Identity fraud, data leaks, and misuse of personal information have become everyday concerns for people and businesses. Passwords, plastic IDs, and older verification methods struggle to keep up with today’s digital demands. This growing pressure has pushed organizations to look for safer and simpler ways to manage identity.

The global Digital Identity Solutions Market was valued at USD 42.12 billion in 2024 and is expected to reach USD 133.19 billion by 2030. This steady rise shows how important it has become to protect users and reduce fraud with better tools.

Digital identity wallets are playing an important role in this. These wallets give people a safe place to store and share verified information like IDs, qualifications, or licenses while keeping them in control of what they choose to share. They help make online interactions smoother and build trust between users, companies, and digital platforms.

More companies are now focusing on building secure and easy-to-use wallet systems for real-world use across different industries. To help you find reliable partners in this growing space, here are the top 10 digital identity wallet development companies to know in 2026.

What Is a Digital Identity Wallet?

A digital identity wallet serves as a secure, user-controlled application that stores and manages verified digital credentials. It acts like a digital version of your physical wallet, holding encrypted forms of your ID, driver’s license, university degrees, professional certifications, and other important documents.

The magic happens through a simple yet powerful flow: User ↔ Issuer ↔ Verifier.

Here’s how it works in plain terms:

- You add your documents: Government IDs, bank KYC details, health records, certificates, and other credentials get added to the wallet in digital form.

- Each document is verified: Every credential inside the wallet comes from an official source so you don’t have to prove its authenticity again and again.

- You choose what to share: If a service asks for age, address, or identity proof, you can share only the specific details they need. No over-sharing.

- You stay in control: You decide who can see your information and for how long. Nothing moves without your permission.

- It works across services: The same wallet can be used for government portals, banks, universities, airports, or any platform that supports digital identity.

The beauty of this system lies in its simplicity and security. You control what information you share, when you share it, and with whom, while verifiers get instant, tamper-proof confirmation of your credentials.

Why Digital Identity Wallets Hold Value in 2026?

Digital identity wallets are becoming an important part of everyday online life. They let people manage their own information safely by choosing what to share, who to share it with, and when. Because the data is stored securely, it helps prevent fraud and leaks. Built on Self-Sovereign Identity (SSI) principles, these wallets give users full control over their personal data and allow them to decide exactly what they want to share and with whom. They reduce the risks of centralized databases by using encrypted, verifiable credentials that are extremely difficult to forge. This not only improves privacy and trust but also makes it easier to comply with global regulations like GDPR, eIDAS 2.0, and W3C standards.

Beyond security and privacy, digital identity wallets are enabling cross-border trust and interoperability. Whether verifying credentials internationally, accessing global services, or integrating with decentralized apps and AI-driven platforms, these wallets are becoming the universal key to both the digital and decentralized worlds. In 2026, they’re not just about identity they’re about enabling secure, seamless participation in the global digital ecosystem.

Digital Identity Trends for 2025–2026

The digital identity wallet landscape is evolving. As we move through 2025, several key trends are influencing the industry and setting the stage for unprecedented growth in 2026:

1. Self-Sovereign Identity (SSI) Adoption

SSI has moved from experimental technology to mainstream adoption. Organizations worldwide are recognizing that giving users control over their identity data is not just good ethics, it’s good business. SSI reduces liability, improves user trust, and creates more efficient verification processes.

2. eIDAS 2.0 & EU Digital Wallet Initiative

The European Union’s eIDAS 2.0 regulation and Digital Wallet Initiative are driving massive adoption across Europe and influencing global standards. This regulatory framework provides a clear roadmap for implementation while ensuring interoperability across member states.

3. Blockchain-based Verification Systems

Advanced blockchain platforms like Hyperledger Indy, Ethereum, and Polygon are providing the infrastructure for truly decentralized identity solutions. These systems offer immutable credential verification while maintaining user privacy through advanced cryptographic techniques.

4. AI-driven Identity Verification

Artificial intelligence is revolutionizing how we verify identities, detect fraud, and automate compliance processes. Machine learning algorithms can identify suspicious patterns in real-time while maintaining user privacy through federated learning and differential privacy techniques.

5. Cross-wallet Interoperability

Standards like OpenID Connect and W3C Verifiable Credentials are enabling seamless interoperability between different wallet providers. Users can choose their preferred wallet while still accessing services across the entire ecosystem, much like how email works across different providers.

Top 10 Digital Identity Wallet Development Companies [2026]

After extensive research and analysis, we’ve identified the leading digital identity wallet development companies that are shaping the industry in 2026. Each company brings unique strengths and specializations to the table:

1. Ment Tech Labs Pvt. Ltd.

4.2 (30+ Reviews)

$30/hr

50-100 Emp.

