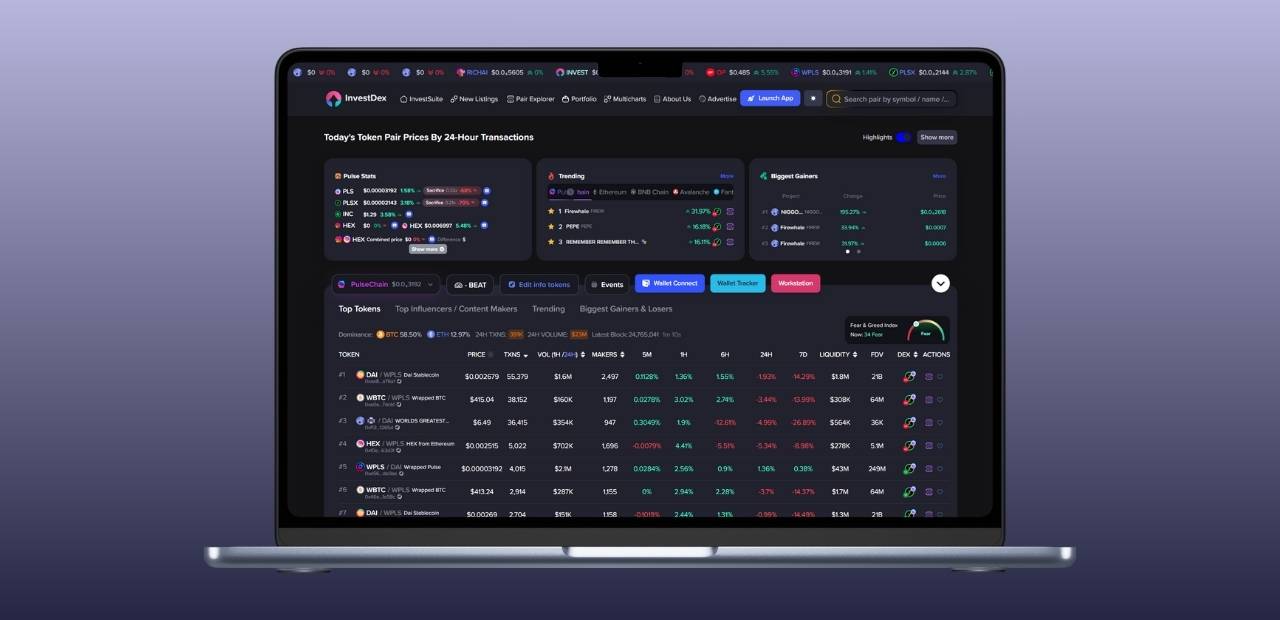

InvestDex

Ment Tech Labs partnered with InvestDex to create a decentralized investment ecosystem that merges traditional portfolio management with DeFi automation. The platform allows users to diversify assets, apply dollar-cost averaging, and monitor portfolio performance in real time, all through on-chain, transparent, and self-custodial architecture.

Region/Industry

Project Duration

Client Type

InvestDex was created to solve one of DeFi’s biggest gaps: the lack of structured, long-term investment tools for serious investors. While most decentralized exchanges focused on short-term yield and swaps, InvestDex aimed to introduce strategies familiar to traditional finance, such as portfolio diversification, performance analytics, and periodic rebalancing.

The founders envisioned a platform that could empower investors to manage their portfolios with precision and transparency, without relying on centralized intermediaries. They reached out to Ment Tech Labs to architect a product that merges institutional-grade strategy with decentralized access: a platform that gives DeFi investors control, data visibility, and strategy automation all in one place.

Bring Institutional-Grade Investing to DeFi

Before partnering with Ment Tech Labs, SocialSwap had a strong vision i.e. to combine trading with social interaction. But executing that vision within a decentralized framework presented unique challenges that required both blockchain expertise and product clarity.

Structuring Investment Logic on Smart Contracts

The primary challenge was converting traditional portfolio management strategies into executable smart contract logic. Dollar-cost averaging, rebalancing, and long-term yield strategies had to operate autonomously without exposing users to custody risks.

Building Real-Time Portfolio Analytics

InvestDex needed a dynamic analytics system that could visualize portfolio health, track token performance, and display aggregated returns across multiple networks with precision.

Managing Multi-Chain Asset Interactions

Users required access to assets across several blockchains, but integrating data and liquidity in real time created complexity in routing, reconciliation, and on-chain reporting.

