Getting listed on a centralized crypto exchange is a critical milestone for any new token, but it is far from the end goal. Many project teams assume that their token’s approval by a CEX will automatically lead to increased visibility, trading volume, and community interest. In practice, a listing without proper planning rarely results in meaningful traction.

Too many projects celebrate the moment they get listed on a crypto exchange, only to see low activity, weak volume, and zero visibility a week later. This is not a listing issue. It’s a strategy issue. Without the right timing, positioning, and post-launch support, even a top-tier listing won’t translate to traction.

This is where crypto exchange listing services create real value. They go beyond basic onboarding and help you design a listing strategy built for exposure, mapping out which exchanges make sense, when to launch, and how to drive volume from day one. In a noisy market, listing becomes effortless. Getting noticed is the real win.

In this blog, we’ll break down what actually happens when your token goes live on a CEX, how centralized exchange listing services can influence price and visibility, and what it takes to convert a listing into long-term market presence.

What Actually Happens When Your Token Goes Live on a CEX?

The moment your token is listed on a centralized crypto exchange, everything becomes public. Traders can now view your charts, assess your volume, and compare your token to thousands of others competing for attention. This is no longer about potential. It’s about performance. And how well you’ve prepared for this moment will shape what happens next.

Most projects see a quick wave of interest following their listing. There’s a spike in announcements, speculative trading, and short-term buys. But that early momentum rarely lasts on its own. Without coordinated market support, activity slows, visibility fades, and your token risks falling into the background before it ever gains traction.

A strong CEX token listing service helps you avoid that drop-off. It gives your token the support needed to stay visible, liquid, and active in those critical early days. This includes working with market makers, timing your listing around announcements and campaigns, and aligning with the exchange’s internal promotion channels. The impact of CEX listing on token price is real, but only when it’s backed by a strategy that turns visibility into actual trading volume and ongoing demand.

What Makes a Token Stand Out After Listing?

Traders immediately judge your token once it goes live on an exchange. Whether they choose to trade, hold, or ignore it often depends on three key factors: visibility, liquidity, and credibility. Here’s how effective token listing services help in each area:

1. Visibility

A listing is only the first step. Real visibility happens when your launch is supported by announcements, coordinated community engagement, and exchange-level promotion. Experienced Centralized Crypto Exchange Development ensure your token appears where traders are looking, at the right time, with the right positioning. Without this, your project risks getting buried among thousands of inactive listings.

2. Liquidity

Trading activity is one of the strongest signals of confidence. When your token has active volume and tight spreads, it attracts more traders and builds momentum. Professional crypto fundraising services help you increase trading volume by working with liquidity providers and aligning your launch with peak attention windows. This early activity is what helps tokens land on trending charts and gain more organic discovery.

3. Credibility

Being listed on a recognized CEX is often seen as a stamp of legitimacy. It tells the market that your project passed technical and compliance checks, and that you are serious about growth. Credibility increases further when that listing is followed by consistent updates, roadmap delivery, and trading support. Token listing services help frame this credibility from day one, making sure your project enters the market with a clear signal, not just a symbol.

Why Listing Alone Isn’t Enough Without Marketing?

Many projects view their exchange listing as the culmination of their efforts. They exert significant effort to secure a listing, issue a few announcements, and then anticipate market dominance. That approach rarely works. In reality, the listing should be the beginning of your post-launch momentum, not the end of it.

An effective token listing marketing strategy is what keeps your token in front of traders after the initial excitement fades. This includes everything from ongoing announcements and trading campaigns to AMAs, influencer content, community engagement, and exchange-native promotions. These efforts are not optional. Without them, even great tokens with strong fundamentals struggle to build long-term visibility or trust.

This is where top-tier crypto exchange listing services bring real value. The right team will help you go beyond the technical process and build a launch narrative that continues after the token goes live. They coordinate your post-launch crypto marketing so the listing isn’t a one-day event but the first chapter in a sustained growth plan that includes volume, retention, and investor confidence.

What the Data Tells Us About Listings, Volume, and Price Performance?

Strong listings are not built on announcements alone. Real results come from structure, timing, and the ability to sustain market interest after going live. Here’s what the data shows about how exchange listings perform with and without support.

