EuroTrust Capital

Ment Tech Labs collaborated with EuroTrust Capital to develop a fully compliant, high-performance trading ecosystem designed for institutional investors and professional traders. The platform supports multiple financial instruments, advanced charting tools, and algorithmic trading capabilities, all within a secure, regulation-ready framework.

Region/Industry

Project Duration

Client Type

EuroTrust Capital is a European financial institution specializing in multi-asset investments and regulated digital trading. The company envisioned a professional platform that could serve institutions, asset managers, and high-net-worth clients under full EU compliance.

They partnered with Ment Tech Labs to architect and build a trading platform that merges traditional financial discipline with modern digital infrastructure. A place where precision, transparency, and regulatory adherence coexist with speed and flexibility.

Partner With a Team That Understands Regulation and Reliability

EuroTrust Capital approached Ment Tech Labs with a defined mission i.e. to create a trading platform that could meet European regulatory standards while supporting institutional-level performance. Before the build began, several challenges required careful planning and deep technical understanding.

Compliance with European Financial Regulations

The platform needed to operate under MiFID II and ESMA guidelines, ensuring transparent trade reporting, data retention, and investor protection protocols across all operations.

Integration of Multi-Asset Trading Instruments

The client wanted to support crypto, forex, and commodities within one interface. Each asset type followed different settlement and liquidity models, creating complexity in risk handling and reconciliation.

Data Privacy and Security Alignment with GDPR

User and transaction data had to be processed and stored under strict GDPR compliance, including access control, encryption, and clear audit trails for regulators.

Institutional-Grade Order Execution

Existing systems struggled to match institutional trading expectations. EuroTrust needed sub-second order execution, accurate depth charts, and uninterrupted uptime during peak hours.

Transparency and Reporting Obligations

Every trade required timestamped, verifiable records for regulatory audits. Manual reporting was not scalable, demanding a fully automated data capture and reporting engine.

Scalable Infrastructure for European Markets

The platform had to operate seamlessly across multiple regions in Europe with local data hosting, low-latency routing, and multilingual support for institutional clients.

Ment Tech’s Approach

To transform Aurix Technologies’ vision into a fully functional, user-focused exchange ecosystem, Ment Tech Labs followed a structured and agile approach. The goal was to create a secure, high-performance, and reward-driven platform that could serve both professional traders and everyday users.

Discovery Phase

The project began with a detailed compliance and system audit. Ment Tech Labs collaborated with EuroTrust’s legal and product teams to translate MiFID II and ESMA regulations into technical specifications. This phase also defined market coverage, supported asset classes, and reporting workflows needed for institutional use.

Design Phase

Our team created a structured interface for professional traders while keeping regulatory workflows visible and traceable. The focus was on multi-screen layouts, order clarity, and integration points for automated reporting. Every UI component was validated against operational transparency requirements.

Development Phase

We built the core trading engine and API architecture to support multiple asset classes. The FIX protocol was implemented for institutional order routing, while real-time synchronization between trade execution, reporting, and analytics ensured accuracy. Internal compliance checks were coded directly into transaction flows to prevent breaches before settlement.

Testing and Verification Phase

Each module went through multi-level validation from performance load testing to compliance simulation. Mock trade sessions were used to verify latency, audit trail consistency, and trade data accuracy across all regions. The QA process worked alongside regulatory advisors to ensure alignment before launch.

Deployment and Ongoing Support Phase

The final rollout included region-based data hosting within the EU, high-availability clusters, and disaster recovery planning. Post-deployment, our team remained involved for real-time monitoring, audit log management, and continuous optimization of liquidity routes and reporting accuracy.

Institutional-Grade Trading Infrastructure Ready for the European Market

Regulated Multi-Asset Trading Platform

Delivered a trading system supporting equities, commodities, forex, and digital assets under unified order management. All trade activities were fully auditable and structured for MiFID II reporting.

FIX Protocol and API Layer Integration

Implemented FIX 5.0 connectivity for institutional clients and liquidity providers, along with REST and WebSocket APIs for analytics and portfolio synchronization.

Real-Time Reporting and Audit Framework

Built a transaction-level audit trail capturing every order, amendment, and execution with timestamps, encryption, and instant regulatory export capability.

Automated Compliance Engine

Developed an internal rule engine that validates trade parameters, user eligibility, and asset restrictions in real time before confirmation, reducing manual compliance overhead.

