Cryptocurrency has grown from a niche market into a major financial ecosystem. Crypto exchanges are now the backbone of digital trading, allowing millions of users to buy, sell, and manage cryptocurrencies securely. In 2025, global crypto exchange platforms processed trading volumes exceeding $9.7 trillion in a single month.

The growing interest in digital assets shows that people and businesses are increasingly participating in cryptocurrency trading. Exchanges today offer more than just basic trading, including derivatives, stablecoin swaps, staking, and cross-chain liquidity. With hundreds of exchanges worldwide and consistently high daily trading volumes, demand for reliable and secure platforms is stronger than ever.

For entrepreneurs and tech leaders, this creates a significant opportunity. Launching a crypto exchange requires careful planning, strong infrastructure, security measures, and compliance with regulations. In this guide, we will cover the key steps and considerations to help you launch a crypto exchange quickly and securely while building a platform that users can trust.

What is a Crypto Exchange and Why Launch a Crypto Exchange in 2026?

A crypto exchange is a digital platform where users can securely buy, sell, and trade cryptocurrencies. Modern exchanges include features like white-label crypto exchange solutions, liquidity management, and compliance-ready KYC/AML systems to ensure seamless and secure trading experiences.

With the crypto market growing rapidly, launching a crypto exchange in 2026 offers an opportunity to tap into an expanding ecosystem. Platforms with hybrid trading infrastructures, self-custody wallets, and turnkey crypto exchange development solutions can scale efficiently while meeting regulatory standards and user expectations.

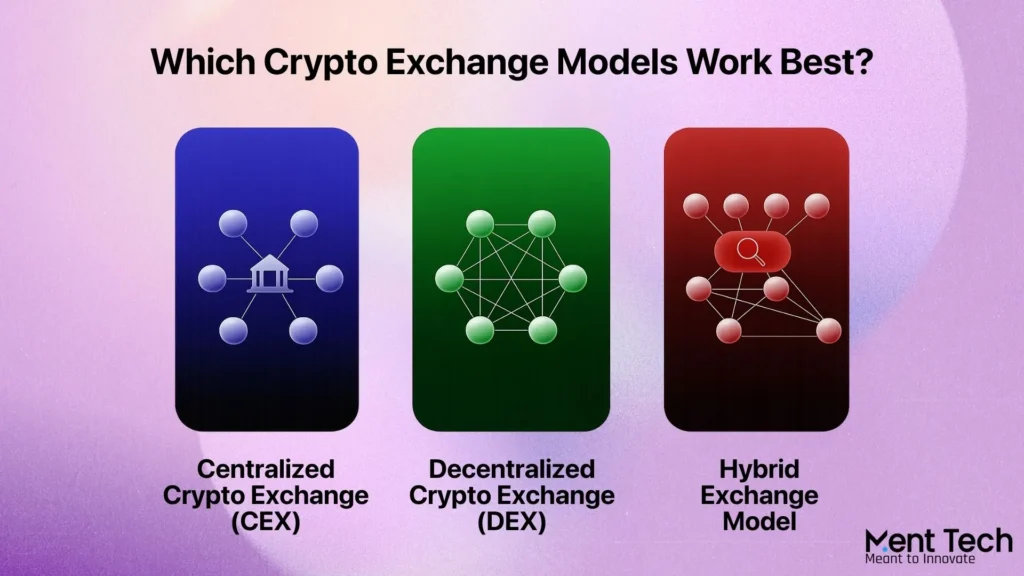

Which Crypto Exchange Models Work Best?

Choosing the right exchange model is crucial for balancing liquidity, security, and user experience. Here’s a breakdown of the main models:

1. Centralized Crypto Exchange (CEX)

Centralized exchanges rely on a core platform that manages trades and custody for users. They are ideal for traders seeking speed and regulatory compliance.

- Deep liquidity for smooth trading

- Integrated fiat on/off ramps

- Compliance-ready frameworks for secure operation

Centralized exchanges are ideal for businesses looking to serve a large user base with a reliable trading infrastructure. They ensure trust, regulatory alignment, and quick access to local fiat, making them the preferred choice for high-value traders.

