Crypto becomes much easier to understand when you know where the activity actually comes from. Behind every swap and every trade on a DeFi platform, there is a pool of funds that keeps everything moving. And these pools are not small. The global TVL across all DeFi protocols was approximately $123.6 billion in Q2 2025, showing how many people are choosing to participate and support these systems together.

What makes this different from traditional finance is how these pools are built. Individual users add their tokens to shared pools so everyone can trade or borrow smoothly, and in return, they can earn fees and rewards. That simple idea powers a huge portion of the crypto world right now.

This article delves into the mechanics of liquidity pools, how they hold the system together, and why they now stand at the core of the DeFi ecosystem.

What is a liquidity pool?

A liquidity pool is basically a shared pot of tokens that people add their crypto into so trading can happen smoothly on decentralized platforms. Instead of depending on a middleman, the pool itself handles the swap, making it possible for anyone to trade instantly.

People add their tokens to these pools, and in return, they get a share of the trading fees. The pool adjusts prices automatically based on how many tokens go in or out during each trade. All of this runs through code, not a central authority, making the process fast, open, and accessible to anyone with a wallet.

How does a liquidity pool work?

A liquidity pool works through a simple, automated system that handles trades on its own.

Each part of the process plays a role in keeping swaps smooth and instant.

Step 1: Build the Fund Pool

A liquidity pool begins when people add two tokens of equal value into a shared pot. These deposits build the base that traders use for swapping. Without these contributions, the pool wouldn’t exist.

Step 2: Trading Process

Instead of waiting for a buyer or seller, traders swap their tokens directly with the pool. This makes every trade fast and smooth, no matter the time of day. The system handles everything automatically in the background.

Step 3: Price Adjustment

Prices inside the pool adjust based on how many tokens it holds. If one token becomes scarce, its price goes up; if it becomes plentiful, the price softens. This keeps trading fair and balanced for everyone using the pool.

Step 4: Cost Sharing

Every time someone makes a swap, a small fee is collected. Those fees get shared among the people who contributed their tokens. It’s a simple way for them to earn without constantly managing their position.

Step 5: Allocating Pool Shares

When someone adds funds to a pool, they receive LP tokens that represent their slice of it. These tokens show exactly how much they own and let them withdraw their share whenever they want. It’s a clear and transparent way to track ownership.

All of this runs on a smart contract, which means the process is automatic and doesn’t rely on any single person to approve trades. Liquidity pools keep the system steady in the background, making sure trades happen quickly and fairly for everyone.

Benefits of Liquidity Pools for Strategic Business Growth

Seeing the real advantages of liquidity pools makes it clear why they’ve become a key part of DeFi. These benefits show how they help both everyday users and active traders in different ways.

1. 24/7 Market Access:

Liquidity pools stay active all the time, allowing trades to go through whenever someone needs them. There’s no opening or closing time like traditional markets. This constant availability makes it easy for users across different time zones to participate without waiting for a window to trade.

2. Rewards for Liquidity Providers:

People who add their tokens to a pool earn a share of the fees generated by every swap. The rewards keep coming as long as the pool is being used, creating a natural flow of passive income. It’s a simple way for contributors to grow their holdings without monitoring the market every day.

3. No Middlemen Needed:

Liquidity pools remove the need for banks or middlemen to approve transactions. Everything runs through transparent code that treats everyone equally. This gives users more control and reduces delays that normally come from traditional financial processes.

4. Lower Price Gaps:

Since pools hold a steady supply of tokens, swaps happen more smoothly and with fewer sudden price changes. Traders get more predictable results because they’re trading directly against the pool, not chasing a buyer or seller who may change their price. This creates a fairer, more stable experience.

5. Enabling new financial tools:

Liquidity pools make it possible for new financial ideas to exist, such as decentralized loans, automated earning tools, and multi-asset strategies. Developers can build creative products because the pools provide a reliable base of funds to work from. This pushes innovation forward across the entire DeFi space.

6. Visible and Secure Process:

All actions in a pool happen through open, verifiable code. Anyone can see how funds move and how rules are applied, reducing room for hidden decisions. This level of clarity builds trust and helps users feel safer when interacting with the system.

7. Global Access:

With no location barriers, anyone with internet access and the required tokens can participate. Liquidity pools open financial opportunities to people who may not have access to traditional banking. This creates a more open, global environment where participation is not limited by geography.