Risk Scoring and Investment Profiling

To make investing more responsible, the team wanted to introduce on-chain risk scoring based on portfolio composition, volatility, and user behavior. Implementing this required new data feeds and predictive algorithms.

Secure and Transparent Automation

Every automated investment action, including portfolio rebalancing and DCA execution, had to remain verifiable on-chain. Maintaining transparency while automating complex financial logic demanded careful architectural design.

User Experience Without Complexity

Professional investors needed control, while casual users preferred simplicity. The interface had to deliver deep functionality without overwhelming new entrants, a balance of technical depth and accessibility.

Ment Tech’s Approach

To transform Aurix Technologies’ vision into a fully functional, user-focused exchange ecosystem, Ment Tech Labs followed a structured and agile approach. The goal was to create a secure, high-performance, and reward-driven platform that could serve both professional traders and everyday users.

Discovery Phase

We started by understanding how professional investors think about diversifying, balancing risks, and managing long-term growth. Our team mapped these strategies into blockchain logic, ensuring that every action, from allocation to rebalancing, could run autonomously on-chain.

Design Phase

The platform was designed to feel familiar to investors yet fully transparent. The interface presented performance data, portfolio mix, and returns clearly, giving users control and confidence without overwhelming complexity.

Development Phase

We built a suite of smart contracts for automated rebalancing, dollar-cost averaging, and structured product execution. Live data from Chainlink and The Graph powered real-time insights, while the backend handled multi-chain activity seamlessly across Ethereum, Polygon, and BNB Chain.

Testing Phase

Each feature was tested against real market data and multiple portfolio conditions. The final version launched with live analytics, self-custodial portfolio tracking, and secure, verified automation that worked flawlessly across chains.

An Autonomous Investment Platform for the DeFi Era

On-Chain Portfolio Management Engine

Ment Tech Labs built a contract-based engine that automates allocation, rebalancing, and asset tracking entirely on-chain, eliminating the need for centralized custodians.

