Crypto trading often feels unpredictable. Prices move quickly, orders don’t always go through smoothly, and sometimes the market seems unstable. Most of this happens because of one key factor: liquidity, the steady flow of buying and selling that keeps the market running. When liquidity is strong, prices stay more stable and trades execute without issues.

| The global crypto market recorded $1.68 trillion in liquidity strength, along with steady growth across exchange platforms that reached $63.38 billion in value during 2025. |

As more people start trading again, exchanges are trying to keep the market stable throughout the day by improving prices and building deeper order books. However, traditional market makers are finding it difficult to maintain this, especially when trading activity jumps.

This is where new liquidity providers are stepping in. They help support exchanges with stronger market depth and smoother trading, making the overall experience more stable for everyone.

Why Are Businesses Preferring Liquidity Providers Over Market Makers?

More businesses are now choosing liquidity providers instead of traditional market makers because LPs focus on steady markets, transparent pricing, and reliable order execution. Their approach supports long-term growth for exchanges and trading platforms, which makes them a better fit for today’s fast-moving crypto environment.

- Quality-Led Market Strategy

Liquidity providers work on keeping markets stable. Their goal is to support strong market depth and smooth price movement. Market makers often focus on short-term gains from the spread, which can create wider price gaps at busy times. - More transparency

A market maker can take the opposite side of a trade, which creates a chance for conflict. Liquidity providers send orders to multiple external venues, which gives businesses clearer, more open pricing. - Reliable Bulk-Order Support

Businesses that handle big trades need an LP that can process volume without major price swings. Liquidity providers offer deeper order books, which keeps slippage low during heavy activity. - Risk control

Working with several LPs helps a platform stay steady even if one source faces issues. This kind of diversity strengthens the overall trading environment. - Technological Advancements:

Most liquidity providers use advanced systems to handle orders quickly and smoothly. This helps exchanges deliver fast and reliable execution throughout the day.

Top 7 Crypto Liquidity Providers to Consider in 2026

With more traders returning to the market, the need for stable liquidity is bigger than ever. These top providers help platforms reduce slippage, handle heavy volume, and deliver a smoother trading experience.

1. Ment Tech Labs Pvt. Ltd.

4.2 (30+ Reviews)

$30/hr

50-100 Emp.

2019

Indore

Ment Tech offers a full liquidity and market‑making platform designed to help exchanges and trading platforms launch with strong, reliable markets from day one. Their solution connects internal order‑book logic with external liquidity from top global venues, so order books stay deep and trades go through smoothly, even when trading volumes rise.

With Ment Tech’s platform, trading pairs get stable pricing, low spreads, and faster execution. This helps avoid wild price swings and makes trading feel fair and predictable. The setup supports any size of exchange: small start‑ups, growing platforms, or large institutions.

2. Galaxy Digital

501-1,000 Emp.

2018

New York

Galaxy Digital remains a major name in crypto financial services tied to deep liquidity and institutional trading. While recent public data on its daily volume is scarce, it continues to serve large clients and handle OTC trades, making it a common “go‑to” for institutions looking to execute big orders without disrupting market prices. Its size and reputation help platforms relying on its services feel confident about liquidity backing even during volatile periods.

For firms and exchanges dealing with sizeable orders, Galaxy Digital’s long history and institutional-grade operations offer a level of stability that smaller or newer providers may struggle to match. That makes Galaxy Digital valuable for projects needing big-footprint liquidity without risky price swings.

3. Wintermute

51-200 Emp.

2017

Greater London

Wintermute is one of the busiest crypto liquidity providers right now, and by late 2025, they were handling billions of dollars in trades on many days. The company shared updates showing strong growth in their OTC and institutional trading, which means more big traders and businesses are using them for smooth and fast crypto buying and selling.

Because of this scale and reach, Wintermute helps exchanges and projects maintain fluid order books and stable pricing even when markets swing hard. That makes Wintermute a go‑to liquidity provider for platforms needing robust support under heavy load or during volatile sessions.