Most Popular Liquidity Pool Platforms

If you’re exploring liquidity pools, a few platforms consistently stand out because of their large user base, smooth experience, and strong track record. Here’s a quick look at the ones people rely on the most and what makes each of them unique.

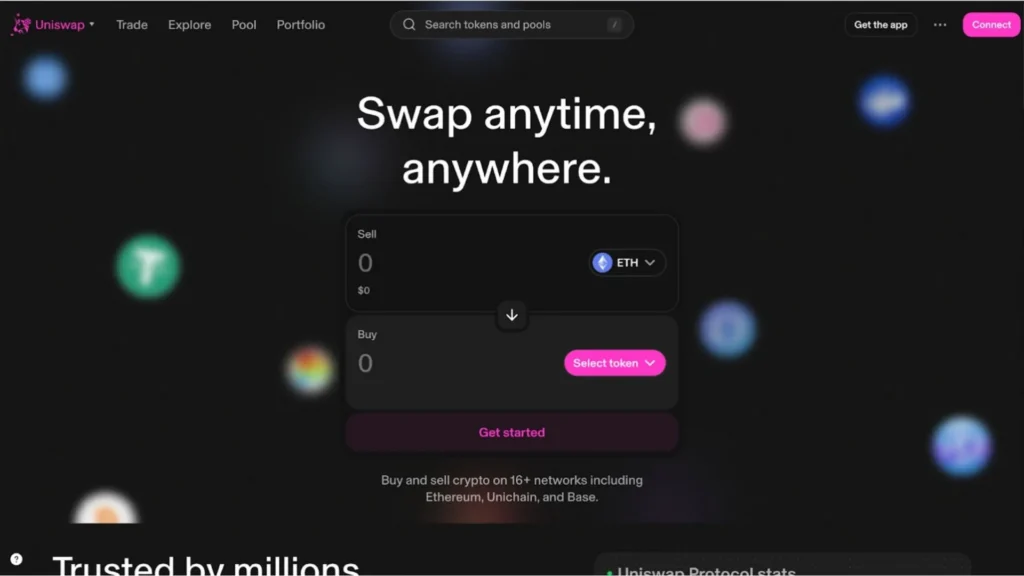

Uniswap—Best Overall

Uniswap is one of the most trusted names in DeFi. It supports thousands of tokens on Ethereum, which makes it a go-to place for both new and rare assets. Newer versions of Uniswap also let liquidity providers focus their funds in specific price ranges, helping them use their capital more efficiently.

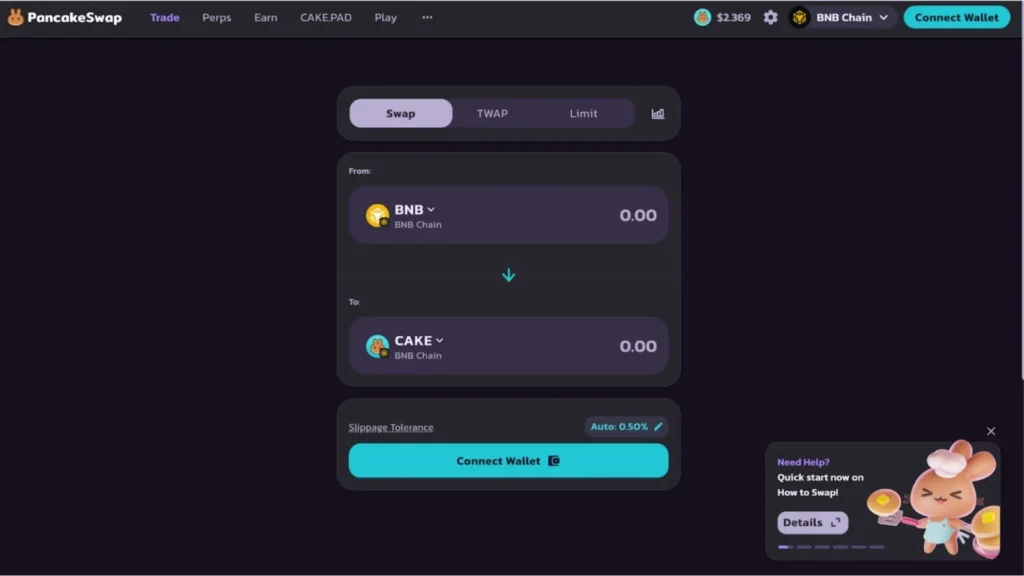

PancakeSwap — Best for Earning Yield

Running on the BNB Chain, PancakeSwap attracts users who want fast, low-cost transactions. It offers many ways to earn, including farming, staking, and fun extras like lotteries. Its native CAKE token is at the center of most rewards, making it appealing for people who prefer active earning options.

