Rising carbon costs are now influencing decisions across industries, from manufacturing to finance. Companies are under mounting pressure to cut emissions and prove measurable sustainability progress. Yet, the $2 billion voluntary carbon market still struggles with fragmented standards, verification gaps, and limited transparency, highlighting the need for better carbon credit education and modern tools.

Carbon tokenization offers a smarter, blockchain-based alternative, turning verified credits into digital tokens that are tradable, traceable, and instantly verifiable. This improves efficiency, reduces fraud risk, and builds trust in climate action.

For example, the Toucan Protocol has already tokenized over 21 million carbon credits, showing the potential for scalable, market-driven sustainability. This shift goes beyond compliance, paving the way for a transparent, efficient, and digitally secure future.

What Is Carbon Tokenization?

Carbon tokenization is the process of converting carbon credits into digital tokens on a blockchain. Each token typically represents one metric ton of verified carbon dioxide that has been removed or avoided through an approved offset project.

Traditionally, carbon credits have been hard to track, trade, and verify, relying on centralized registries, manual processes, and outdated tools. Tokenizing carbon credits solves these issues by creating secure, blockchain-based assets that are transparent, tradable, and auditable.

These carbon tokens are stored in digital wallets similar to cryptocurrencies but are backed by real, verifiable climate impact rather than speculation. This makes them valuable for companies aiming to meet sustainability goals while engaging with both voluntary and compliance carbon markets. Leveraging tokenization as a service further streamlines the process, enabling organizations to integrate carbon assets into broader digital ecosystems and tap into new market opportunities.

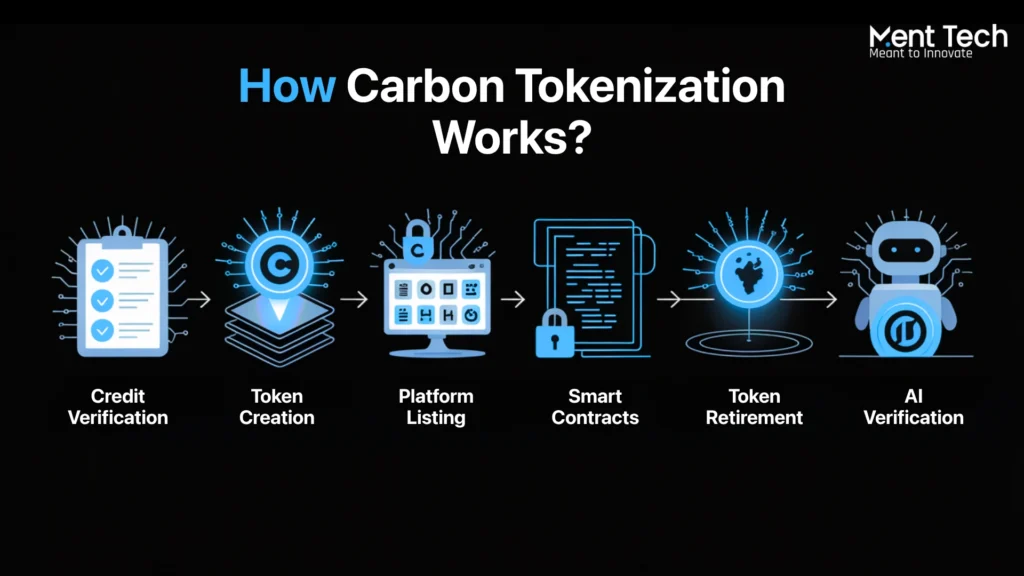

How Carbon Tokenization Works?

The process of turning carbon credits into digital assets involves several coordinated steps. Each stage adds trust, speed, and visibility to carbon markets.

1. Credit Verification

Before anything is tokenized, carbon credits must be verified by independent bodies such as Verra or Gold Standard. These organizations confirm that each credit is tied to a real reduction in emissions. This verification step ensures the foundation is accurate before moving to blockchain.

2. Token Creation

Once verified, the credit moves to a token development company. Blockchain technology transforms the credit into a digital token at this point. Most carbon tokenization platforms use established chains like Ethereum or BNB Smart Chain. Each token is backed by a smart contract, linking it to a specific emissions reduction.