4. Amber Group

201-500 Emp.

2017

Singapore

Amber Group claims to support over 200 tokens with its liquidity services and, according to industry sources, handles around $5 billion in market‑making volume daily. For exchanges that want broad token support and access to a deep liquidity pool, Amber offers a wide net rather than a narrow specialty.

This breadth helps platforms launch many trading pairs without worrying about liquidity gaps. For users, this means smoother trades across different assets. For the exchange, it allows listing variety without compromising order-book health.

5. Cumberland

51-200 Emp.

2014

Chicago, Illinois

Cumberland DRW brings to the table a long-established legacy from traditional markets, adapted to crypto liquidity. Known for supporting OTC trades and large‑block transactions, Cumberland helps maintain order‑book depth even when other providers pull back.

For exchanges focused on reliability and risk management, especially those catering to institutional clients who execute large orders, Cumberland’s conservative approach and institutional background are assets. Their liquidity support tends to avoid abrupt swings during volatile periods, helping maintain market stability.

6. GSR Markets

201-500 Emp.

2013

London

GSR Markets is active on over 60 exchanges globally, offering liquidity support to both new token listings and established markets. According to recent on‑chain reports, as of November 2025, GSR held substantial positions in some assets; for example, over 48.5 million NEIRO tokens (with a value around $5.08 million), which suggests GSR remains actively engaged in liquidity provisioning and market support.

For exchanges and token projects that value transparency and consistent order‑book depth, GSR’s experience and active presence make it a trustworthy liquidity partner, especially when launching newer tokens or catering to diverse markets.

7. B2Broker

201-500 Emp.

2014

Dubai

B2Broker offers tier‑1 liquidity through a unified API and is often chosen by brokers and exchanges looking for a quick, scalable liquidity setup. Its model is particularly helpful for firms that prefer simplicity and want to avoid integrating with multiple liquidity sources directly.

For exchanges trying to grow rapidly and support many trading pairs from the start, B2Broker’s solution lowers upfront complexity, enabling platforms to offer competitive pricing and wide coverage while minimizing technical overhead.

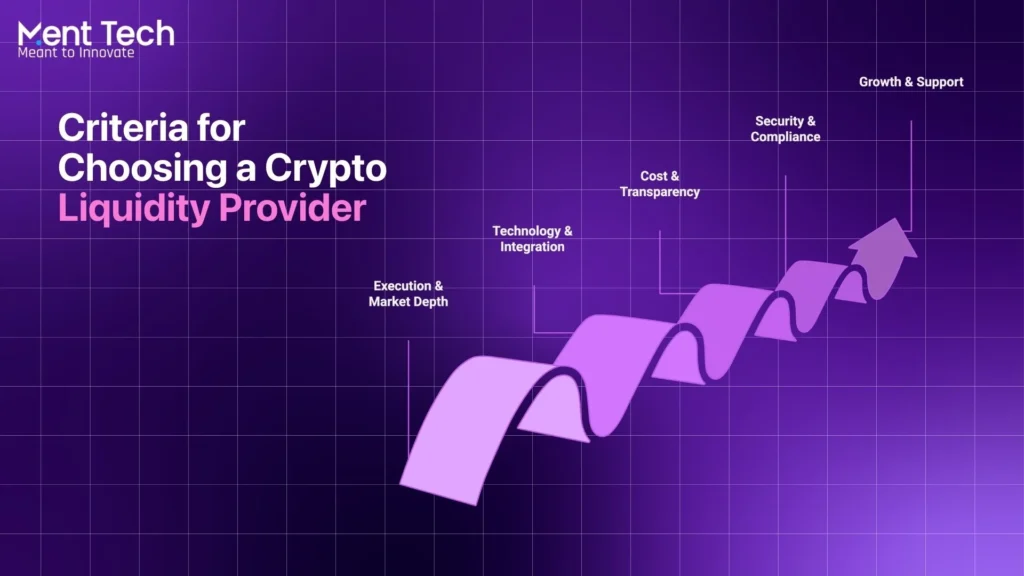

Key Evaluation Criteria for Choosing a Crypto Liquidity Provider

Finding the right crypto liquidity provider is important for smooth trading, steady pricing, and long‑term growth. A good partner should support strong performance while keeping operations stable and cost‑friendly. These points help make that choice easier:

1. Strong Execution and Market Depth

A reliable liquidity provider should offer fast execution to prevent order delays during busy periods, keeping prices stable and minimizing sudden jumps. At the same time, strong market depth is essential; tight spreads only matter when there’s enough volume in the order book to handle activity without causing sharp price movements.

2. Technology and Integration

A good liquidity provider should integrate smoothly with your existing trading platform and tools, reducing extra work for the team. Equally important is a stable infrastructure; reliable APIs, high uptime, strong backups, and well-placed servers all help ensure continuous, low-latency trading without interruptions.

3. Cost and Transparency

A strong trading platform should offer a clear and fair pricing structure, covering spreads, commissions, monthly charges, and any extra fees without hidden costs. Equally important is transparency: reliable providers explain how orders are handled, where liquidity comes from, and how final prices are formed, helping build trust and reduce confusion.

4. Security and Compliance

Providers with recognized licenses inspire greater confidence by following strict rules around safety and trading practices. Alongside regulated operations, strong protection measures such as multi-signature controls, secure storage methods, and regular audits help ensure assets remain safe at all times.

5. Growth and Support

During busy trading periods, responsive customer support plays a crucial role in resolving issues before they impact performance. Scalability is equally important; a provider should grow alongside your business, enabling smooth expansion without unnecessary costs, delays, or the need to switch platforms later.

How Ment Tech Powered Wenbit’s Launch With Advanced Liquidity Support

Wenbit wanted to build a trading platform that felt fast, stable, and easy for everyday users while still supporting professionals who trade large volumes. They also needed steady pricing, strong access to liquidity pools, and a system that stayed reliable even during heavy market activity things that were difficult to manage on their own.

Ment Tech worked closely with them to build a complete solution, from backend development to secure wallets and clear portfolio tools. The team kept refining and supporting the system after launch, helping Wenbit grow confidently. The result was a high-performance exchange designed for real traders and real-world conditions.

Conclusion

Strong liquidity is now one of the biggest drivers of crypto-exchange success. As trading grows, platforms need partners who keep markets stable, handle high volumes, and maintain smooth pricing. The right liquidity provider ensures tighter spreads, faster execution, and a safer user experience. With more global players offering deep liquidity and advanced tools, exchanges entering 2026 have stronger support than ever to scale confidently.

Ment Tech supports this growth by delivering reliable, ready-to-use liquidity and market-making solutions tailored for real trading conditions. Our systems help exchanges maintain strong order books, stable pricing, and consistent performance even during high-traffic periods. With ongoing monitoring and support, we ensure platforms stay efficient, competitive, and prepared to handle rising demand.

Frequently Asked Questions:

Yes. Strong liquidity providers keep the order book filled so trades can go through at stable prices. This helps prevent sudden jumps or drops in pricing when users place buy or sell orders, especially during busy market hours.

Costs depend on the provider and the type of setup an exchange needs. Most LPs charge through spreads, monthly fees, or usage‑based pricing. Many offer flexible plans, so exchanges can start small and scale without heavy upfront expenses.

Ment Tech supports all sizes of exchanges, from early‑stage platforms to growing mid‑size businesses. The system is built to stay stable even as trading volume increases, which makes it easy for new exchanges to grow without worrying about liquidity gaps.

There isn’t a single “biggest” liquidity provider globally, as the market is spread across several major players. However, firms like Ment Tech, Galaxy Digital and more have historically been among the largest in terms of volume and market coverage.

Yes. A strong liquidity provider keeps order books deep even during heavy activity. This prevents sudden price jumps and ensures traders can enter or exit positions smoothly.