Forex trading used to be very different from what we see today. People relied mostly on their own experience, handwritten charts, and quick decisions. But the market is much bigger now. It moves $6.6 trillion every day, compared to $5.1 trillion a few years ago, and this huge growth has changed the way traders work.

Because the market moves so fast, many professionals now use tools that help them understand information more clearly. Today, about 70% of financial professionals use AI to support their trading, and more than half depend on it to make safer decisions. In the last three years, the use of AI in financial markets has grown by over 40%.

People choose AI because it can look at large amounts of information quickly and give a clearer picture of what is happening. It doesn’t get tired or confused, and it helps traders make decisions with more confidence. This has made forex trading more steady, more informed, and easier to manage than before.

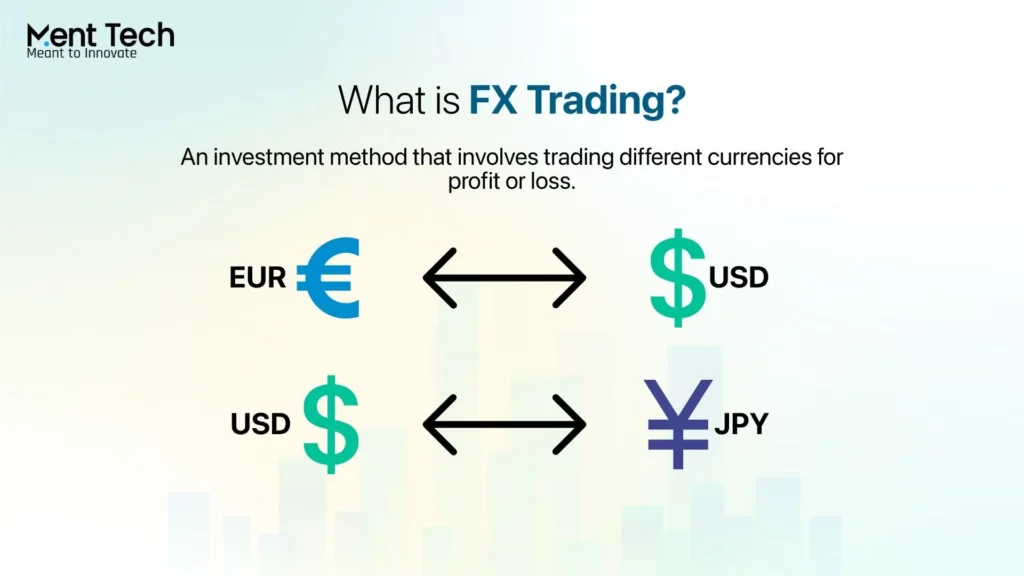

What Is Forex Trading?

Foreign exchange trading, commonly known as forex or FX, represents the world’s largest and most liquid financial market. At its core, the foreign exchange trading definition is simple: buying one currency while simultaneously selling another to profit from the exchange rate differences between currency pairs.

It’s like exchanging money for a vacation, but instead of just getting foreign currency for travel, traders aim to buy currencies when they’re cheap and sell them when they become more valuable. The foreign exchange trading platform serves as the digital marketplace where these transactions happen 24 hours a day, five days a week.

Key Concepts Every Trader Should Know:

- Currency Pairs: Currencies are always traded in pairs like EUR/USD (Euro vs US Dollar) or GBP/JPY (British Pound vs Japanese Yen). The first currency is called the base currency, and the second is the quote currency.

- Pips: The smallest price movement in a currency pair, typically the fourth decimal place. For example, if EUR/USD moves from 1.1050 to 1.1051, that’s a one-pip movement.

- Leverage: A tool that allows traders to control larger positions with smaller amounts of capital. With 100:1 leverage, you can control $100,000 worth of currency with just $1,000 in your account.

Why Is AI the New Advantage in Forex Trading?

Traditional foreign exchange currency trading faced several critical challenges that made AI integration not just helpful, but absolutely necessary for competitive trading in today’s markets.

The Human Trading Dilemma:

- Overwhelming Market Volatility: Currency markets can move dramatically within seconds based on economic announcements, geopolitical events, or even social media posts from world leaders. Human traders simply cannot process and react to this information fast enough to capitalize on rapid price movements.