3. Platform Listing

After creation, carbon tokens are listed on blockchain-based platforms where they can be traded or retired. These carbon tokenization platforms offer transparency, instant access, and lower transaction costs for businesses and investors.

4. Smart Contracts

Smart contracts for carbon trading automate the rules and make the process trustless. Once written into the blockchain, they control how tokens are issued, transferred, and retired without manual oversight.

5. Token Retirement

When a company wants to claim an offset, it purchases and retires the token. Carbon token retirement is recorded on-chain, making it permanent and preventing any future reuse or double counting.

6. AI Verification

We use AI in carbon credit verification to analyze environmental data and flag inconsistencies. This strengthens the system by ensuring only valid, high-quality carbon credits enter the market.

Key Technologies Behind Carbon Tokenization

Carbon tokenization relies on a stack of modern technologies that work together to improve transparency, speed, and accountability. These tools make blockchain carbon credits more reliable and scalable while also enhancing carbon credit education by providing clearer, verifiable data to all market participants.

1. Blockchain Infrastructure

At the core is blockchain. It records every carbon credit transaction in an immutable ledger. Businesses can see where a token came from, when it was created, and whether it has been retired. This trust layer is critical for global carbon markets.

2. Smart Contracts

Smart contracts for carbon trading remove the need for manual processing. They execute actions like transferring ownership or retiring a token automatically when certain conditions are met. This reduces errors and increases trust.

3. AI and Analytics

AI-powered carbon offset tracking helps monitor data from carbon reduction projects. It verifies the accuracy of emissions data and flags inconsistencies. AI also improves credit scoring and helps build cleaner carbon portfolios.

5. Data Tokenization

Sensitive data is secured through data tokenization, much like RWA tokenization entertainment protects real-world assets. This ensures that project details, environmental readings, and identity information are safely stored and shared only when needed.

6. Real-World Integration

Real estate tokenization for sustainability is one area where these systems converge. Developers can issue carbon tokens linked to green building projects, offering proof of environmental performance to investors.

Benefits of Carbon Tokenization for Businesses

Carbon tokenization is not just a technical upgrade. It offers real value for businesses looking to reduce emissions, meet compliance goals, and tap into the growing carbon credits market. According to EY’s 2025 sustainability market insights, tokenized carbon markets surpassed $2 billion in value, reflecting strong global adoption and growing investor interest.

1. Full Transparency

Blockchain technology records every transaction from issuance to retirement, ensuring verifiable tracking of carbon credits. This transparency builds trust with regulators, investors, and customers while minimizing fraud risks.

2. Accessibility & Fractional Ownership

Tokenized platforms enable fractional trading, letting SMEs, small investors, and individuals participate without high costs or complex intermediaries, opening global carbon markets to more participants.

3. Enhanced Liquidity

Tokenized credits can be traded 24/7 on digital marketplaces, removing geographical barriers, eliminating intermediaries, and reducing transaction costs.

4. Faster Transactions

Smart contracts automate credit issuance, transfers, and retirement, enabling near-instant settlements and reducing delays from manual processes.

5. Credible ESG Reporting

Immutable blockchain records allow businesses to accurately demonstrate their carbon offset achievements, producing transparent and verifiable sustainability reports for stakeholders.

6. Scalable Sustainability Solutions

Tokenized carbon credits can be bundled with other green assets, creating innovative investment products that merge measurable climate action with strong financial opportunities.