2019

Indore

Ment Tech is known for building powerful, enterprise-grade digital identity wallet solutions on advanced blockchain systems. Their platform combines Self-Sovereign Identity (SSI) models, multi-chain support, biometric security, and automated compliance to give users full control over their data.

Ment Tech’s goal is to make digital identity management simpler, safer, and transparent for both individuals and enterprises. Their solutions are being used in finance, governance, and enterprise ecosystems to enable secure, user-owned identity experiences.

2. Gataca

11-50 Emp.

2017

Europe

Gataca offers a powerful yet easy-to-use self-sovereign identity solution, centered around its Gataca Wallet, a digital ID wallet where you can securely store verifiable credentials like your national ID, diplomas, or work badges. Everything is encrypted and unlocked only by you, so you control who gets to see which piece of your identity.

Through Gataca Studio, organizations can issue and verify credentials via an intuitive dashboard, making it super simple for users to authenticate themselves using just their wallet and no passwords needed. Gataca works almost like a crypto wallet, safeguarding your identity with the same kind of security rigor

3. Thales Group

10,001+ Emp.

2011

France

Thales makes a digital identity wallet that’s designed to keep your personal information safe while giving you full control. You can store things like your ID, license, or other important documents on your phone and share only what’s needed, nothing extra.

Thales focuses heavily on security, so your data stays protected at every step. They also offer custom APIs, which means businesses and governments can easily connect their systems to the wallet and build smooth, personalized identity experiences for their users.

4. Bitdeal

51-200 Emp.

2016

Tamil nadu

Bitdeal is a tech company that helps businesses transform using blockchain, AI, and smart automation. They build everything from secure crypto wallets and decentralized apps to AI-powered systems that work smartly on their own. Their blockchain expertise means they can create transparent and tamper-proof applications, while AI helps power intelligent bots and tools that learn and make decisions.

On top of that, they automate repetitive tasks like trading or compliance so your system runs smoothly without constant manual effort.

5. Affinidi

201-500 Emp.

2020

Singapore

Affinidi offers a digital identity wallet that helps you store and share your important documents safely. With the Affinidi Vault, you can keep things like your ID, certificates, or work documents in one secure place and choose exactly what information you want to share, nothing more. Affinidi also lets you log in to apps without passwords using Affinidi Login, which makes the whole experience easier and safer.

For businesses, Affinidi provides tools to issue and verify digital credentials quickly and securely, so everything works smoothly for users.

6. Evernym

50-100 Emp.

2013

Utah, United States

Evernym was among the first to introduce Self-Sovereign Identity (SSI) frameworks that allow users to control and share their own credentials securely. Their technology uses verifiable credentials and privacy-preserving protocols, minimizing the risks of data misuse or breaches.

Evernym’s solutions have influenced the broader decentralized identity movement and continue to shape how institutions think about trust and digital proof.

7. Dock Labs

11-50 Emp.

2017

Zug, Switzerland

Dock Labs builds decentralized credential systems designed to make professional and educational verification easier and more secure. Their wallet platform includes integration with TON wallet and other major blockchains, helping organizations issue and verify digital credentials instantly.

Dock focuses on user ownership of data, ensuring that information stays private and tamper-proof while still being easy to verify globally.

8. IDEMIA

10,001+ Emp.

2013

France

IDEMIA builds super-secure digital identity wallets that let you store government-issued credentials (like your driver’s license or ID) right on your phone. They use strong cryptography and biometric tech (like fingerprint or face recognition) to make sure only you can access your identity. Their wallet stores your data locally in an encrypted way, and you decide exactly what to share when you need to prove something.

On the payment side, IDEMIA even supports an offline wallet for digital currencies (like CBDCs), so you can make secure payments without needing to be online. Plus, they have a crypto hardware wallet solution (B.CHAIN) , a biometric card that acts like a cold wallet for digital assets, keeping your keys safe in a tamper-resistant chip.

9. Maticz Technologies

50 – 249 Emp.

2020

Madurai, Tamil Nadu

Maticz Technologies creates white-label digital identity wallets with modular architecture, allowing businesses to launch customized solutions quickly. Their focus is on affordability and flexibility giving startups and enterprises alike the tools to adopt blockchain-based identity systems with minimal technical barriers.

Maticz also emphasizes user-friendly designs, ensuring smooth onboarding and management for non-technical users.

10. Codezeros

50 – 249 Emp.

2008

Ahmedabad, India

Codezeros brings together AI and blockchain to build digital identity systems with trust scoring, decentralized data handling, and Bitcoin Ordinals/BRC support. Their wallets combine advanced security layers with adaptable architecture for managing both assets and identities.