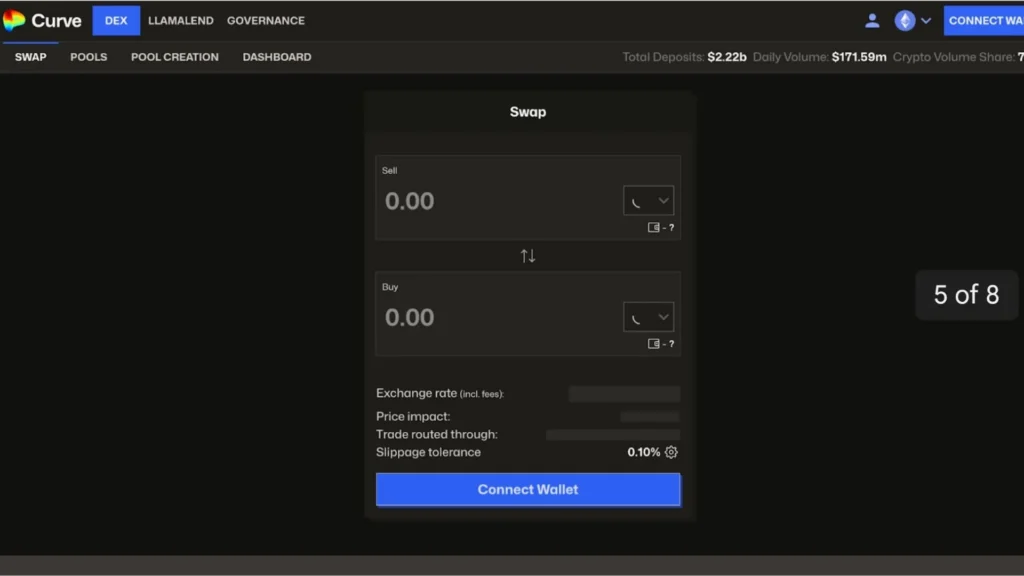

Curve Finance—Ideal for Stablecoins

Curve focuses on stablecoins such as USDT, USDC, and DAI, and other assets that stay close to the same price. Because of this focus, it offers very smooth swaps with minimal price changes. People who want lower-risk earnings often choose Curve because the pools stay steady and predictable.