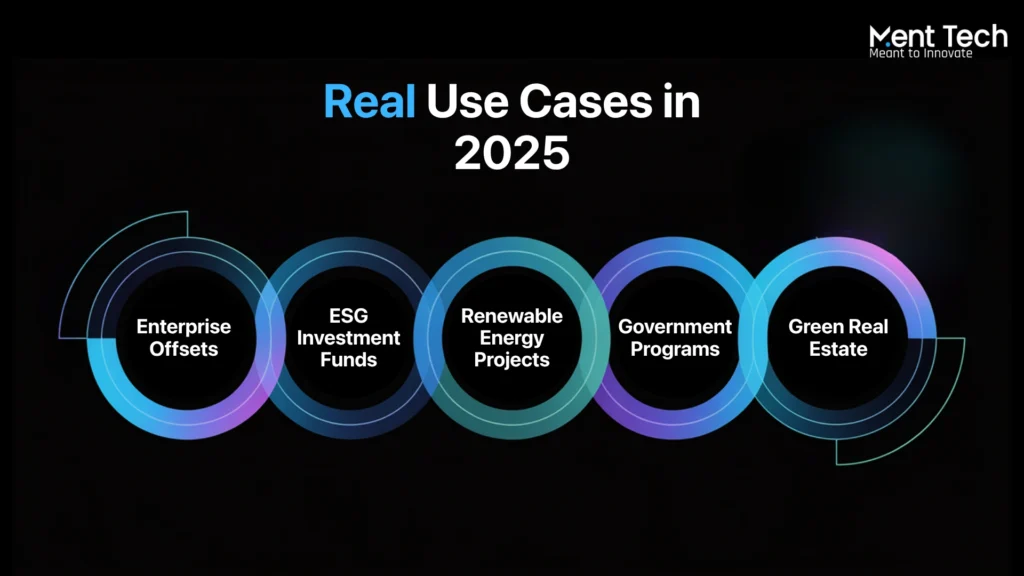

Carbon Tokenization’s High-Impact Applications in 2025

1. Enterprise Offsets

Large corporations are using carbon tokenization services to meet net zero goals. Verified credits are purchased and retired through blockchain, giving companies a clean, auditable record of their climate impact.

2. ESG Investment Funds

Asset managers are adding tokenized carbon credits to ESG portfolios. These use cases of carbon tokenization allow funds to offer clients measurable environmental impact along with financial returns.

3. Renewable Energy Projects

Solar, wind, and hydro projects are creating renewable energy tokens linked to carbon offsets. These tokens are then traded by businesses looking to compensate for emissions with clean energy support.

4. Government Programs

Governments are launching blockchain based carbon credit programs to promote cleaner industries. By using tokenized systems, they improve efficiency, reduce fraud, and create transparency for public reporting.

5. Green Real Estate

Developers are using carbon neutral real estate strategies. They tokenize emissions savings from green buildings and offer them to investors as part of sustainable real estate projects.

Challenges in Carbon Tokenization

While carbon tokenization offers speed and transparency, challenges remain. Insights from tokenized real estate show the need for clear regulations, verified assets, and strong market trust.

1. Regulatory Gaps

Many countries have yet to define how carbon tokens fit into existing environmental and financial regulations. This uncertainty slows adoption and leaves market participants unsure of compliance requirements.

2. Lack of Standards

The absence of a unified global framework means different projects use varying certification methods. This makes it difficult to compare token value, increases the risk of double-counting offsets, and can undermine trust in the carbon token market.

3. Price Volatility

Like other digital assets, carbon tokens can experience fluctuations driven by speculation rather than environmental value. This volatility complicates long-term sustainability planning for businesses.

4. Technical Adoption Barriers

Implementing blockchain for carbon credits requires specialized skills, from token development to integration with existing systems. Many organizations struggle with the technical complexity and training needed to participate effectively.

5. Energy Inefficiencies

Some blockchains used for carbon tokenization still consume significant energy, raising concerns about whether the infrastructure itself aligns with sustainability goals.

6. Risk of Misuse

Without strong verification and data integrity, there’s potential for fraudulent or low-quality credits to enter the market. Robust auditing, AI-powered verification, and transparent reporting are essential to maintain credibility.