2. Decentralized Crypto Exchange (DEX)

Decentralized exchanges allow users to trade directly from their wallets without intermediaries, offering full asset control.

- Peer-to-peer trading without intermediaries

- Integration with staking, yield farming, and other DeFi products

- Greater flexibility and user control

DEX platforms attract users who prioritize self-custody and decentralized finance features. By offering direct asset control and access to advanced crypto tools, they cater to long-term holders and DeFi enthusiasts.

3. Hybrid Exchange Model

Hybrid exchanges combine centralized infrastructure with decentralized features to deliver the best of both worlds.

- Centralized liquidity for active trading

- Decentralized self-custody for advanced users

- Regulatory compliance and risk management

Hybrid exchanges allow businesses to serve professional traders and retail users simultaneously while maintaining compliance, liquidity, and scalability in a single ecosystem.

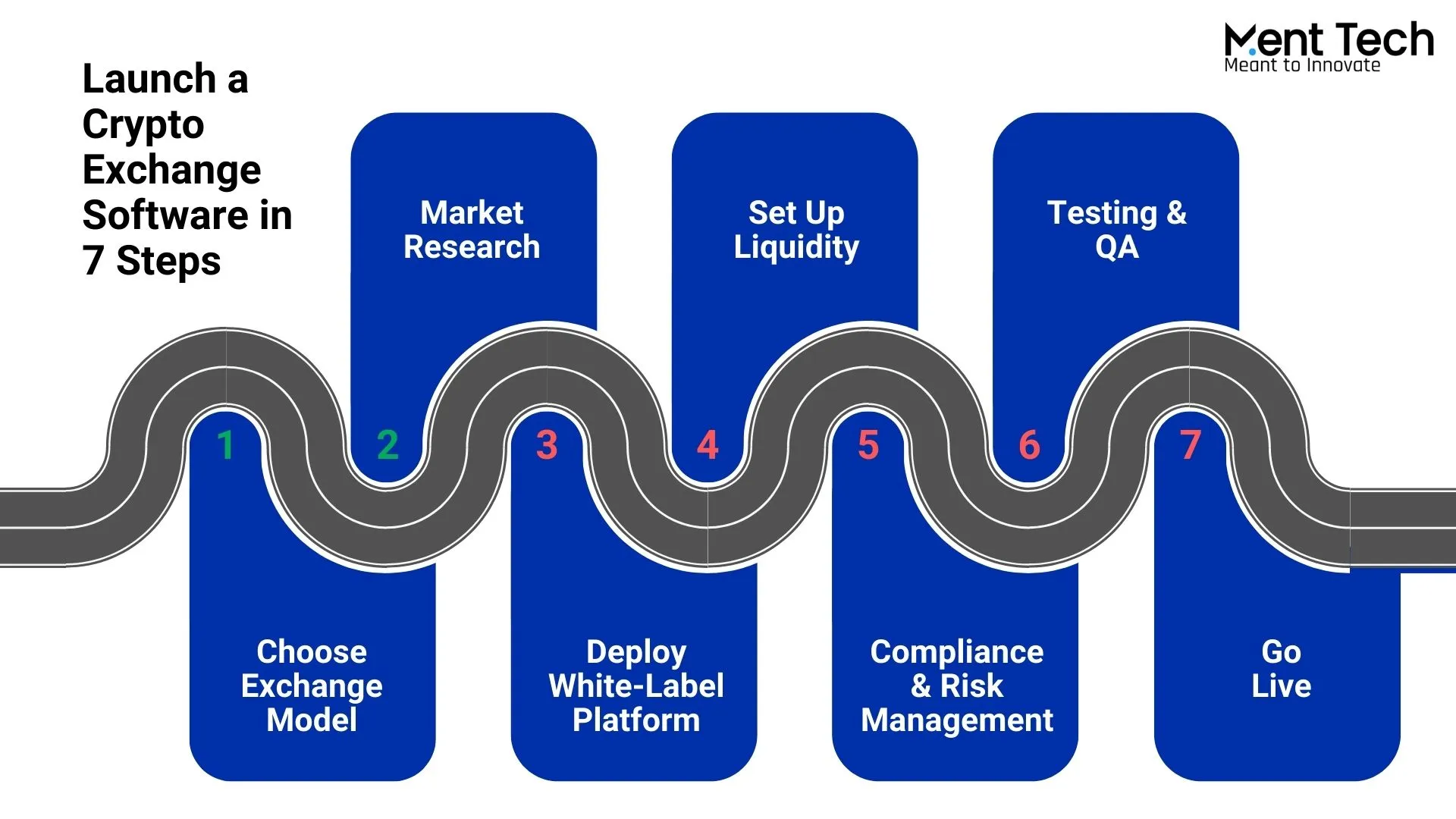

How to Launch a Crypto Exchange Software in 7 Steps?

Launching a cryptocurrency exchange demands careful planning, secure infrastructure, and compliance systems. These 7 steps ensure a fast, scalable, and fully operational crypto trading platform using white-label or custom solutions.

Step 1: Define Exchange Model and Infrastructure

Finalize your exchange model, CEX, DEX, or hybrid, and build the core infrastructure, including the matching engine, wallet system, and fiat rails. Set up KYC and AML workflows early to ensure compliance and smooth licensing.

Step 2: Conduct Market Research and Strategy

Understand your target audience, trading habits, and preferred cryptocurrencies. Conduct competitive analysis to identify gaps and opportunities. Strategic planning ensures your crypto exchange is positioned for growth, adoption, and user trust.

Step 3: Deploy White Label Crypto Exchange

Leverage a ready-to-use white-label crypto exchange platform to accelerate deployment. Configure trading pairs, fee structures, branding, and admin dashboards. Integrate custodial and optional non-custodial wallets for hybrid access to offer advanced trading features.

Step 4: Set Up Liquidity and Trading Pairs

