Digital banking has quietly become a part of everyday life. People now expect to open accounts in minutes, move money across borders, and manage both fiat and crypto from a single app. This is no longer limited to fintech startups. Crypto exchanges, Web3 platforms, and payment companies are increasingly building neo-banking capabilities to meet user expectations and stay competitive.

The numbers make this direction clear. The global neo-banking market was valued at over USD 150 billion in 2023 and is expected to reach approximately USD 3,02,025.3 million (around USD 3 trillion) by 2032, fuelled by mobile-first usage, cross-border payments, and the need for more flexible financial services. As crypto adoption grows alongside this expansion, businesses are turning to white-label crypto neo-bank solutions as a practical way to launch secure, scalable banking products without starting from zero.

| Key Takeaways 1. The neo-banking market in Europe is expected to reach USD 34.1 billion by 2030, driven by increased digital adoption and regulatory support. 2. White-label crypto neo-banks cut launch time by 60–70%, enabling faster market entry. 3. More than 65% of new digital banks now use white-label or BaaS models. 4. Crypto–fiat neo-banks see 30–40% higher user retention than standalone platforms. 5. Asia-Pacific is the fastest-growing region, with emerging markets driving mobile-first banking solutions. |

What Is a White-Label Crypto Neo-Bank?

A white-label crypto neo-bank is a ready-to-use digital banking platform that enables businesses to launch branded banking and crypto services without building the technology from scratch. It allows companies to offer wallets, payments, cards, and crypto trading under their own brand while relying on a trusted provider for the backend infrastructure. These platforms include secure user onboarding, compliance support, and integrated crypto functionality for sending, receiving, and trading digital assets. By using a turnkey solution, businesses save time and reduce costs while maintaining full control over branding and customer experience.

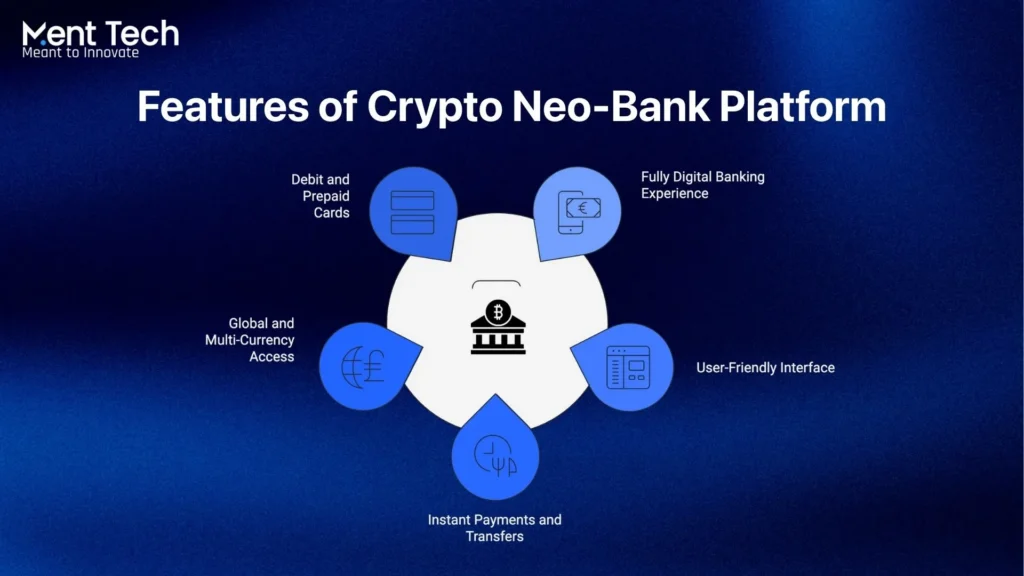

Key Features of a Modern Crypto Neo-Bank Platform

These features demonstrate why modern crypto neo-banks are revolutionizing digital banking, offering users a seamless blend of convenience, security, and global access.