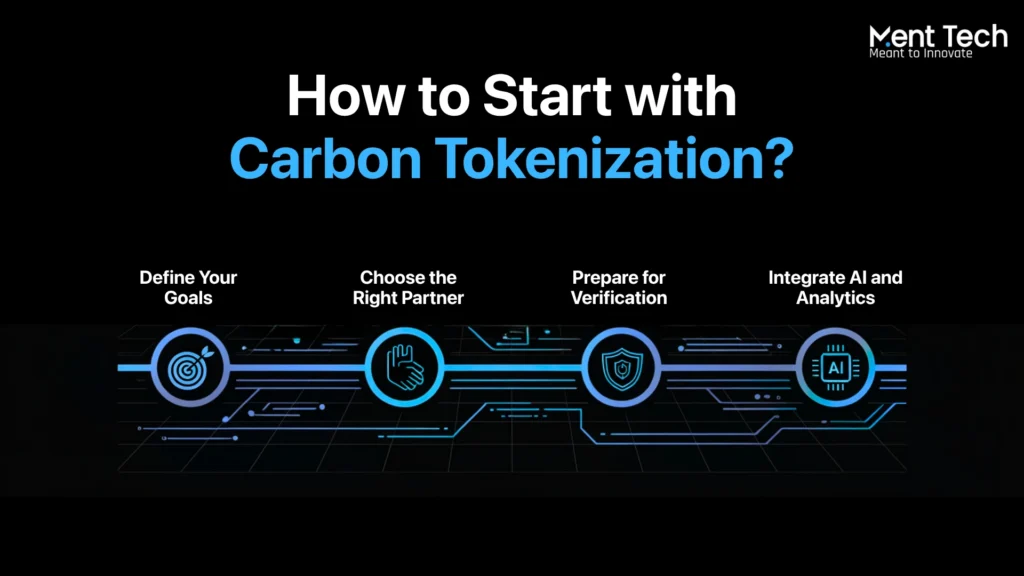

How to Start with Carbon Tokenization?

Starting with carbon tokenization doesn’t necessitate starting from the beginning. With the right partners and tools, businesses can enter the space quickly and confidently.

1. Define Your Goals

Begin by understanding what you want to achieve. Are you looking to meet sustainability targets, improve ESG reporting, or participate in the carbon credits market? A clear carbon credit strategy will guide the rest of the process.

2. Choose the Right Partner

Work with a trusted token development company that understands both blockchain and carbon markets. They will help with smart contract creation, blockchain selection, and compliance planning.

3. Prepare for Verification

Ensure your carbon credits are verified by a credible third party. Verified credits form the base of your tokens, so accuracy at this stage is critical.

4. Integrate AI and Analytics

Use AI in sustainability operations to track emissions data and forecast offset needs. This adds precision to your reporting and strengthens your position in the tokenized carbon market.

Conclusion

Carbon credit tokenization is redefining how organizations trade, track, and report carbon offsets, bringing transparency, speed, and trust to global sustainability markets. By leveraging blockchain, businesses can open new revenue streams, strengthen ESG credibility, and participate in climate action with a measurable impact.

Ment Tech Labs is a leading carbon tokenization company, covering everything from credit verification to smart contract deployment. We help organizations enhance liquidity, simplify compliance, and amplify their sustainability impact, turning carbon credits into a powerful tool in the fight against climate change. Contact Ment Tech today to get started.

Join the conversation:

Telegram: https://t.me/menttechlabspvtltd

Discord: https://discord.com/invite/tNwNXhhKZF

Frequently Asked Questions

1. What are carbon tokens?

Carbon tokens are digital representations of verified carbon credits stored on a blockchain. Each token equals a specific amount of emissions reduced or avoided. These tokens can be bought, sold, or retired to help meet sustainability goals and improve emissions tracking.

2. How does carbon tokenization work?

Carbon tokenization involves converting certified carbon credits into digital assets. A token development company creates blockchain carbon credits, which are then listed on carbon tokenization platforms. Smart contracts manage their lifecycle and record every action for transparency.

3. Why should businesses consider carbon tokenization?

Tokenization offers a faster, more reliable way to manage carbon credits. It allows companies to trade and retire offsets with full transparency. It also simplifies ESG reporting and opens access to sustainable investments.

4. Can small companies use carbon tokenization?

Yes. Carbon tokenization for businesses is becoming more accessible. Small and mid-sized companies can now enter the market using tokenized platforms, fractional credits, and AI-powered verification tools.

5. Is carbon tokenization regulated?

Regulation is still evolving. Many regions are developing frameworks to recognize tokenized carbon credits under financial and environmental laws. Choosing a partner with compliance expertise is essential for staying ahead.

6. How do I get started with tokenization?

Start by identifying your carbon offset strategy and then partner with a trusted token development company. Look for teams that offer carbon tokenization services, including smart contract setup, blockchain integration, and credit verification.