Proper crypto liquidity is crucial for seamless trading. Integrate liquidity providers or market-making services and configure order book depth. Activate core spot markets to enable smooth trading operations and support high-value traders.

Step 5: Implement Compliance and Risk Management Systems

Activate KYC/AML workflows, transaction monitoring, and audit logging. Set tiered account limits, withdrawal controls, and risk thresholds. These systems ensure your platform meets regulatory requirements while maintaining user security and trust.

Step 6: Perform Testing and Quality Assurance

Conduct rigorous QA, stress testing, and sandbox trials. Identify and fix potential issues in transaction processing, wallet operations, and trading performance. Thorough testing ensures your cryptocurrency exchange runs smoothly at launch.

Step 7: Go-Live Readiness

Finalize documentation for regulators, align internal compliance processes, and prepare for official launch. By completing this step, your crypto exchange software is fully operational, secure, and scalable to handle growing users and trading volumes.

Key Legal and Compliance Requirements for Launching a Crypto Exchange

Launching a crypto exchange requires meeting key legal and compliance standards, including licensing, KYC/AML workflows, and tax reporting. Ensuring these steps keep your platform secure, compliant, and trusted by users.

1. Licensing and Entity Setup

- Register your exchange as a legal entity with the relevant authorities to operate officially and gain market credibility.

- Apply for crypto exchange licenses and prepare all required documentation to meet regulatory standards.

- Align KYC and AML workflows early, so your platform can smoothly pass audits and maintain compliance.

2. Capital and Financial Preparedness

- Maintain minimum paid-up capital and sufficient equity levels to support operational and regulatory requirements.

- Prepare audited financial statements and proof-of-funds to demonstrate financial stability to investors and regulators.

- Secure adequate funding to ensure smooth crypto liquidity and uninterrupted trading for your users.

3. Operational Governance and KYC Setup

- Define clear processes for IT, compliance, risk, and customer support teams to run the exchange efficiently.

- Implement tiered account limits and enhanced transaction monitoring to manage risk and protect assets.

