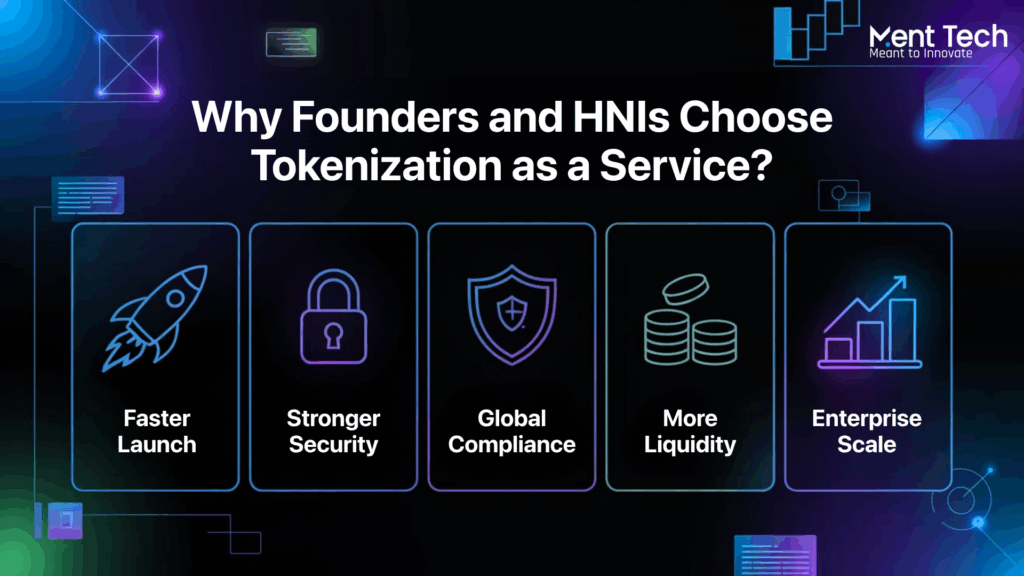

Key Benefits of TaaS for Founders and HNIs

Tokenization as a Service is not just a technical upgrade. It is a strategic tool for protecting assets, scaling operations, and unlocking new forms of value. Both startup founders and high net-worth individuals are seeing measurable returns by using tokenization services to digitize, secure, and manage high-value data and assets.

Here are the most important benefits:

1. Fast and Cost Effective Deployment

TaaS platforms remove the need for in-house blockchain development. Founders can launch tokens, test ideas, or digitize workflows in weeks instead of months. The costs are flexible and suited to both startups and large enterprises.

2. Enhanced Security and Privacy

With a secure token vault, strong encryption, and role-based access, Tokenization as a Service protects sensitive data at every layer. HNIs use this to protect real estate records, investment agreements, and digital wealth from fraud or leaks.

3. Built In Compliance at Scale

TaaS platforms are designed to meet data laws such as PCI DSS, GDPR, and HIPAA. For startups operating across regions or HNIs managing cross-border portfolios, compliance-ready tokenization ensures peace of mind without slowing down operations.

4. Greater Liquidity Through Tokenized Assets

By working with an asset tokenization development company, investors and startups can convert real-world assets into tokenized real estate. These tokens can be sold in parts, exchanged easily, or held across wallets, offering liquidity without asset disposal.

5. Scalable for Enterprise Growth

As your user base grows, TaaS infrastructure grows with you. Whether you are processing thousands of user transactions or managing high-value investor data, tokenization platforms are built to support large-scale adoption with real-time performance.

6. Easier Access to Digital Ownership Models

From fractional real estate to startup equity, TaaS makes new investment models possible. Both founders and HNIs can participate in innovative tokenizing financial products using tokenized assets that are secure, portable, and programmable.

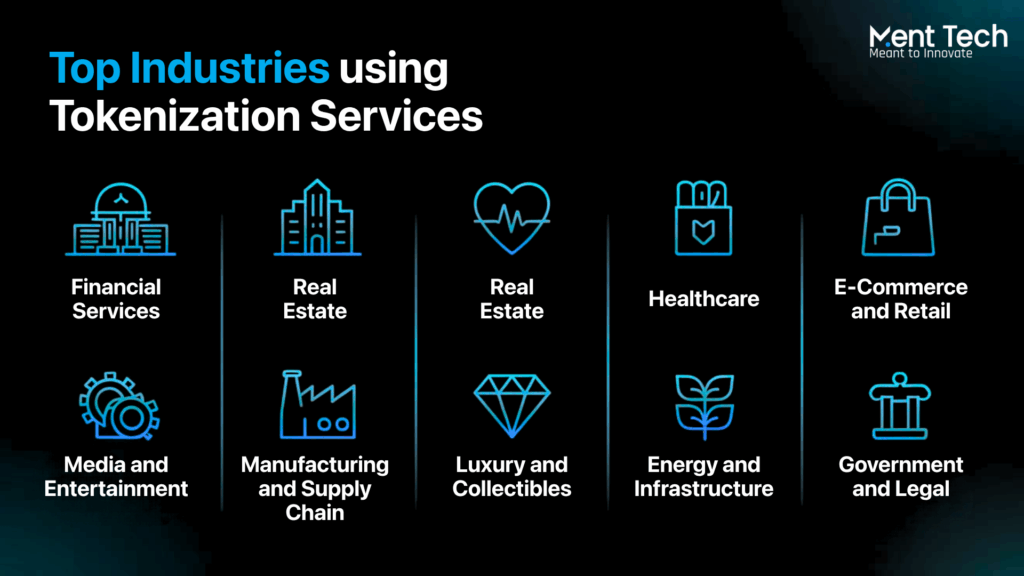

Use Cases of Tokenization as a Service Across Industries

Tokenization as a Service is being adopted across industries where data sensitivity, asset ownership, and compliance are top priorities. From early stage startups to large enterprises, TaaS platforms are helping businesses secure operations, unlock liquidity, and create digital-first asset models.

