Did you know that digital wallet users are expected to reach 6 billion by 2030, accounting for over 75% of the global population? As digital payments and crypto adoption grow rapidly, businesses must deliver secure, fast, and intuitive wallet experiences to meet rising user expectations.

Building wallet infrastructure from scratch is costly and technically demanding. Wallet as a service (WaaS) simplifies this by providing ready-made, secure wallet systems that businesses can integrate quickly without managing blockchain complexity, custody risks, or ongoing maintenance.

From fintech platforms to Web3 applications, wallets as a service help companies improve onboarding, scale transactions, and launch faster. This blog explains wallet as a service, its practical advantages, and its role in modern digital and crypto payments.

What is Wallet-as-a-Service (WaaS)?

Wallet as a Service (WaaS) offers businesses ready-to-use digital and cryptocurrency wallets that are secure and easy to integrate into existing wallet systems. A crypto wallet as a service supports multiple digital assets such as cryptocurrencies, stablecoins, and NFTs, offering users a smooth and reliable experience without the need to manage complex blockchain infrastructure or private keys.

WaaS platforms include features like multi-currency support, private key management, DeFi integration, and compliance tools. Using wallets as a service allows businesses to launch faster, manage digital assets easily, and provide a secure wallet solution for fintechs, Web3 applications, and other companies aiming to grow in the digital economy.

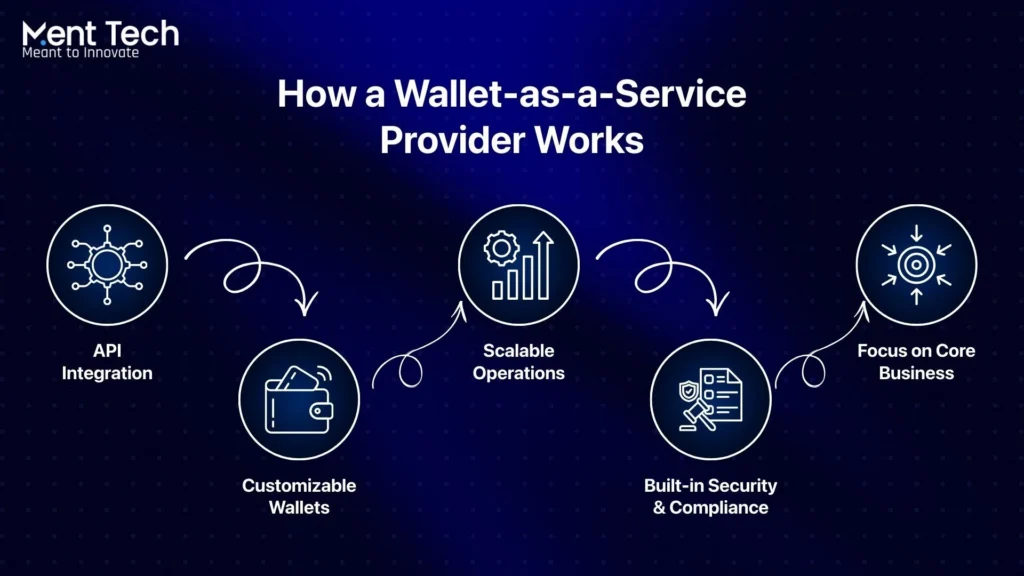

How a Wallet-as-a-Service Provider Works

Wallet-as-a-Service providers help businesses add secure digital and crypto wallets without building complex infrastructure. By utilizing wallets as a service, companies can provide seamless transactions, digital asset storage, and payments while focusing on their core operations.

- API Integration—Enable wallet creation, transactions, balance tracking, and token management across multiple chains through seamless API integration, ensuring a smooth experience for both crypto-savvy users and newcomers.

- Customizable Wallets—Adjust the wallet experience with branding, loyalty programs, and interface options to match your business identity and audience needs. With a crypto wallet as a service, businesses can provide rewards, staking, and easy onboarding for digital assets.

- Scalable Operations—Handle growing user bases and higher transaction volumes without disruption. WaaS solutions allow platforms to scale quickly while maintaining speed, reliability, and performance for digital wallet services.

- Built-in Security & Compliance—Protect user data and meet regulations like AML, KYC, and GDPR easily. Wallet-as-a-service providers implement encryption, multi-factor authentication, and fraud monitoring to keep funds secure.

- Focus on Core Business—With wallet and promotion as a service handled by WaaS, companies can focus on their main products while offering a secure, fully functional, and user-friendly wallet experience for customers.

Choosing the Right Wallet for Your WaaS Integration

Wallet-as-a-Service (WaaS) platforms provide a variety of wallet types to meet different business needs and user preferences. Selecting the right wallet ensures secure, user-friendly, and seamless digital and crypto payment experiences.

1. Custodial Wallets

Custodial wallets are managed by a third party that securely stores users’ private keys. They simplify the user experience, making them ideal for digital wallet as a service solutions that require easy access and basic wallet and DeFi portfolio tracker features.