1. Fully Digital Banking Experience

A modern white-label neo-bank operates completely online, letting users open accounts, make payments, and manage funds from their mobile or web app. This digital-first approach ensures access anytime, anywhere, while keeping costs low and convenient for users.

2. User-Friendly Interface

The platform is designed for simplicity. With a clear, mobile-first layout, managing both fiat and crypto becomes intuitive. A white-label crypto neo-banking platform focuses on making complex financial tools easy to use, helping customers stay engaged and confident in their transactions.

3. Instant Payments and Transfers

Real-time processing allows users to send and receive funds instantly. From daily transactions tocross-border payments, the turnkey solution ensures smooth, reliable operations without delays, improving overall financial flexibility.

4. Global and Multi-Currency Access

Modern platforms support multiple currencies and seamless international payments. With low fees for currency conversion, users can manage funds globally while enjoying a crypto integration that works alongside traditional banking features.

5. Debit and Prepaid Cards

Many platforms offer physical or virtual cards, often co-branded with Visa or Mastercard, enabling users to spend both fiat and cryptocurrencies in daily life. This feature is a key part of a neo-bank that bridges traditional finance and the crypto world effortlessly.

Top White-Label Crypto Neo-Bank Development Companies in 2026

After analyzing dozens of White-Label Crypto Neo-Bank Development Companies, we’ve identified the top 10 that consistently deliver excellent results. Here’s our ranking based on expertise, client reviews, project success, and innovation:

1. Ment Tech Labs Pvt. Ltd.

4.2 (30+ Reviews)

$30/hr

50-100 Emp.

2019

Indore

Ment Tech positions itself as a leading provider of white-label crypto neo-bank solutions, focusing on fast, secure, and scalable digital finance products. The company highlights its strength in blockchain, Web3, and crypto software development, helping businesses launch wallets, exchanges, payment systems, and fully branded crypto banks. Ment Tech aims to make digital banking simple for clients by offering ready-made solutions with strong security, easy customization, and long-term technical support.

2. SDK.finance

15-50 Emp.

2013

Vilnius, Vilniaus Apskritis

SDK.finance is a white-label FinTech platform that helps companies launch neo-banks, crypto banks, e-wallets, and payment apps quickly. Their ready-to-use software includes core banking, crypto-to-fiat processing, and mobile banking functionality. Businesses use their platform to build custom digital banking and crypto solutions without starting from scratch. SDK.finance is trusted globally and even recognized in industry awards for its payment tech.

3. AutoRek

51-200 Emp.

1994

Glasgow, Scotland

AutoRek is a software company that creates powerful automated financial controls and data systems for banks and payment firms. Their tools help clients manage large amounts of financial data, ensure regulatory compliance, and reduce manual work. Though not focused solely on crypto, their platform supports financial reporting and reconciliation useful for modern digital banking operations. AutoRek is known for accuracy, scalability, and long industry experience since 1994.

4. EvaCodes

51-200 Emp.

2019

Kiev

EvaCodes is a Web3 and blockchain development company that builds custom digital finance products, including white-label neo-bank platforms, crypto wallets, DeFi apps, and smart contracts. They work closely with clients to turn ideas into working blockchain and crypto solutions. EvaCodes has completed many projects worldwide and supports startups and enterprises launching digital banking and crypto systems. Their services also include NFT launchpad and token development.

5. Solaris

201-500 Emp.

2015

Berlin, Germany

Solaris is a leading FinTech platform that offers banking as a service and digital banking solutions. They provide APIs and infrastructure for companies to launch licensed neo-banking and crypto services. Solaris is well-known for enabling fast deployment of digital accounts, cards, and payment services without needing a full banking license. Their platform helps fintechs and businesses build modern banking and crypto products.

6. 4IRE

201-500 Emp.

2010

Stockholm

4IRE is a blockchain and FinTech development company with experience building solutions for banking, crypto, and digital finance. They help businesses create neo-bank software, digital wallets, DeFi platforms, and other blockchain products. With a strong team and many successful projects, 4IRE supports companies looking to launch secure blockchain and crypto systems.