Tokens with no post-listing support see early gains but quick drop-offs

- Tokens listed on Tier-1 exchanges see an average 45 percent price increase in the first 48 hours

- Nearly 70 percent retrace by over 30 percent within one week if not backed by a clear marketing or volume plan

- Without visibility support, your token drops out of trending charts and trading interest fades

Projects that use token listing services maintain stronger volume and price support

- Tokens supported by structured crypto exchange listing services increase trading volume by 2.3 times on average in the first two weeks

- Coordinated announcements, exchange promotion, and community engagement help build trust and momentum

- Market makers and liquidity alignment also contribute to better spread, depth, and trading confidence

The impact of CEX listing on token price is real but only with strategy

- A listing provides exposure, but strategy sustains it

- Professional listing teams help time your announcements, support liquidity, and integrate post-launch campaigns

- Projects that prepare for post-listing activity are more likely to build lasting visibility and retain investor attention

Building a Scalable Listing Strategy Step by Step

A strong crypto community building service is not just about getting your token on a centralized exchange. It is about doing it at the right time, in the right way, and with the right support. A well-executed listing strategy for new tokens can help build steady momentum without risking early burnout or budget misalignment. Here is a step-by-step approach to doing it right.

1. Assess Token and Team Readiness

Before listing, ensure your smart contract has been audited, your tokenomics are clearly explained, and your legal setup is compliant. Projects that skip this stage often face rejection or poor performance. Founders should also be prepared to share public team details and documentation when approaching exchanges.

2. Choose the Right Exchange Tier

Not every token needs to launch on a top-tier CEX. Early listings on mid-tier or regional platforms help test market response and build real traction. Experienced token listing services can help you evaluate the right fit based on your audience, region, and current scale.

3. Secure Liquidity and Market Support

Without volume, your token quickly disappears from watchlists and charts. Plan liquidity in advance and work with market makers if needed. This helps increase trading volume and maintain early momentum after listing.

4. Coordinate Marketing and Listing Timelines

Your announcement, social activity, exchange promotions, and community engagement should all peak around your listing date. Leading crypto exchange listing services can manage this coordination to help your token stay visible beyond launch day.

5. Plan for Multiple Listings, Not Just One

Treat your first listing as a phase, not a finish line. As your token grows, schedule additional exchange listings to tap into new regions and user bases. A long-term exchange strategy improves reach, credibility, and access to capital over time.

What to Look for in a Token Listing Service Partner?

A strong listing partner does much more than just help you submit an application. They help you plan the entire process from the beginning. This includes choosing the right exchange, preparing your documents, and making sure your tokenomics and smart contract are ready. Good token listing services also understand what exchanges are looking for and help you avoid common delays or rejections.

Experience and relationships are key. The best listing teams already work closely with major centralized exchanges. This gives your project faster communication, more flexible listing options, and sometimes even better visibility on launch. A partner with direct exchange access can help position your token for success, especially during the early hours when attention is highest.

The support should not stop once the token goes live. Reliable crypto exchange listing services continue to work with you after the listing. They help manage announcements, coordinate marketing, monitor early trading performance, and suggest the next steps. With the right partner, you do not just get listed you enter the market with momentum, structure, and confidence.

Avoid These Mistakes When Listing Your Token

Many promising projects struggle after listing, not because of weak fundamentals, but because of strategic missteps. A listing can boost visibility and trading volume, but only when it’s done with structure and preparation. Here are the most common mistakes teams make and how the right token listing services can help avoid them.

- Listing Too Early: Going live without testing, auditing, or community support for your token often results in low volume and weak performance.

- Choosing the Wrong Exchange: Picking a platform that doesn’t align with your user base or region limits reach and wastes budget. Good crypto exchange listing services help identify the right fit.

- Skipping Market Preparation: Without liquidity, volume support, or market-making coordination, tokens fail to hold attention beyond the first few hours

- No Post-Launch Marketing: Visibility drops quickly when a listing is not backed by announcements, campaigns, and ongoing community engagement.

- Treating the Listing as the Final Step: A token listing should be part of a long-term growth strategy, not a one-time event. Momentum must be planned and sustained.

What Should You Look for in a Token Listing Service?