2. Non-Custodial Wallets

Non-custodial wallets give users full control over their private keys and funds. They are best suited for blockchain wallet-as-a-service platforms, supporting DeFi, NFT marketplaces, and other web3 applications, focusing on privacy, autonomy, and asset security.

3. Smart Wallets

Smart wallets operate via smart contracts instead of relying solely on private keys. They offer programmable transactions, social or multi-signature recovery, and gasless transactions, making them a flexible crypto wallet as a service option for businesses.

4. Embedded Wallets

Embedded wallets are integrated directly into applications, enabling users to manage digital assets without leaving the platform. These wallets enhance security, provide multi-device access, and can be customized to match branding, making them ideal for digital wallets and promotion as a service.

5. Multi-Sig Wallets

Multi-signature wallets require multiple approvals before transactions are executed. They increase security, prevent unauthorized access, and offer collaborative management, making them suitable for crypto wallet as a service solutions.

6. Multi-Party Computation (MPC) Wallets

MPC wallets split private keys among multiple parties using cryptography, improving security and operational control. They are chain-agnostic, work across all EVM-compatible blockchains, and support enterprise use cases like escrow or organizational asset management.

Crypto Wallet-as-a-Service vs Digital Wallet-as-a-Service

As digital and crypto payments expand, knowing the difference between Crypto Wallet-as-a-Service and Digital Wallet-as-a-Service helps businesses select the right solution. Both support seamless wallet integration, but they serve different assets, transactions, and user needs.

| Feature | Crypto Wallet-as-a-Service | Digital Wallet-as-a-Service |

| Definition | Cloud-based wallet solution that lets businesses offer secure crypto storage, transactions, and DeFi features without building wallet infrastructure. | Online service enabling electronic payments, loyalty points, tickets, and digital passes for users without physical cards. |

| Supported Assets | Cryptocurrencies (Bitcoin, Ethereum), stablecoins, NFTs, and other digital tokens. | Fiat currencies, debit/credit cards, mobile payments, loyalty points, and gift cards. |

| Use Cases | Crypto exchanges, NFT marketplaces, DeFi apps, blockchain-based loyalty programs, and tokenized asset management. | E-commerce payments, closed-loop or semi-closed loyalty wallets, mobile wallets like Apple Pay or Paytm, and ticketing solutions. |

| Security & Compliance | Enterprise-grade encryption, private key management, multi-sig wallets, AML/KYC compliance, and fraud monitoring. | PCI-compliant encryption, secure access controls, fraud detection, and seamless integration with banking APIs. |

| User Control | Users can manage private keys (non-custodial) or use provider-managed wallets (custodial) for enhanced security and autonomy. | Users rely on provider-managed access with passwords, PINs, or biometrics for secure transactions. |

| Integration | API and SDK-based integration with apps, platforms, and blockchain/DeFi protocols. | API integration with merchant systems, payment gateways, loyalty programs, and mobile apps. |

| Revenue Opportunities | Crypto payments, staking, lending, cross-border transfers, DeFi services, and tokenized rewards. | Payments, cashback, loyalty rewards, card-linked offers, merchant fees, and micro-transactions. |

Top Advantages of Wallet-as-a-Service for Businesses

Wallet-as-a-Service (WaaS) lets businesses integrate secure digital and crypto wallets quickly, reducing costs and enhancing security while delivering smooth user experiences.

1. Cost Reduction

Building an in-house digital or crypto wallet requires significant investment in infrastructure, security, and compliance. With a wallet as a service, businesses can offer digital wallet solutions without the high upfront costs, focusing on core operations.

2. Accelerated Time-to-Market

Wallet-as-a-service providers enable businesses to deploy digital and crypto wallets quickly. Companies can integrate wallet functionalities via APIs, allowing faster onboarding and reducing development time while reaching customers efficiently.

3. Enhanced Security

WaaS platforms provide enterprise-grade security, including encryption, multi-factor authentication, and secure key management. By leveraging these solutions, businesses can safeguard user assets and ensure a trusted crypto wallet experience.

4. Regulatory Compliance

Navigating financial regulations can be complex. Wallet-as-a-service providers help businesses adhere to AML, KYC, and other compliance requirements, reducing legal risks while enabling secure transactions.

5. Multi-Chain Support

Managing digital wallets across multiple blockchains is simplified with WaaS. Platforms offer seamless wallet creation, management, and transactions, supporting both digital wallets and blockchain wallets for diverse user needs.

6. User-Friendly Experience

Wallet-as-a-service solutions provide intuitive interfaces for digital and crypto wallets. Businesses can offer seamless wallet operations to both experienced crypto users and newcomers, improving engagement and satisfaction.

Real-World Applications of Wallet-as-a-Service Solutions

Wallet-as-a-Service (WaaS) helps businesses across industries integrate secure and scalable digital wallets without complex infrastructure. These solutions enable seamless transactions, improved security, and expanded digital payment capabilities.

1. Cryptocurrency Exchanges

- Integrate a crypto wallet as a service for deposits, withdrawals, and trading.

- Ensure multi-signature authentication, private key management, and fraud monitoring.