7. Avenga

5,001-10,000 Emp.

2019

Cologne, North Rhine-Westphalia

Avenga is a IT and software services company that builds custom digital banking, FinTech, and blockchain solutions for enterprise clients. With thousands of employees worldwide, Avenga offers development support for complex systems including neo-bank platforms, crypto services, and financial apps. Their scale and experience make them a strong partner for large FinTech projects.

8. OyeLabs

51-200 Emp.

2019

Panchkula, Haryana

OyeLabs is a technology company that offers software development including FinTech and blockchain solutions. They support businesses building digital platforms, crypto tools, and custom apps. OyeLabs focuses on delivering reliable, scalable software for modern finance, helping startups create products like neo-bank systems and crypto payment apps.

9. Synodus

201-500 Emp.

2019

Cau Giay, Hanoi

Synodus is a digital solution provider that builds web and mobile apps, including financial and crypto systems. They help companies design and develop secure digital platforms, potentially including neo-bank features and crypto integration. Synodus works with startups and growing businesses to launch reliable digital finance products.

10. Crassula

51-200 Emp.

2015

Riga, Latvia

Crassula is a tech company that develops custom software for finance, blockchain, and other industries. They support businesses in building digital banking systems, crypto wallets, and secure financial apps. With a strong focus on quality development, Crassula helps companies launch modern digital finance and neo-bank solutions.

Evaluation Criteria for Choosing a Right White-Label Crypto Neo-Bank Development Partner

When picking a white-label crypto neo-bank development partner, the right choice can make or break your launch. Here are the top 5 things to focus on:

- Regulatory & Compliance Knowledge

The partner should be well-versed in financial rules and crypto regulations, including KYC, AML, and international standards. They should help you stay fully compliant while reducing legal risks. - Strong Security Measures

Security is non-negotiable when dealing with digital assets. Look for providers with proven experience in protecting funds, including secure wallets, encryption, and regular audits. - Technical Expertise & Scalability

A reliable partner knows blockchain, smart contracts, and cloud solutions. They should deliver a platform that can handle growing users and higher transaction volumes without issues. - Customization & Branding Flexibility

Your platform should feel unique. The partner should allow you to customize the interface, features, and branding so it reflects your business and meets user expectations. - Support & Ongoing Maintenance

Launching is just the beginning. Ensure the provider offers strong post-launch support, updates, and continuous monitoring to keep your platform running smoothly.

How Ment Tech Supported LBank’s Move Toward Crypto Neo-Banking

Ment Tech helped LBank expand into a fully digital, crypto-friendly banking experience by providing a white-label crypto neo-banking platform that combined secure wallets, seamless crypto integration, and real-time transaction capabilities.

Acting as a turnkey solution, Ment Tech enabled LBank to focus on delivering a smooth user experience and strong branding, while the technical backbone, compliance tools, and scalable infrastructure were handled efficiently. This approach allowed LBank to move quickly into the neo-bank space, offering both fiat and crypto services under its own brand with confidence and reliability.

Frequently Asked Questions:

Using a white-label platform reduces development time, ensures regulatory compliance, and provides a fully functional banking system, letting startups launch faster and focus on branding and user experience.

Ment Tech provides a turnkey white-label crypto neo-banking platform that handles infrastructure, compliance, security, and scalability. This lets businesses focus on delivering a smooth user experience and strong brand presence.

Costs vary depending on platform complexity, licensing, integrations, and customization. Pricing models can include one-time setup fees, subscription-based models, or revenue-sharing agreements with the provider.

Yes, most platforms allow full branding, UI/UX customization, and additional feature integration so your platform feels unique while using a reliable backend.

Absolutely. Enterprises can leverage white-label neo-banking solutions to offer branded banking services for employees, partners, or customers without investing heavily in backend technology.