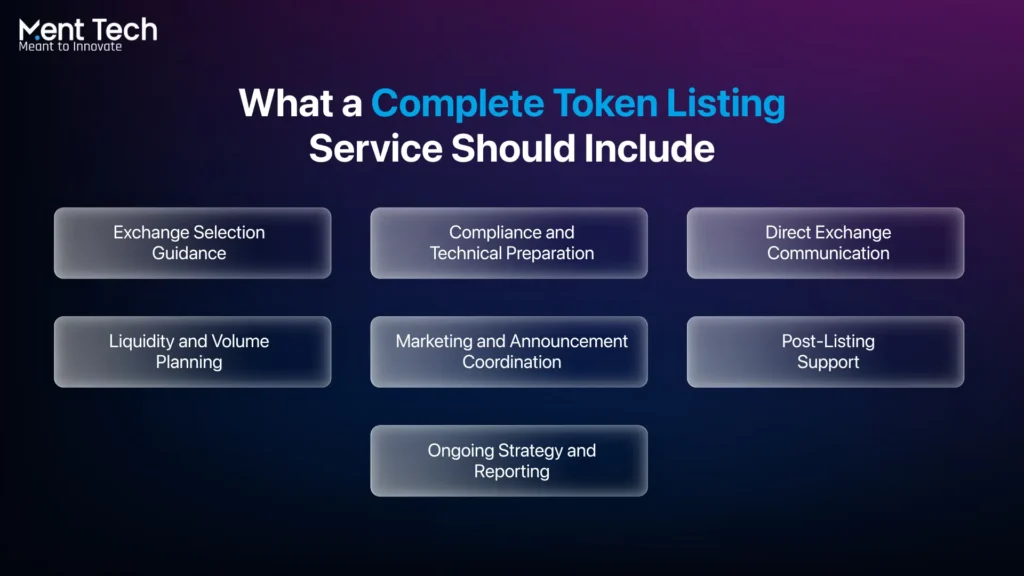

Choosing a listing partner is a strategic decision. Beyond the exchange access, you need a team that understands timing, positioning, and long-term traction. Here are the core elements every reliable crypto exchange listing service should offer.

1. Exchange Selection Guidance: The partner should help you choose the right platform based on your audience size, region, and growth goals.

2. Compliance and Technical Preparation: Good token listing services support you with smart contract audits, tokenomics structure, and legal readiness.

3. Direct Communication With Exchanges: Look for teams that already have working relationships with exchanges to save you time and improve your chances of approval.

4. Liquidity and Volume Planning: A complete service aligns your launch with market makers and prepares for sustained trading activity from day one.

5. Coordinated Marketing and Announcements: Your partner should align listing timelines with PR, community updates, and exchange promotions.

6. Post-Listing Support: You need more than a launch day. The right team helps track results, manage follow-up exchanges, and keep visibility strong.

Final Thoughts

A successful token listing requires more than paperwork and timing. It takes structure, market readiness, and a coordinated plan to turn that listing into real traction. From exchange selection to post-launch volume, every step matters, and each one shapes how the market sees your project.

At Ment Tech, we support token founders and Web3 teams with end-to-end services designed to launch with clarity. Our token listing services help projects enter the market with volume, visibility, and credibility. Alongside our crypto exchange listing services, we also offer centralized exchange development and long-term go-to-market planning.

If you’re preparing to list your token and want to do it with the right team behind you, we’re here to help you move forward with confidence and strategy.

Frequently Asked Questions

Token listing services help projects get their tokens listed on centralized crypto exchanges by handling exchange communication, documentation, technical requirements, and post-launch support.

A CEX listing can lead to increased trading activity and price discovery. However, sustained price performance depends on volume, market support, and ongoing visibility.

Crypto exchange listing services guide projects through exchange selection, compliance preparation, listing timelines, and launch marketing to ensure a smooth and strategic market entry.

To increase trading volume, work with market makers, align your launch with community campaigns, and use professional services that focus on both liquidity and visibility after listing.

Start with mid-tier exchanges that match your project size, build momentum with early trading activity, then scale listings as your user base grows. A phased listing strategy works best.

List your token once your smart contract is audited, your tokenomics are finalized, and your community is active. Timing should align with product readiness and marketing efforts.

Choose an exchange based on your target market, liquidity goals, listing fees, and brand alignment. A strong listing partner can help assess fit and negotiate better terms.

After listing, the market begins evaluating volume, price action, and engagement. Without structured support, many tokens lose attention quickly. Post-listing activity is critical.