Advanced Charting and Market Analysis Module

Integrated professional-grade charting tools with real-time data feeds, algorithmic strategy testing, and multi-indicator analysis for institutional traders.

Regional Infrastructure Deployment

Configured EU-based cloud clusters for data residency, low-latency routing, and backup replication between Frankfurt and Amsterdam to meet regional hosting and continuity standards.

Our clients

The Aurix Exchange platform is a robust digital asset ecosystem that seamlessly integrates trading, payments, and

rewards. Each component is crafted for optimal reliability, scalability, and real-time efficiency.

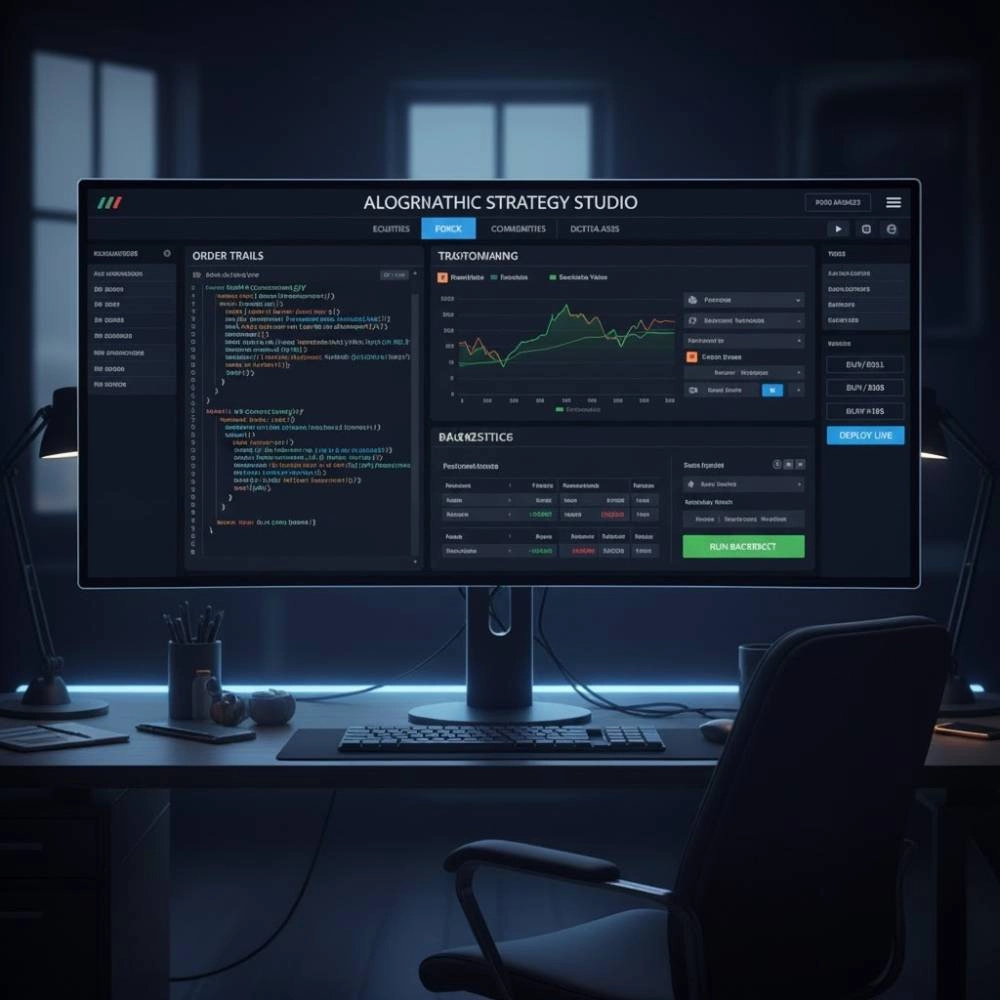

Multi-Asset Trading Interface

Unified access to equities, forex, commodities, and digital assets in one platform.

Institutional Order Management

Advanced order types, real-time execution, and full trade visibility for professional traders.

Integrated Compliance View

Built-in regulatory panel displaying order trails, KYC status, and transaction audits.

Algorithmic Strategy Support

Custom scripting environment for backtesting and deploying trading algorithms.

Real-Time Risk Dashboard

Portfolio-wide exposure tracking, margin alerts, and automated risk controls.

Professional Charting Tools

Interactive charts with institutional data feeds, indicators, and cross-asset analytics.

Start Your Project with a Free Strategy Call