Artificial intelligence now plays a key role in how the financial world operates. Modern trading platforms go beyond basic transactions; they process data, automate strategies, and deliver real-time insights. Swyftx AI brings these capabilities together, combining advanced crypto trading tools with machine learning to offer a smarter and more efficient trading experience.

The numbers tell an impressive story. According to recent market research, the global crypto exchange market reached USD 71.35 billion in 2025 and is projected to grow to USD 260.17 billion by 2032, with a CAGR of 20.30%. This explosive growth is driven largely by AI-powered trading solutions that make investing accessible to everyone.

Swyftx AI shows how intelligent trading platforms can combine smart technology with great user experience. We will cover everything from core features and development steps to trading app development cost estimates and the strategic advantages of partnering with an experienced crypto trading app development cost team.

What Is Swyftx AI?

Swyftx stands as one of Australia’s most trusted cryptocurrency trading platforms. The platform has built its reputation on three core pillars: intuitive design, competitive fees, and complete transparency in operations. Users can trade, monitor, and manage their digital assets through a secure and fully compliant environment that makes cryptocurrency trading as simple as online banking.

What sets Swyftx apart from traditional exchanges is its commitment to user education and support. The platform provides extensive learning resources, real-time market analysis, and 24/7 customer support to help both beginners and experienced traders make informed decisions.

The AI Advantage in Swyftx AI

Swyftx AI takes the solid foundation of the original platform and supercharges it with artificial intelligence. The smart algorithms work around the clock, analyzing massive volumes of real-time market data to deliver several key benefits:

- Data-driven recommendations: The AI processes market trends, news sentiment, and historical patterns to suggest optimal trading opportunities

- Predictive insights: Advanced algorithms forecast potential price movements and market volatility to help users time their trades better

- Automated portfolio management: The system can automatically rebalance portfolios based on user preferences and market conditions

- Risk assessment: AI continuously monitors and alerts users about potential risks in their trading strategies

The ultimate goal is simple: make trading smarter, faster, and more accessible for everyone, from first-time crypto buyers to seasoned institutional investors.

How the Swyftx Model Works?

To build a crypto trading app like Swyftx, you need to understand the underlying business model that combines solid fundamentals with intelligent automation.

Step 1: Establish a Solid Business Foundation

Swyftx focuses on user trust and engagement from the start. It maintains transparency in fees, offers educational resources to guide traders, and ensures compliance across all supported regions. This creates a reliable and credible trading environment.

Step 2: Integrate AI for Smarter Trading

The AI engine works continuously, learning from historical data, user behavior, and real-time market trends. Over time, it refines its predictions and insights, helping users make smarter, data-driven trading decisions.

Step 3: Adopt a Hybrid Operational Approach

Swyftx merges the speed and security of centralized exchanges with the adaptability of AI systems. This hybrid setup ensures fast execution, high liquidity, and institutional-grade protection while offering automated trading and personalized strategies.

Step 4: Build a Sustainable Revenue and Engagement Model

Revenue streams are designed to grow with user success. These include tier-based trading fees, premium subscriptions, margin trading, and referral rewards. Gamified features, AI-powered support, and loyalty programs keep users engaged and motivated to trade more actively.

How Swyftx AI Earns Revenue and Why Its Pricing Works?

The monetization strategy of Swyftx AI demonstrates how to balance profitability with user satisfaction. The platform uses dynamic pricing tiers that serve both beginners with small portfolios and professional traders managing large volumes.

The low-fee structure encourages higher transaction volumes, creating a win-win situation where users save money on fees while the platform generates revenue through volume. AI personalization plays a crucial role by tailoring the user experience to maximize engagement and lifetime value. Users who receive relevant recommendations and automated assistance tend to trade more frequently and maintain larger account balances.

This approach creates a sustainable business model where user growth and platform profitability support each other. As users become more successful with AI-assisted trading, they naturally increase their trading activity and explore premium features.

Why Should You Invest in Developing an AI App Like Swyftx AI?