- Maintain compliance with KYC/AML standards for secure transactions.

2. Fintech Platforms

- Embed wallets as a service for crypto and digital asset management.

- Support fiat-to-crypto conversions, peer-to-peer transfers, and staking.

- Offer user-friendly wallet interfaces for both beginners and experienced users.

3. Gaming & NFT Platforms

- Provide a blockchain wallet as a service for in-game assets and NFT storage.

- Enable multi-chain support for interoperability across Ethereum, Solana, and Polygon.

- Ensure secure, non-custodial wallets with easy access for users.

4. E-Commerce & Retail

- Accept crypto payments with a digital wallet as a service at checkout.

- Implement tokenized loyalty programs and rewards for customer engagement.

- Automate cashback, discounts, and digital gift card transactions securely.

5. DeFi & Web3 Applications

- Offer non-custodial wallets with a crypto wallet as a service for DeFi access.

- Enable staking, lending, and decentralized exchange interactions safely.

- Support multi-chain transactions for broader accessibility and efficiency.

6. Enterprise Blockchain Solutions

- Use a Top Blockchain wallet as a service provider for treasury, payroll, and cross-border payments.

- Ensure secure storage of digital assets with regulatory compliance.

- Facilitate tokenization and seamless on-chain fund transfers for enterprises.

Why Build Wallet-as-a-Service with Ment Tech?

Building a reliable wallet platform today goes beyond blockchain integration. It requires strong security foundations, scalable architecture, and a clear understanding of how users interact with digital and crypto wallets. At Ment Tech, we help businesses launch Wallet-as-a-Service solutions that are practical, secure, and built for real-world adoption.

Real wallet products built for real users

- Infinity Wallet: Built a multi-chain crypto wallet with integrated DeFi features, secure staking, and seamless digital asset management across multiple blockchains. Designed to support high transaction volumes while keeping the user experience simple and accessible.

- Kana Labs: Delivered advanced wallet functionality for a DeFi platform, including cross-chain swaps, portfolio tracking, gas optimization, and one-click strategy execution across multiple blockchain networks.

With ISO-certified processes, compliance-ready development, and hands-on experience across digital wallet-as-a-service and blockchain wallet-as-a-service projects, Ment Tech delivers wallet platforms that businesses can confidently deploy and scale.

Must-Have Features for Wallet-as-a-Service Solutions

Choosing the right Wallet-as-a-Service (WaaS) ensures secure transactions, easy integration, and efficient management of digital and crypto assets across multiple blockchains.

1. Multi-Currency and Multi-Chain Support

Manage both fiat and cryptocurrencies in a single wallet and conduct transactions across multiple blockchain networks, simplifying operations and supporting global business requirements.

2. Advanced Security Protocols

Robust encryption and multi-party computation (MPC), along with automated KYC/AML compliance, protect wallets from unauthorized access and cyber threats.

3. Seamless Integration with Platforms

Easily integrate the wallet with existing web and mobile applications, ensuring a consistent user experience and reducing technical overhead.

4. User Management and Permissions

Assign roles and control access to funds, transaction authorizations, and activity monitoring, ensuring operational security and accountability.

5. Integration with Financial Tools

Sync with accounting and financial software for accurate bookkeeping, regulatory compliance, and simplified auditing processes.

6. On and Off-Ramping

Enable seamless conversion between fiat and cryptocurrencies, integrating with banks and payment gateways for fast, efficient, and cost-effective transfers

Conclusion

Wallet-as-a-Service is revolutionizing how businesses handle digital and crypto assets, making transactions faster, safer, and more efficient. Choosing the right provider ensures smooth operations and seamless integration.

At Ment Tech, we specialize in secure and user-friendly WaaS solutions tailored to meet your business needs. Partner with us to implement a digital wallet strategy that drives efficiency, creates opportunities, and keeps you ahead in the evolving financial landscape.

Partner with us to transform your digital wallet strategy into a solution that succeeds in the modern financial ecosystem. Contact Ment Tech today to get started and take your crypto and digital asset management to the next level.

FAQs

Wallet-as-a-Service enables businesses to integrate digital wallets into their apps without needing to build the infrastructure from scratch. It makes managing, sending, and receiving digital assets simple and efficient.

WaaS provides ready-made wallet infrastructure, APIs, and security protocols, reducing development time and costs. This lets businesses launch functional digital wallets in weeks instead of months.

Yes. Leading WaaS providers use encryption, multi-party key management, and continuous monitoring to protect funds and data. Many businesses rely on a crypto wallet as a service to ensure safe transactions.

Most WaaS solutions allow white-labeling and interface customization. This helps businesses create a wallet that aligns with their brand, offering a seamless and consistent user experience.

Modern WaaS platforms support various cryptocurrencies and blockchain networks. Users can manage Bitcoin, Ethereum, stablecoins, and other digital assets within a single wallet.

WaaS platforms often include KYC and AML checks to help businesses stay compliant. Companies looking to integrate secure solutions often explore options like the Top 10 Digital Identity Wallet to meet regulatory and identity verification requirements.