Codezeros continues to expand its reach across fintech and enterprise sectors, helping businesses adopt smarter, AI-assisted identity tools.

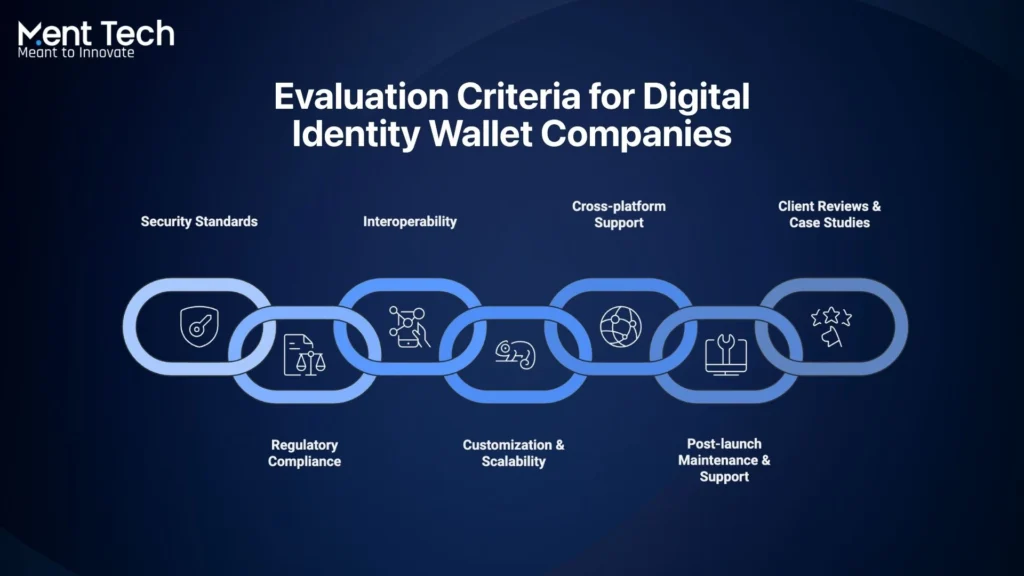

How to Evaluate a Digital Identity Wallet Development Company?

Choosing the right digital identity wallet development company is crucial for your project’s success. Here are the key criteria you should evaluate when making your decision:

1. Experience in Blockchain and Identity Systems

Look for companies with proven experience in Decentralized Identity (DID), Know Your Customer (KYC) processes, and Self-Sovereign Identity (SSI) frameworks. The company should demonstrate deep understanding of identity protocols, credential schemas, and the technical challenges unique to identity management systems. Ask for specific examples of identity projects they’ve completed and the technologies they’ve implemented.

2. Security Standards

Security cannot be an afterthought in identity systems. Evaluate the company’s expertise in end-to-end encryption, biometric access controls, Multi-Party Computation (MPC), and zero-knowledge proofs. They should understand advanced cryptographic techniques and be able to implement security measures that protect user data while enabling efficient verification processes.

3. Regulatory Compliance

Ensure the company understands and can implement compliance with key regulations including eIDAS 2.0, GDPR, HIPAA (for healthcare applications), and ISO/IEC 27001 standards. They should have experience navigating regulatory requirements and building systems that remain compliant as regulations evolve.

4. Interoperability

Your digital identity wallet should work seamlessly with multiple identity frameworks and standards. The company should demonstrate expertise in implementing W3C Verifiable Credentials, DID standards, and integration with various issuer and verifier systems. Future-proofing through standards compliance is essential.

5. Customization & Scalability

Every organization has unique requirements. The development company should offer flexible solutions that can adapt to your specific wallet UI needs, API requirements, and issuer-verifier logic. They should also demonstrate ability to build solutions that scale from pilot programs to enterprise-wide deployments.

6. Cross-platform Support

Modern identity solutions need to work across all platforms. Look for companies that can deliver mobile apps (iOS and Android), web applications, and enterprise SDKs that integrate with your existing systems. The solution should provide consistent user experience across all platforms.

7. Post-launch Maintenance & Support

Digital identity systems require ongoing maintenance, security updates, and technical support. Evaluate the company’s commitment to continuous security audits, regular updates, and responsive technical assistance. They should offer clear service level agreements and have a track record of long-term client relationships.

8. Client Reviews & Case Studies

Look for verified experience across both public and private sectors. The company should be able to provide detailed case studies, client testimonials, and references from similar projects. Pay attention to their experience with organizations similar to yours in size, industry, and technical requirements.