Building an AI-powered trading app opens doors to one of the most lucrative opportunities in modern fintech. Here are five compelling reasons to consider this investment:

- Rising demand for automation: More investors want data-driven, automated solutions that remove emotion from trading decisions

- Cross-market potential: A single platform can support cryptocurrency, forex, stocks, and commodities trading, maximizing your addressable market

- Higher user engagement: AI personalization keeps users active longer, leading to better retention and higher lifetime value

- Strong ROI potential: Multiple revenue streams including subscriptions, trading fees, and premium services create sustainable profitability

- Early adoption advantage: The AI-fintech ecosystem is still maturing, giving early movers a significant competitive advantage

For fintech startups and established trading platforms, this represents the perfect time to innovate and capture a tech-savvy, growth-oriented user base that values intelligent automation.

Why Swyftx AI Stands Out in the Market?

Swyftx AI has established itself as a market leader through several key differentiators:

- Accurate AI predictions: The platform uses advanced sentiment analysis and real-time data processing to provide highly accurate market predictions

- Intuitive user interface: Complex trading operations are simplified through smart design and AI-guided workflows

- Regulatory compliance: Strong KYC/AML integration ensures user safety while maintaining regulatory compliance

- Fast onboarding: New users can start trading within minutes thanks to streamlined verification and wallet setup

- Continuous innovation: Regular updates introduce new AI features like smart alerts, trading bots, and risk assessment tools

- Educational focus: Built-in learning resources help users understand both trading fundamentals and AI-powered features

Market Opportunity: With the crypto exchange market growing at over 20% CAGR through 2032, AI-driven trading apps represent one of the fastest-growing segments in fintech. This makes now the ideal time to develop such a platform.

Core Features of an AI Trading App Like Swyftx AI

A strong trading platform should cover the complete journey from account creation to portfolio management. When you set out to build a crypto trading app like Swyftx, these features form the foundation of a system that simplifies trading, reduces risk, and builds user trust.

1. Real-Time Market Data

A trading app should provide more than just price numbers. It needs to deliver live market data with advanced charting tools that help users spot trends, identify support and resistance levels, and make informed decisions. Integration with multiple data providers ensures accuracy and reduces latency. Technical indicators like moving averages, RSI, MACD, and Bollinger Bands should be built-in, allowing traders to analyze markets without switching to external tools.

2. Multi-Asset Trading Support

Modern traders want access to different asset classes from one platform. Supporting cryptocurrencies, stocks, forex, and commodities expands your market reach and keeps users engaged. Each asset class needs its own liquidity pools, order matching engines, and compliance frameworks. This feature also opens doors to Margin & Leverage Trading and Futures Trading System capabilities for advanced users.

3. AI-Powered Predictive Analytics

Accurate predictions set AI trading apps apart from traditional platforms. Your system should analyze historical price data, trading volumes, and market sentiment from news and social media. Machine learning models can forecast short-term price movements and alert users about potential opportunities. The AI should learn from market behavior and adapt its predictions based on changing conditions, helping users time their entries and exits more effectively.

4. Sentiment Analysis Engine

Market sentiment drives price action. An AI-powered sentiment analysis engine monitors news articles, social media posts, influencer opinions, and forum discussions to gauge market mood. This feature helps users understand what drives price movements beyond technical indicators. Real-time sentiment scores can warn traders about sudden negative sentiment that might trigger sell-offs or positive buzz that could push prices higher.

5. Automated Portfolio Rebalancing

Portfolio management takes time and discipline. An AI system can automatically rebalance user portfolios based on predefined rules and risk tolerance. When one asset outperforms and becomes too large a percentage of the portfolio, the system can suggest or execute rebalancing trades. This keeps risk in check and helps users maintain their desired asset allocation without constant manual intervention.

6. Intelligent Trading Bots with Custom Strategies

Trading bots execute strategies automatically, removing emotion from trading decisions. Users should be able to create custom bots with specific entry and exit rules, stop-loss levels, and profit targets. Pre-built strategies for beginners and advanced customization for experienced traders make this feature valuable across user segments. The bots should operate based on real-time market conditions and AI recommendations.