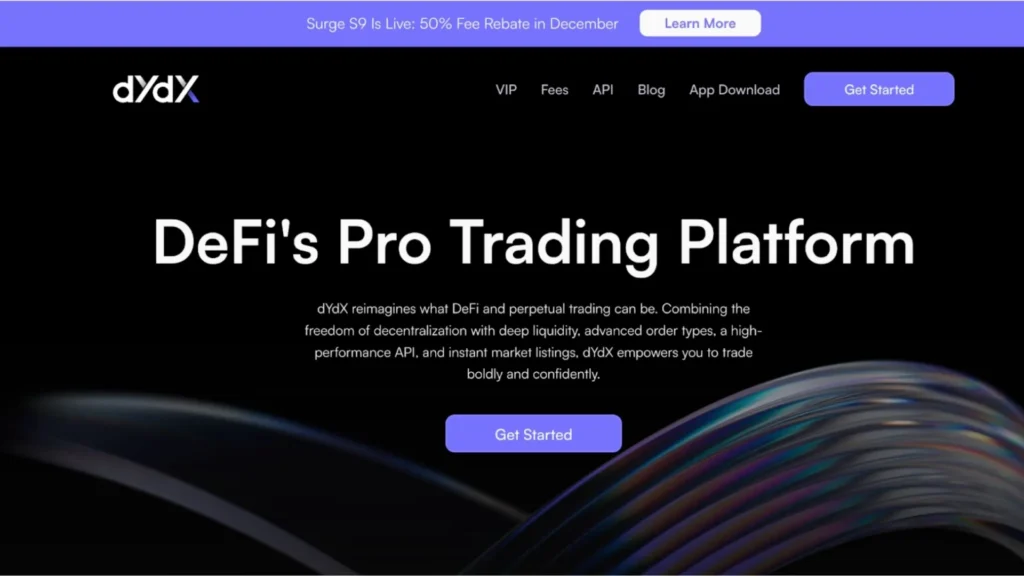

dYdX—Best for Advanced Trading

dYdX is designed for users who want more advanced tools like perpetual contracts and leverage. It offers a fast trading experience and lower fees by running on its own chain. While it isn’t a beginner-friendly DEX, it’s popular among traders who want deeper control over their positions.

1inch — Best Aggregator

1inch is different from typical DEXs. Instead of having its own pool, it searches across many platforms to find the best price for your swap. Whether you’re doing a small trade or a large one, 1inch can route the transaction in a way that saves you money and reduces losses.

How to Evaluate Your Liquidity Pool Performance?

Measuring how well a liquidity pool is performing helps you see if your tokens are truly working for you. These checks make it easier to track gains, spot issues early, and decide whether to stay in a pool or move to a better one.

1. Fee Generation vs. Impermanent Loss

A good way to judge a pool’s performance is by comparing the fees you’ve earned with the value lost from price movements between the two tokens. If the fees collected are higher than the loss caused by those price shifts, your position is working in your favor.

Example: If you earned $60 in fees but your tokens dropped by $40 because their prices moved apart, you’re still up $20 overall.

2. Pool Depth and Volume

The size of the pool and the amount of daily trading tell you how active and stable it is. Bigger pools usually keep prices more steady, while high trading volume means more opportunities for fee earnings.

Example: An ETH/USDC pool with high daily volume on Uniswap often gives LPs steady fee earnings because thousands of swaps happen each day.

3. Range Utilization (for concentrated liquidity)

If you’re using a platform where you choose a price range, your returns depend on how often the market stays inside that range. The more active your range is, the more fees you earn for the capital you’ve placed.

Example: If your selected range stays active 80% of the time, your liquidity is working harder and generating more fees.

4. Net Performance vs. Holdings

A simple way to see whether providing liquidity is helping you is by comparing your final value to what you would have had if you just held the tokens. If the pool position comes out ahead, it’s adding value.

Example: If adding ETH and USDC to a pool earned you $220 total value, but holding those same tokens would have given you $200, your LP position added extra value.

5. Execution Costs

If you change your liquidity position regularly, extra costs like gas fees and small price differences can reduce your overall returns. It’s important to make sure these adjustments are actually worth it.

Example: If adjusting your range costs more in gas than the extra fees you hope to earn, it may not be worth the change.

Final Thoughts on Liquidity Pools

Liquidity pools make the crypto world run smoothly, letting people trade, earn, and move tokens without needing a middleman. Once you understand how they work, what types exist, the benefits they offer, and the risks to watch out for, it becomes much easier to decide where your tokens should go and what suits your comfort level. They’re simple in idea but powerful in how they support the entire DeFi space.

At Ment Tech, we help businesses and founders build secure, user-friendly DeFi products, including liquidity pool setups, custom DEXs, analytics dashboards, and automated tools. If you’re planning to launch a token, create your own pools, or build a platform with safe and efficient liquidity features, our team can guide you from planning to deployment with clear explanations and reliable development support.

FAQs

Ment Tech provides tools and strategies to help you track fees, optimize price ranges, reduce impermanent loss, and manage your liquidity efficiently. By combining analytics, automation, and secure smart contracts, we make it easier to earn more while minimizing risks.

You can view a pool’s size, volume, and rewards on platforms like Uniswap, PancakeSwap, or Curve. Tools like Zapper and DeBank also show a pool’s performance, fees, and overall health in one place.

Costs can include transaction (gas) fees when depositing or withdrawing tokens and potential losses from price changes between token pairs (impermanent loss). It’s important to factor in these costs when calculating potential earnings.

Liquidity pools can offer higher rewards but may come with price-related risks. Staking usually feels steadier because returns are predictable. The right choice depends on whether you prefer stability or higher earnings potential.

They can be safe on trusted platforms, but risks still exist, such as bugs in the contract or sudden price changes. Choosing well-known platforms and reviewing audits helps reduce these problems.