Use Cases of Digital Identity Wallets Across Industries

Digital identity wallets are helping how organizations across various sectors handle identity verification and credential management:

1. Government & Public Sector

Digital identity wallets enable governments to issue secure digital versions of essential documents, including electronic IDs (eID), digital passports, and taxation credentials. Citizens can access government services seamlessly while maintaining privacy and security. The EU Digital Identity Wallet Pilot has shown great success, with over 250 organizations across Europe taking part in real-world testing.

2. Finance & Banking

Financial institutions leverage digital identity wallets for streamlined digital KYC processes, dynamic credit scoring based on verifiable credentials, and sophisticated fraud detection systems. These solutions reduce onboarding time from days to minutes while maintaining regulatory compliance and enhancing security.

3. Healthcare

Healthcare providers use digital identity wallets to manage verified patient records, medical credentials, and professional certifications securely. Patients control access to their medical data while healthcare providers can instantly verify professional qualifications and patient eligibility.

4. Education

Educational institutions issue tamper-proof digital diplomas, certificates, and professional credentials that students own and control. Employers can instantly verify educational qualifications, reducing hiring fraud and streamlining the recruitment process.

5. Travel & Mobility

Digital identity wallets revolutionize travel by enabling seamless border control processes, airline identity verification, and hotel check-ins. Travelers can prove their identity and travel eligibility without sharing unnecessary personal information.

6. Web3 / Metaverse

In the decentralized web, digital identity wallets serve as portable identity solutions for decentralized applications (dApps) and Decentralized Autonomous Organizations (DAOs). Users maintain consistent identity across platforms while participating in governance, accessing services, and conducting transactions.

Success Story: The EU Digital Identity Wallet Pilot program has successfully demonstrated cross-border identity verification with over 250 participating organizations. Users can now access services across multiple EU countries using a single digital identity wallet, showcasing the transformative potential of this technology.

Future of Digital Identity Wallets

By 2026, digital identity wallets will act like universal digital passports, secure and easy-to-use tools that help people verify who they are across every part of online life. From government services to banking and global platforms, these wallets will bring everything together in one trusted place for both personal and professional use. With help from AI, they’ll be able to study user behavior and transactions in real time to spot fraud while keeping personal data private.

In the coming years, these wallets will do more than just store identity details. They’ll connect smoothly across different blockchains, manage security checks automatically, and handle complex online processes on their own. As more governments, companies, and digital platforms start using shared standards, one digital identity wallet could soon give people access to almost everything and may even take the place of physical IDs by 2028.

Conclusion

Digital identity wallets are quietly changing how we prove who we are online. They make the process simple, safe, and more personal giving people control over their information instead of relying on too many logins and third-party systems.

The companies mentioned above are helping build safer and more trusted digital spaces, where privacy and security come first.

At Ment Tech, the focus is on creating practical, secure, and scalable digital identity solutions. Their team works closely with businesses and governments to design systems that protect user data and make digital verification effortless. If you’re looking to hire secure developers who understand the balance between innovation and privacy, Ment Tech has the right expertise to help you build confidence.

Frequently Asked Questions:

A digital identity wallet acts as your personal, secure digital storage system for verified credentials like your ID, driver’s license, educational certificates, and professional qualifications. It lets you prove who you are and what you’re qualified for without sharing unnecessary personal information. Think of it as a smart, secure version of your physical wallet that works across all digital services.

Digital identity wallets are powered by a combination of technologies including blockchain for immutable credential verification, advanced cryptography for security, biometric authentication for access control, AI for fraud detection, and mobile/web technologies for user interfaces. Standards like W3C Verifiable Credentials and Decentralized Identifiers (DIDs) ensure interoperability across different systems.

The companies listed in this guide are all capable of building custom digital identity wallets, but your choice should depend on your specific needs. For enterprise solutions, consider Ment Tech or LeewayHertz. For AI-integrated solutions, Antier Solutions excels. For rapid deployment, Maticz Technologies might be your best bet. Evaluate each company based on your technical requirements, timeline, and budget.

While digital identity wallets are not technically mandatory under eIDAS 2.0, the regulation requires EU member states to provide digital identity solutions to their citizens by 2026. This creates a strong push toward adoption. Many organizations are proactively implementing these solutions to stay ahead of regulatory requirements and provide better user experiences. The trend suggests widespread adoption will make them practically essential for acc

Yes, when properly implemented, digital identity wallets are significantly safer than traditional storage methods. They use advanced encryption, biometric authentication, and cryptographic signatures that make your credentials nearly impossible to forge or steal. Unlike physical documents that can be lost or copied, digital credentials in properly designed wallets are tamper-proof and under your complete control.