- Emotional Decision-Making: Fear and greed are traders’ worst enemies. When facing significant losses, humans often make irrational decisions like holding losing positions too long or exiting profitable trades too early. These emotional responses have destroyed countless trading accounts over the years.

- 24/7 Market Monitoring Challenge: The forex market never truly closes, moving across different time zones from Sydney to Tokyo to London to New York. No human trader can effectively monitor markets around the clock, meaning opportunities are constantly being missed during sleep or personal time.

- Data Overload Problem: Modern foreign exchange trading requires analyzing economic indicators, central bank policies, political developments, social sentiment, technical patterns, and correlation data across multiple currency pairs simultaneously. The sheer volume of information has become impossible for humans to process effectively.

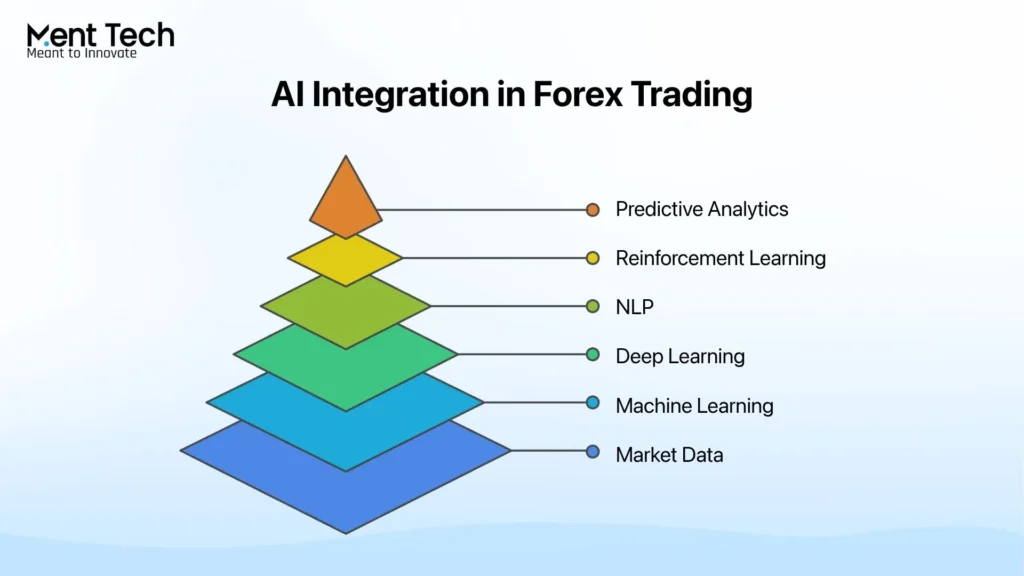

How AI Works in Forex Trading?

AI in forex trading exposes a whole new world where smart systems read markets and make extremely accurate trades, far quicker than any human could.

1. Machine Learning (ML)

Machine learning algorithms excel at identifying patterns in historical forex data that human traders might overlook. These systems analyze years of price movements, economic announcements, and market reactions to predict future currency trends. The What Is AI Trading approach allows algorithms to continuously improve their predictions as they process more data.

2. Deep Learning

Deep learning networks can recognize intricate relationships between seemingly unrelated market factors. For example, they might discover that Australian dollar movements correlate with iron ore prices, Chinese manufacturing data, and US Treasury yields in ways that traditional analysis would miss.

3. Natural Language Processing (NLP)

NLP technology reads and interprets news articles, central bank communications, social media posts, and economic reports in real-time. This allows foreign exchange trading software to gauge market sentiment and predict how news events might impact currency prices before human traders can even finish reading the headlines.

4. Reinforcement Learning

These AI systems learn from their trading successes and failures, continuously refining their strategies through feedback loops. Like a chess master who gets better with each game, reinforcement learning algorithms improve their trading performance over time.

5. Predictive Analytics

AI transforms massive datasets into actionable trading insights within milliseconds. This includes processing economic calendars, technical indicators, order flow data, and market positioning information to generate trading signals.