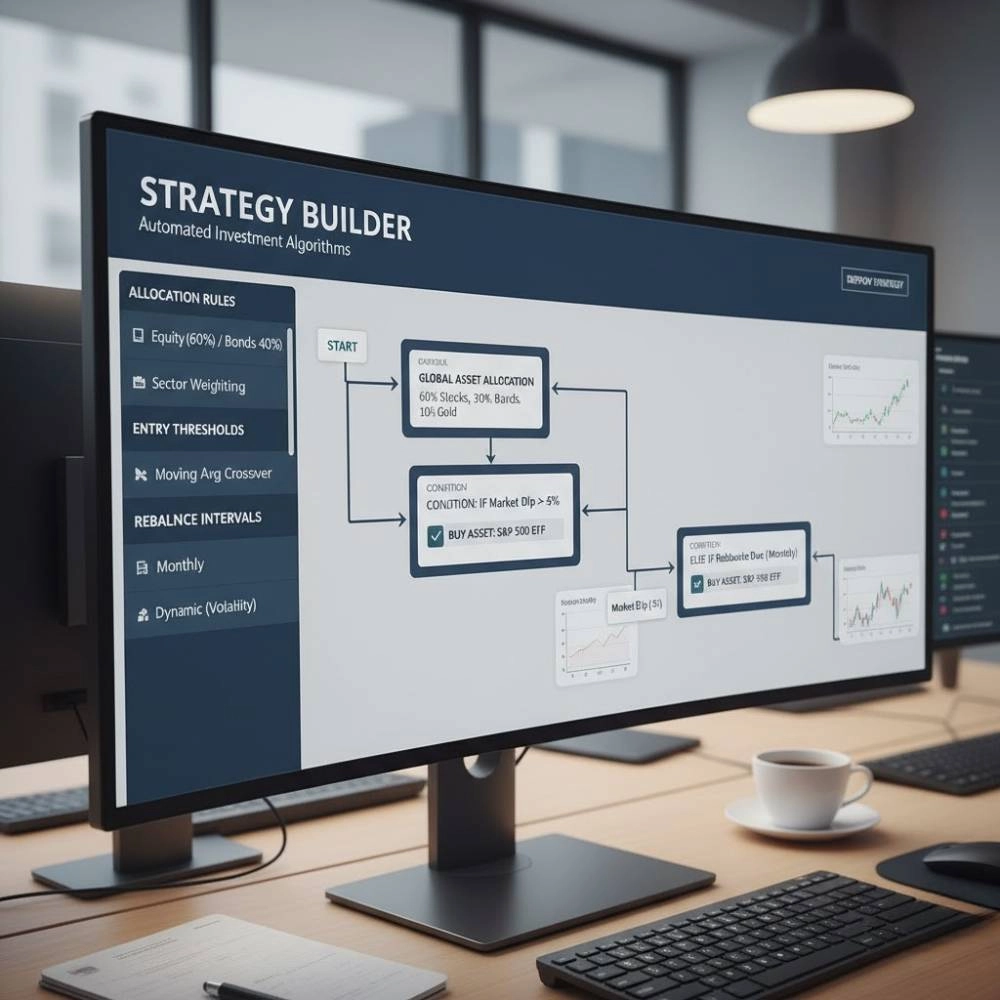

Automated Investment Strategies

Developed DCA, yield optimization, and risk-based reallocation strategies controlled through programmable logic, allowing investors to automate recurring buys and balance exposure in volatile markets.

Multi-Chain Liquidity Integration

Integrated Ethereum, Polygon, and BNB Chain with a single access layer that enables users to trade, monitor, and manage multi-chain portfolios without leaving the dashboard.

Tokenized Portfolio Representation

Introduced tokenized portfolio receipts that represent ownership and allow instant liquidity without liquidating underlying assets.

Predictive Analytics and Risk Engine

Implemented a data engine powered by Chainlink oracles and volatility models that assess real-time market conditions and adjust user portfolios accordingly.

Smart Index Creation Tools

Built a module that lets users create and invest in custom index-style token baskets, blending traditional index logic with decentralized execution.

Our clients

The Aurix Exchange platform is a robust digital asset ecosystem that seamlessly integrates trading, payments, and

rewards. Each component is crafted for optimal reliability, scalability, and real-time efficiency.

Strategy Builder Interface

Users can create and deploy automated investment strategies by setting allocation rules, entry thresholds, and rebalance intervals through a visual builder.

Real-Time Market Intelligence Feed

Integrated on-chain and off-chain data streams deliver price movements, liquidity depth, and sentiment indicators to support informed portfolio actions.

Adaptive Yield Routing

The platform’s routing logic identifies the most efficient liquidity pools and re-routes funds dynamically to optimize yield and reduce slippage.

Portfolio Tokenization Layer

Each portfolio position can be minted as an NFT-backed receipt, enabling instant proof of ownership and simplified asset transfers.

Compliance-Aware Smart Contracts

Optional compliance parameters allow professional investors to integrate KYC or jurisdictional limits directly into their portfolio contracts.

Multi-Factor Risk Dashboard

Comprehensive analytics visualize volatility, asset correlation, and projected drawdowns, giving investors full control over risk exposure in real time.

Driving Performance and Efficiency Across DeFi Markets

UAE

Building A1, Dubai Digital Park, Dubai Silicon Oasis, Dubai, United Arab Emirates.

USA

5857 Owens Ave Suite 300

Carlsbad, CA 92008

UK

One Avenue, 23 Finsbury Circus, London, England, EC2M 7EA

Ireland

101, Monkstown Rd, Monkstown, Blackrock Co. Dublin, Ireland

India

Annapurna Rd, Saraswati

Nagar, Indore, Madhya Pradesh, 452001

Ment Tech Labs Private Limited operates as a technology provider, not engaged in cryptocurrency holding or trading. Our website showcases a range of software technology products, solutions, and services that comply with local laws and regulations, holding the necessary licences and approvals. For detailed information about a specific product, solution, or service, kindly contact our sales team.

Ment Tech Labs Private Limited is a registered trademark in multiple Asian countries, following appropriate company registration procedures.

The trademark 'Ment Tech Labs Private Limited' holds international registration number BPLM16595F and belongs to Ment Tech Labs Pvt. Ltd., an Indian company registered with company number U62099MP2023PTC064895. However, the company does not offer any financial or similar services advertised on this website.

By accessing this website, you agree to the terms and conditions provided in the Legal Information and Disclaimers, Privacy Policy, and Cookie Policy documents. These documents contain essential information about the company, its products and services, as well as your responsibilities as a user of this website. If you do not agree with the outlined terms and conditions, we recommend leaving the website.