- Ensure governance structures and escalation procedures safeguard both the exchange and its users from fraud.

4. Taxation and Reporting

- Set up periodic reporting systems to manage applicable taxes on all crypto transactions accurately.

- Maintain detailed records of trading activity and financial statements for transparency and regulatory audits.

- Stay compliant with tax authorities to avoid penalties while building trust with investors and users.

Cost of Developing a Crypto Exchange?

Understanding the cost is crucial for planning your crypto exchange. Expenses vary depending on whether you choose a white-label solution for fast deployment or a fully custom-built platform with complete control and scalability. Careful budgeting ensures smooth development, regulatory compliance, and a reliable crypto trading experience.

| Exchange Model | Estimated Cost | Key Benefits |

| White-Label Crypto Exchange | $50k+ | Fast deployment, compliance-ready, cost-effective, saves time and resources. |

| Custom-Built Crypto Exchange | $1M+ | Fully customizable, scalable, and full control over features and architecture. |

Factors Affecting the Cost of Crypto Exchange Development

The cost of developing a crypto exchange depends on multiple technical and operational factors. From the exchange model and compliance requirements to security architecture and feature depth, each decision directly impacts the overall budget and development timeline.

1. Exchange Model

The choice between a centralized, decentralized, or hybrid exchange directly influences development complexity. Advanced models require a more robust architecture, increasing time and cost.

2. Compliance and Licensing

KYC and AML implementation, legal documentation, and adherence to regulatory standards add to overall expenses. Compliance readiness is critical for long-term operations.

3. Security and Scalability

High-level security protocols, secure wallet management, and scalable infrastructure raise development costs but are essential for platform reliability and user trust.

4. Core Platform Features

The trading engine, wallet integration, multi-asset support, and fiat on/off ramps significantly impact the budget. Feature depth determines engineering effort.

5. User Experience and Interface

Custom UI/UX design improves usability and engagement but requires additional design and testing resources. A smooth experience supports user retention.

6. Ongoing Maintenance and Support

Post-launch maintenance, system updates, monitoring, and technical support contribute to long-term operational costs and platform stability.

Conclusion

Crypto exchanges are transforming how digital assets are traded and managed worldwide. Building a successful platform requires more than a fast launch. It demands secure architecture, reliable liquidity, and compliance-ready systems from the start.

At Ment Tech, we specialize in crypto exchange development, helping businesses build scalable, secure, and market-ready platforms. From exchange architecture and liquidity integration to compliance workflows and performance optimization, we support you at every stage.

Partner with Ment Tech to turn your crypto exchange idea into a reliable trading platform built for growth and trust. Get in touch with our team today to begin your crypto exchange development journey.

FAQs

Creating a crypto exchange involves selecting the right exchange model, integrating secure wallets, setting up a trading engine, ensuring liquidity, and implementing KYC/AML compliance. Partnering with a professional crypto exchange development company can streamline the process and reduce time-to-market.

Earning a consistent $100 per day depends on your trading strategy, market conditions, and risk management. While profits are possible, crypto trading carries significant volatility, so understanding the market and using reliable platforms is crucial.

The best exchange platform depends on your needs. Centralized exchanges (CEX) offer high liquidity and fiat on/off ramps, while decentralized exchanges (DEX) provide self-custody and DeFi features. Look for secure, compliant, and user-friendly exchanges.

Crypto exchanges use specialized trading software that includes a matching engine, wallet integration, liquidity modules, security layers, and analytics dashboards. Both custom-built and white-label crypto exchange software are common options.

With a white-label crypto exchange solution, a fully functional platform can be launched in as little as 7 days. Custom-built exchanges may take several months depending on features, compliance requirements, and integrations.

A successful exchange includes a secure trading engine, multiple payment options, wallet integrations, real-time analytics, liquidity management, and KYC/AML compliance. Scalability and user experience are equally important.

Costs vary based on the exchange model, features, security, compliance, and scalability. White-label exchanges start around $50k, while custom-built platforms can exceed $1M depending on complexity.