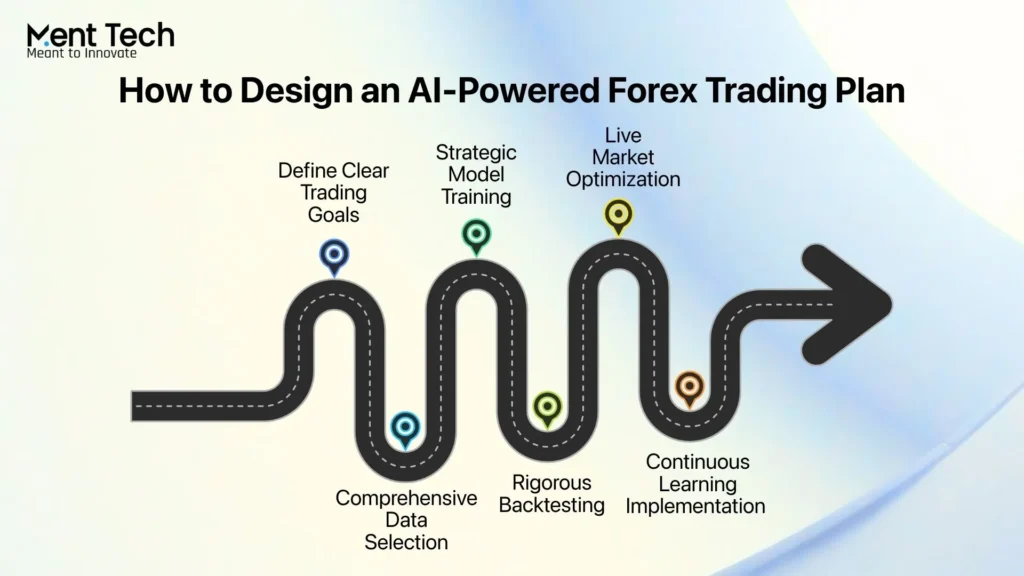

How to Create a Successful FX Trading Strategy Powered by AI?

Building a profitable AI-powered foreign exchange algorithmic trading strategy requires systematic planning and execution. Success depends not just on the AI technology itself, but on how well the models are trained, tested, and implemented.

Step 1: Define Clear Trading Goals

Determine your trading style and objectives. Are you building a scalping system for quick profits, a swing trading approach for medium-term gains, or a long-term position trading strategy? Your AI system needs specific parameters to optimize for your chosen timeframe and risk tolerance.

Step 2: Comprehensive Data Selection

Gather high-quality historical price data, trading volume information, economic indicators, news sentiment data, and correlation patterns. The quality of your data directly impacts your AI model’s performance – garbage in means garbage out.

Step 3: Strategic Model Training

Use machine learning algorithms to identify profitable patterns in your data. Train separate models for different market conditions (trending vs ranging markets) and currency pairs, as each may require unique approaches.

Step 4: Rigorous Backtesting

Validate your AI models using historical data to test accuracy and profitability. Ensure your backtesting includes different market conditions, economic cycles, and volatility periods to verify robustness.

Step 5: Live Market Optimization

Adjust parameters and retrain your models for current market environments. Markets evolve constantly, so your AI systems must adapt to changing conditions and emerging patterns.

Step 6: Continuous Learning Implementation

Enable your AI systems to adapt and improve as they encounter new market data and conditions. The best foreign exchange trading online platform integrates continuous learning capabilities to maintain competitive performance.

Key Applications of AI in Forex Trading

Artificial intelligence has revolutionized multiple aspects of foreign exchange trading, creating opportunities for enhanced profitability and risk management across various trading functions.

1. Algorithmic Trading Automation

AI systems execute trades automatically at optimal speeds, capitalizing on price discrepancies and market inefficiencies faster than any human trader could react. These systems can process hundreds of trades simultaneously across multiple currency pairs.

2. Advanced Market Forecasting

Predictive models analyze real-time economic data, technical indicators, and sentiment analysis to forecast currency price movements with impressive accuracy. This helps answer the crucial question: is foreign exchange trading profitable when enhanced with AI predictions.