7. Smart Order Execution System

Speed and accuracy in order execution determine trading success. The platform should support market orders, limit orders, stop-loss orders, and more advanced order types like trailing stops and iceberg orders. An intelligent execution engine routes orders to the best available liquidity sources, minimizing slippage and ensuring users get the best possible prices. This is particularly important during high volatility when prices change rapidly.

8. AI-Powered Chatbot for Instant Support

Users need quick answers when trading. An AI chatbot should handle common queries about account setup, trading procedures, fee structures, and market information. Natural language processing allows users to ask questions in plain language and receive helpful responses instantly. The chatbot can also provide market insights, explain AI predictions, and guide users through complex features without human intervention.

9. Secure Wallet Management

Asset security is non-negotiable. The platform should offer both custodial wallets for convenience and non-custodial options for users who want full control. Multi-signature authentication, cold storage for the majority of funds, and hot wallets only for active trading balances create multiple layers of protection. Integration with hardware wallets and support for Token Vesting & Claim Portal features add extra value for token projects.

10. Seamless KYC and Onboarding

First impressions matter. AI-assisted KYC verification speeds up the onboarding process by automatically verifying identity documents, checking against sanctions lists, and assessing risk levels. Users should be able to start trading within minutes rather than waiting days for manual verification. The system should comply with AML regulations while keeping the process smooth and user-friendly.

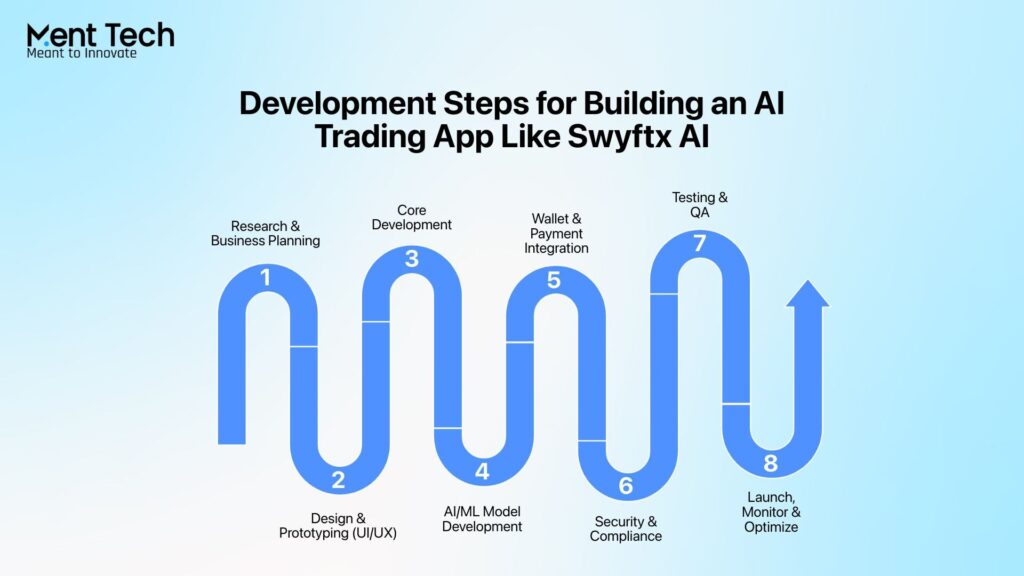

Development Steps for Building an App Like Swyftx AI

Building a successful AI-powered trading app takes planning, precision, and smart AI integration. Below are the key stages that shape a reliable and scalable trading platform:

Step 1: Research & Business Planning

Define your target audience, supported markets, and compliance requirements. Establish your business model, fee structure, and competitive positioning strategy. Conduct market research to identify user pain points and analyze competitor offerings.

Step 2: Design & Prototyping (UI/UX)

Create user-friendly wireframes and interactive prototypes. Focus on simplicity, clarity, and accessibility while ensuring the interface can handle complex trading operations. Test designs with real users to validate usability before development begins.