Here are the top industries using tokenization services in 2025:

1. Financial Services

Banks and fintech companies use compliance ready tokenization to protect transaction data and issue asset backed tokens. This includes tokenized bonds, revenue contracts, and digital securities. TaaS also helps reduce fraud and streamline settlement processes.

2. Real Estate

Developers and HNIs use RWA Tokenization for Real Estate to fractionalize properties, simplify cross-border ownership, and streamline document tracking and transfers via smart contracts.

3. Healthcare

Hospitals and digital health startups use Tokenization as a Service to secure patient data and maintain HIPAA compliance. TaaS enables real time access without exposing sensitive information, helping teams work faster and stay compliant.

4. E-Commerce and Retail

Online brands use TaaS to manage customer data securely and issue loyalty tokens. Tokenization reduces PCI DSS scope, protects payment data, and allows businesses to offer new incentives without taking on regulatory risk.

5. Media and Entertainment

Production houses and content platforms tokenize IP rights, royalties, and licenses. This allows creators and investors to track usage, earn revenue, and transfer ownership easily through secure token vaults and API-based workflows.

6. Manufacturing and Supply Chain

Supply chain firms use TaaS platforms to track goods, verify product authenticity, and tokenize physical items like equipment or materials. It enables real time monitoring and reduces data tampering.

7. Luxury and Collectibles

From fine art to watches, luxury brands and investors use tokenization services to digitize ownership and enable fractional access. These digital tokens are secure, tradable, and easier to manage than physical certificates.

8. Energy and Infrastructure

Energy providers tokenize carbon credits, grid assets, and funding agreements. This creates better liquidity, transparency, and investor participation for infrastructure projects.

9. Government and Legal

Agencies and legal tech platforms use Tokenization as a Service to store records securely and automate contract workflows. It ensures compliance and audit trails without data leaks or unauthorized access.

Choosing the Right TaaS Provider

Not all tokenization-as-a-service platforms are built the same. The right provider can help you move fast, stay compliant, and scale with confidence. The wrong one can delay your launch or expose your data to risk.

Here are the key factors to evaluate when selecting a TaaS platform:

1. Proven Security Infrastructure

Choose a provider that offers a secure token vault, strong encryption, and role based access. Your asset data and private records must be fully protected at every stage.

2. Compliance First Approach

Make sure the platform offers compliance ready tokenization for laws like PCI DSS, GDPR, HIPAA, and region specific privacy standards. It should also provide audit logs, permissions, and automated compliance checks.

3. API Based Integration

The best platforms offer simple REST APIs and SDKs for fast integration. Look for a TaaS provider that fits your existing tech stack without adding friction or complexity.

4. Customization and Flexibility

Every business has different tokenization needs. Work with a token development company that offers custom modules, smart contract logic, and flexible deployment across cloud, on premise, or hybrid setups.

5. Scalability for Enterprise Workloads

If you expect to grow, your TaaS provider should support millions of transactions, multi tenant use cases, and seamless scaling. Check for case studies, uptime metrics, and support benchmarks.

6. Industry Expertise

Choose a provider with expertise in RWA tokenization, healthcare, real estate, or finance. Many also partner with a crypto marketing agency to promote token launches and reach investors.

7. Long Term Support and Roadmap

Tokenization is not a one time setup. The provider should offer long term maintenance, feature updates, and a clear roadmap that aligns with evolving regulations and industry needs.

Conclusion

Tokenization as a Service provides a secure, flexible, and cost-effective way to protect sensitive data and digitize assets. It’s ideal for industries like e-commerce, healthcare, and financial services where security, compliance, and scalability are critical.

At MentTech, a leading Real Estate Tokenization Development Company, we deliver enterprise-grade TaaS platforms and custom solutions for asset tokenization, investor onboarding, and secure token vaults. Our team of financial and blockchain experts ensures smooth integration, strategic guidance, and real-world impact.

Looking to tokenize your real estate or manage high-value assets? MentTech makes compliance-ready tokenization fast, secure, and simple!

FAQ

1. What is tokenization as a service used for?

Tokenization as a Service is used to secure sensitive data, digitize real-world assets, enable fractional ownership, and maintain compliance with regulations like GDPR and PCI DSS. It also supports digital asset tokenization to improve transparency and liquidity.

2. Can startups use tokenization as a service for fundraising?

Yes. Startups use TaaS to tokenize equity, revenue streams, or IP, allowing them to raise capital through secure and trackable digital assets. This process of tokenization of assets helps startups attract investors with greater trust and flexibility.

3. Is TaaS secure for storing high-value data?

TaaS platforms use secure token vaults, encryption, and role-based access to protect high-value data and prevent unauthorized access or fraud. Trusted Tokenization as a Service platforms also ensure compliance and safeguard against emerging cyber risks.

4. What industries benefit the most from TaaS?

Industries such as finance, healthcare, real estate, e-commerce, and media benefit from TaaS by securing data, automating compliance, and unlocking liquidity. Tokenization development services expand these use cases to cover asset-backed tokens and digital securities.

5. How do I choose the right TaaS provider?

.Look for proven security infrastructure, API integration, compliance support, scalability, and industry experience to ensure success. A trusted Tokenization as a Service platform or token development company can assess needs and handle deployment.

6. Can TaaS support real-world asset tokenization?

Yes. TaaS is widely used for RWA tokenization, including real estate, private equity, luxury goods, and infrastructure assets. It shows how tokenization of assets makes them accessible, secure, and tradable across global digital markets.