3. Dynamic Risk Management

AI continuously evaluates market volatility and automatically adjusts position sizes, stop-loss levels, and exposure limits to protect trading capital. The Crypto Liquidity Solution and Market Making Platform approach has been adapted for forex markets with great success.

4. Intelligent Portfolio Optimization

Advanced algorithms automatically diversify trading across multiple currency pairs, optimizing risk-reward ratios and reducing correlation-based losses that might occur when trading related currencies.

5. Fraud Detection and Security

AI monitoring systems detect unusual trading patterns, potential market manipulation, and security threats in real-time, protecting both individual traders and broader market integrity.

6. Real-Time Sentiment Analysis

Natural language processing captures market mood from news feeds, social media, and economic communications, providing crucial context for trading decisions beyond pure technical analysis.

How to Balance AI and Human Expertise?

The best trading strategies combine AI’s analytical power with human intuition and oversight. While AI can process massive data, identify patterns, and execute trades instantly, it lacks the contextual awareness that seasoned traders bring. Humans interpret geopolitical shifts, policy signals, and market psychology factors that often escape even the smartest algorithms.

To achieve true balance, use AI for data-heavy tasks like market scanning, execution, and risk monitoring, but keep humans in charge of strategic direction and critical decisions. This “human-in-the-loop” model ensures efficiency without dependency. AI amplifies human strengths, while traders provide the judgment and adaptability that machines can’t replicate.

Benefits of AI Integration in Forex Trading

The integration of artificial intelligence into foreign exchange trading delivers measurable advantages that have transformed how both institutional and retail traders approach currency markets.

1. Lightning-Fast Execution Speed

AI systems execute trades in milliseconds, capitalizing on price movements and arbitrage opportunities that disappear before human traders can react. This speed advantage is crucial in high-frequency trading environments where microseconds matter.

2. Enhanced Accuracy and Precision

Machine learning algorithms eliminate human errors in calculation, data analysis, and trade execution. AI systems maintain consistent performance standards without fatigue, distraction, or computational mistakes that plague manual trading.

3. Emotion-Free Trading Decisions

Perhaps the most significant advantage is removing fear and greed from trading decisions. AI systems follow predetermined parameters regardless of recent wins or losses, maintaining disciplined approaches that human psychology often undermines.

4. 24/7 Market Consistency

AI systems monitor and trade markets around the clock without breaks, ensuring consistent application of trading strategies across all market sessions from Asian through European to American trading hours.

5. Advanced Risk Control

Dynamic risk management systems continuously adjust position sizes, stop-losses, and exposure levels based on real-time market volatility and correlation analysis. This proactive approach protects capital more effectively than static risk management rules.

6. Operational Efficiency Gains

AI automation reduces analysis time, eliminates routine manual tasks, and cuts operational costs significantly. Traders can focus on strategic decisions while AI handles data processing, market monitoring, and trade execution tasks.

Real-World Examples of AI Adoption in Forex Trading

Major financial institutions and technology companies are leading the transformation of foreign exchange trading through innovative AI implementations that demonstrate the practical benefits of machine learning in currency markets.

1. JP Morgan’s LOXM Algorithm

JP Morgan developed LOXM (Learning Optimized eXecution Model) for smart trade execution that reduces market impact and improves pricing for large foreign exchange transactions. This AI system learns from each trade to optimize future execution strategies.

2. HSBC’s AI-Powered Analytics

HSBC implemented artificial intelligence systems that provide enhanced client pricing and market analysis. Their AI models analyze vast amounts of market data to offer more competitive pricing and better risk management for corporate clients.

3. ING’s Autonomous Trading Systems

ING has deployed autonomous trading systems that improve market liquidity and reduce operational costs. These systems automatically adjust pricing and manage risk across multiple currency pairs without constant human intervention.

4. Citi and UBS Predictive Analytics

Both Citi and UBS utilize advanced predictive analytics for market forecasting and client advisory services. Their AI systems analyze economic indicators, technical patterns, and sentiment data to provide superior market insights.

5. Fintech and Retail Platform Integration

Modern retail trading platforms increasingly integrate AI features like automated trading bots, risk management tools, and market analysis capabilities. The AI Trading Assistant Platform has become standard for competitive forex brokers serving individual traders.