Step 3: Core Development (Front-End + Back-End + Trading Engine)

Build robust trading infrastructure with real-time APIs, high-speed order processing, and scalable architecture that can handle thousands of concurrent users. Implement microservices architecture for better scalability and maintenance.

Step 4: AI/ML Model Development

Gather and clean historical market data, news sentiment, and user behavior patterns. Train predictive models for price forecasting, risk assessment, and portfolio optimization. Implement continuous learning systems that improve accuracy over time based on new data and user feedback.

Step 5: Integration of Wallets and Payment Systems

Connect trusted wallet APIs, implement secure payment gateways, and enable seamless fiat-to-crypto and crypto-to-crypto transactions. Ensure support for multiple payment methods to maximize user convenience.

Step 6: Security, Compliance, and KYC Setup

Implement advanced encryption, multi-factor authentication, and comprehensive identity verification. Ensure compliance with local and international trading regulations including KYC/AML requirements. Set up regular security audits and penetration testing.

Step 7: Testing & Quality Assurance

Conduct extensive functional, load, and security testing. Validate trading accuracy, AI prediction reliability, and user experience across different devices and scenarios. Test edge cases and stress scenarios to ensure platform stability under high load.

Step 8: Launch, Monitor & Optimize

Start with a controlled beta launch to gather user feedback. Continuously monitor AI performance, user engagement, and system stability while optimizing features based on real usage data. Implement analytics dashboards to track key performance indicators and user behavior.

How Ment Tech Can Help You Build a Swyftx-Like Trading App

At Ment Tech, we specialize in creating intelligent trading platforms that combine AI technology with robust trading infrastructure. As a leading crypto trading app development company, our expertise spans the complete development lifecycle:

- End-to-end AI trading app development: From initial concept and market research to deployment and post-launch optimization, we handle every aspect of your project

- Advanced AI and ML integration: Our team of expert AI developers builds sophisticated predictive analytics, sentiment analysis, and automated trading systems

- Secure infrastructure development: We implement institutional-grade security measures, compliance frameworks, and high-performance trading engines

- Ongoing support and optimization: Post-launch monitoring, AI model retraining, and continuous feature enhancement to keep your platform competitive

Our team includes experienced professionals who understand both the technical complexities of AI development and the regulatory requirements of financial applications. When you hire top Indian app developers from Ment Tech, you get access to world-class expertise at competitive rates.

FAQs

A basic MVP with core features can take 4-6 months to develop. A fully-featured platform with advanced AI capabilities, multiple asset classes, and comprehensive compliance features typically requires 8-12 months. The timeline depends on project complexity, team size, and the depth of AI integration required.

Key technologies include AI/ML frameworks (TensorFlow, PyTorch) for predictive analytics, real-time data processing systems, secure wallet APIs, payment gateway integrations, KYC/AML verification systems, advanced encryption protocols, cloud infrastructure (AWS, Azure), and APIs for market data feeds. The tech stack should support high performance, scalability, and security.

Yes, the crypto exchange market is growing at over 20% CAGR and is projected to reach $260 billion by 2032. AI-powered trading apps have multiple revenue streams including trading fees, subscription tiers, margin trading interest, and referral programs. With proper execution and user acquisition strategy, the ROI potential is strong.

Key challenges include ensuring data quality and accuracy for AI models, maintaining robust security against cyber threats, meeting evolving regulatory compliance requirements, building high-performance infrastructure for real-time trading, and creating an interface that balances simplicity for beginners with depth for expert traders. Partnering with an experienced crypto trading app development company helps overcome these challenges.

Yes, crypto trading platforms must comply with financial regulations in their operating regions. This includes obtaining necessary licenses, implementing KYC/AML procedures, and maintaining data privacy standards. Requirements vary by country, so consulting with legal experts and building compliance features from the start is essential.

Absolutely. Modern trading platforms like Swyftx support multiple asset classes including cryptocurrencies, stocks, forex, and commodities. This cross-market approach increases your addressable market and user engagement. However, each asset class adds complexity and may require additional regulatory compliance.