The Future of AI-Driven Forex

The evolution of artificial intelligence in foreign exchange trading continues accelerating, with emerging technologies promising even more sophisticated capabilities and market integration in the coming years.

Emerging Technologies Shaping Tomorrow’s Markets:

- Autonomous Trading Agents: Next-generation AI systems will operate with greater independence, making complex strategic decisions and adapting to market changes with minimal human oversight. These autonomous agents will manage entire portfolios while learning from market evolution in real-time.

- AI-Integrated Trading Ecosystems: Future foreign exchange trading platforms will feature comprehensive AI integration across all functions – from market analysis and trade execution to risk management and client communication. The Enterprise-Grade Centralized Crypto Exchange Development model is being adapted for traditional forex markets.

- Blockchain and AI Synergy: The combination of blockchain technology with AI trading systems promises enhanced transparency, reduced settlement times, and improved security for foreign exchange transactions. Smart contracts could automate trade settlement and compliance monitoring.

- Quantum Computing Integration: Quantum computing capabilities will enable AI systems to process exponentially more market data and run complex simulations that are impossible with current technology. This advancement could revolutionize market prediction accuracy and risk modeling.

- Enhanced Regulatory Framework: Regulatory authorities worldwide are developing comprehensive frameworks for AI in financial markets. Future regulations will require greater transparency in AI decision-making processes and establish standards for algorithmic trading systems.

- Ethical AI Standards: The industry is moving toward establishing ethical guidelines for AI trading systems, ensuring fair market access and preventing AI-driven market manipulation or systemic risks.

Conclusion

Artificial Intelligence has become an essential part of modern foreign exchange trading, helping traders make data-driven decisions with greater accuracy and speed. The key to long-term success lies in blending AI-powered systems with human insight to create smarter, more adaptive trading strategies. AI is no longer just a tool, it is a trusted partner that enhances how traders analyze, decide, and perform in the global forex market.

At Ment Tech, we help businesses harness the full potential of AI in trading. As a leading Cryptocurrency Exchange Development Company, we design intelligent and scalable systems that strengthen both forex and digital asset markets. From AI Trading Assistant solutions to enterprise-grade platforms, Ment Tech enables traders and institutions to operate with efficiency, confidence, and innovation in every trade.

Frequently Asked Questions (FAQs)

No, AI cannot guarantee profits in forex trading. While AI significantly improves decision-making, accuracy, and efficiency, the forex market remains inherently unpredictable due to countless variables including geopolitical events, economic announcements, and unexpected market shocks. AI is a powerful tool that enhances trading performance, but it does not eliminate market risks or ensure profitability.

Not necessarily. Many modern foreign exchange trading platforms offer user-friendly AI tools and trading bots that require no programming knowledge. However, having basic understanding of how AI systems work and the ability to set proper parameters will significantly improve your results. For custom AI strategies, programming skills or working with developers becomes valuable.

Foreign exchange trading can be more profitable with AI assistance due to improved accuracy, speed, and emotion-free decision-making. Research shows that 70.8% of financial professionals use AI for algorithmic trading with positive results. However, profitability depends on proper system design, quality data, effective risk management, and realistic expectations. AI enhances your edge but does not eliminate the need for sound trading principles.

Key risks include over-reliance on technology without understanding how systems work, poor quality data leading to inaccurate predictions, technical failures or connectivity issues causing missed opportunities, and the “black box” nature of some AI models making it difficult to understand decision-making processes. Additionally, AI systems trained on historical data may struggle with unprecedented market conditions.

No, AI cannot completely replace human forex traders. While AI excels at data processing, pattern recognition, and emotionless execution, humans provide essential contextual understanding, strategic thinking, and adaptability to unprecedented situations. The most successful approach combines AI capabilities with human oversight in a “human-in-the-loop” trading model.

The best platform depends on your specific needs, experience level, and trading style. Look for platforms offering robust AI tools, quality data feeds, reliable execution, strong security, and regulatory compliance. Popular options include MetaTrader with AI plugins, proprietary institutional platforms, and modern fintech solutions offering integrated AI Trading Assistant capabilities.